Arkansas Approval of Restricted Share Plan for Directors with Copy of Plan

Description

How to fill out Approval Of Restricted Share Plan For Directors With Copy Of Plan?

If you want to comprehensive, acquire, or print legal file templates, use US Legal Forms, the greatest variety of legal kinds, which can be found online. Utilize the site`s simple and convenient look for to find the files you will need. Different templates for organization and individual functions are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to find the Arkansas Approval of Restricted Share Plan for Directors with Copy of Plan within a few click throughs.

If you are currently a US Legal Forms customer, log in to your accounts and then click the Download switch to get the Arkansas Approval of Restricted Share Plan for Directors with Copy of Plan. You can also gain access to kinds you previously delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape to the proper metropolis/nation.

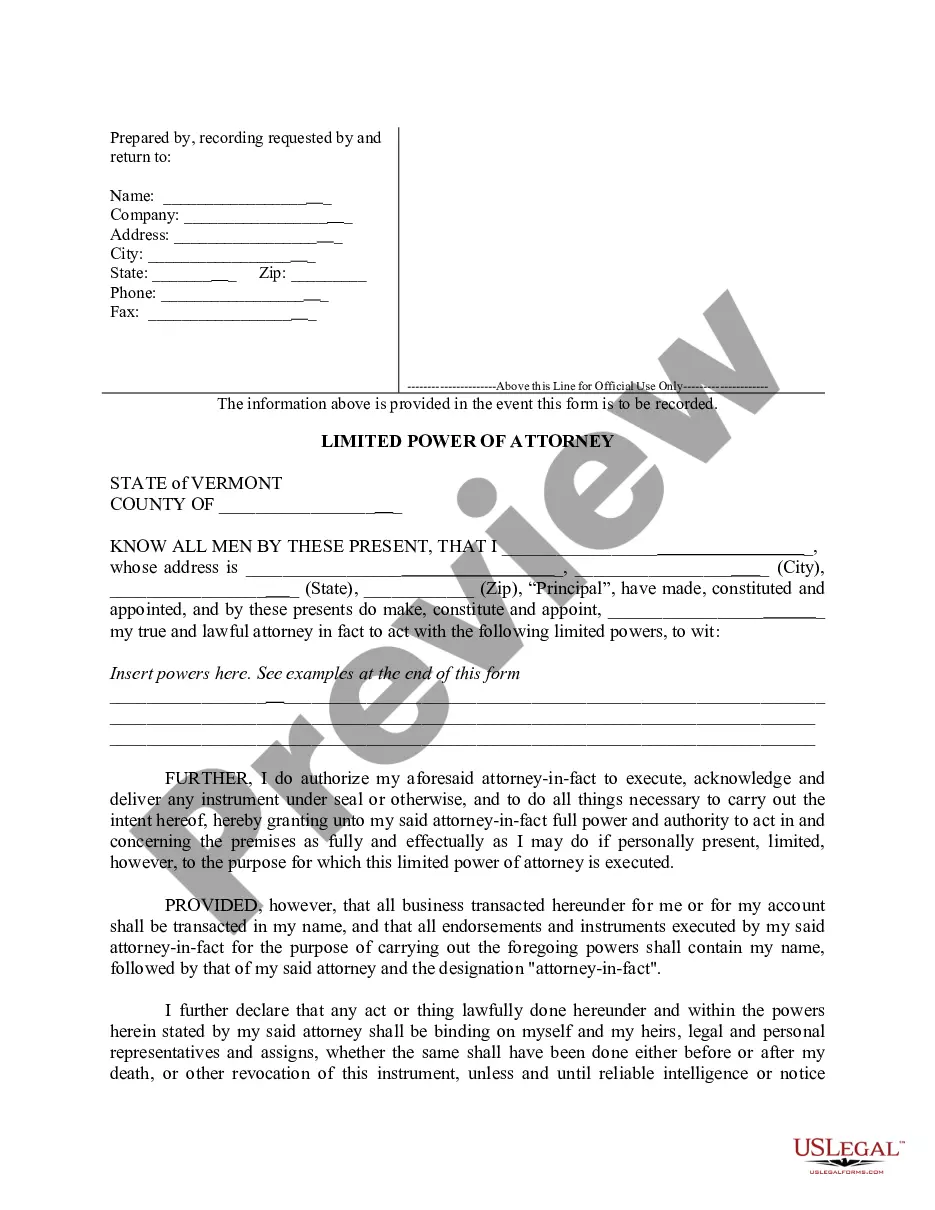

- Step 2. Use the Review option to check out the form`s articles. Do not forget about to read through the outline.

- Step 3. If you are not happy with all the form, use the Lookup industry towards the top of the display screen to find other variations of your legal form template.

- Step 4. After you have found the shape you will need, click the Get now switch. Opt for the rates program you prefer and add your credentials to sign up for the accounts.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the file format of your legal form and acquire it on your gadget.

- Step 7. Comprehensive, modify and print or indicator the Arkansas Approval of Restricted Share Plan for Directors with Copy of Plan.

Every legal file template you purchase is your own for a long time. You may have acces to each and every form you delivered electronically with your acccount. Click the My Forms area and select a form to print or acquire once more.

Be competitive and acquire, and print the Arkansas Approval of Restricted Share Plan for Directors with Copy of Plan with US Legal Forms. There are millions of specialist and state-certain kinds you can utilize for your organization or individual needs.

Form popularity

FAQ

Two Ways to Start A New Business in Arkansas Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Arkansas Secretary of State. Get your business licenses. Set up a business bank account.

(Small Businesses) 1. The business must be registered with the Arkansas Secretary of State. 2. The business must elect Subchapter S treatment for federal income tax purposes by filing an Election by Small Business (Form 2553) with the IRS.

Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

Along with many states, Arkansas does not require every business to obtain a generic business license at the state level. The only statewide permit or license applicable to most businesses is the Arkansas sales tax permit, often called a seller's permit, which registers your business for the Arkansas sales and use tax.

Lesson Summary. ing to the Arkansas real estate regulations , any client funds (e.g. earnest money, security deposits) received by a broker must be given to an escrow agent or deposited into a trust account within three days. If the broker deposits the client funds, they become known as trust funds.