Arkansas Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

Are you presently in the position where you need to have paperwork for either enterprise or personal uses just about every day time? There are tons of authorized papers templates accessible on the Internet, but discovering ones you can depend on isn`t straightforward. US Legal Forms delivers a huge number of form templates, much like the Arkansas Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, which are composed to satisfy federal and state needs.

If you are already familiar with US Legal Forms site and get a free account, just log in. Next, it is possible to acquire the Arkansas Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on design.

If you do not come with an accounts and want to begin using US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is for the right area/county.

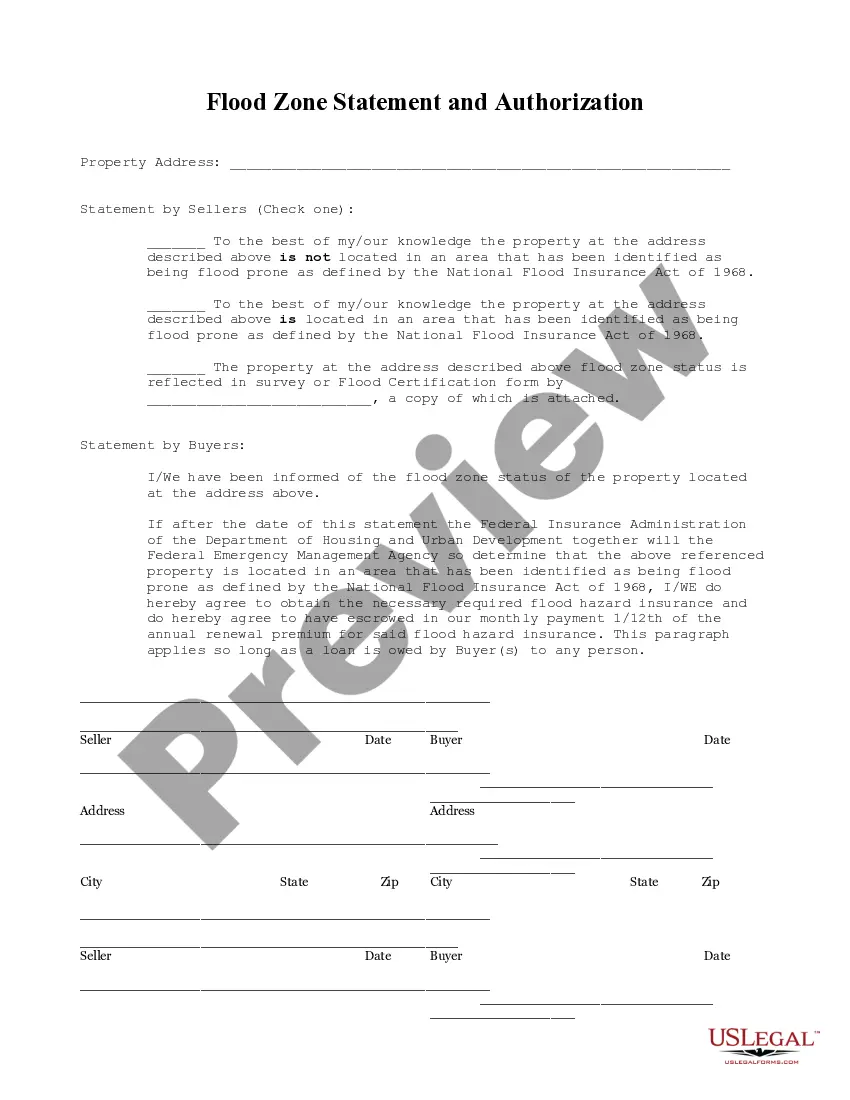

- Use the Review key to examine the shape.

- Read the explanation to ensure that you have chosen the proper form.

- If the form isn`t what you`re looking for, take advantage of the Lookup discipline to find the form that fits your needs and needs.

- If you obtain the right form, click Get now.

- Opt for the costs prepare you want, fill out the required info to produce your money, and buy an order utilizing your PayPal or Visa or Mastercard.

- Select a convenient file file format and acquire your copy.

Discover every one of the papers templates you possess purchased in the My Forms food list. You can get a more copy of Arkansas Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on at any time, if necessary. Just select the essential form to acquire or print out the papers design.

Use US Legal Forms, probably the most considerable variety of authorized types, to save efforts and steer clear of mistakes. The services delivers professionally made authorized papers templates that you can use for a selection of uses. Generate a free account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

New Arkansas Employer: Register with the Arkansas Department of Finance and Administration (501)-682-7290 Click here to access the "Register New Business" link. Click the "Register New Business" link to begin the process.

Payment of Wages: Arkansas Arkansas employers must pay employees in cash, by check, direct deposit or payroll debit card. ... Employers must pay most employees at least semimonthly. ... Employers must make the deductions from employees' wages that are required by state or federal law.

WHO MUST FILE THIS REGISTRATION: Every employer with one (1) or more employees. WHERE TO FILE: Department of Finance and Administration, Withholding, P.O. Box 8055, Little Rock, Arkansas 72203-8055. HOW TO REGISTER: Complete front of this form by typewriter or print with ink or ball point pen.

If you've run payroll in Arkansas previously, you can find your Withholding Account ID (also called a DFA Account ID) and filing frequency by: Reviewing Payment Vouchers received from the Department of Finance and Administration. Calling the agency at (501) 682-7290.

Employers can register for the UI tax program online using ADWS's EZ Tax Registration system, where they provide their business information and receive an Employer Account Number (EAN).

An employer is required to withhold tax from wages of employees who work within the State of Arkansas. An employer is not required to withhold Arkansas tax from the wages of any employee who does not work within the state of Arkansas. However, the employee's wages are still taxable.

To Close Login or Sign-Up. Click on account. Click request to close account (under I want to) Must submit closure for each account type.