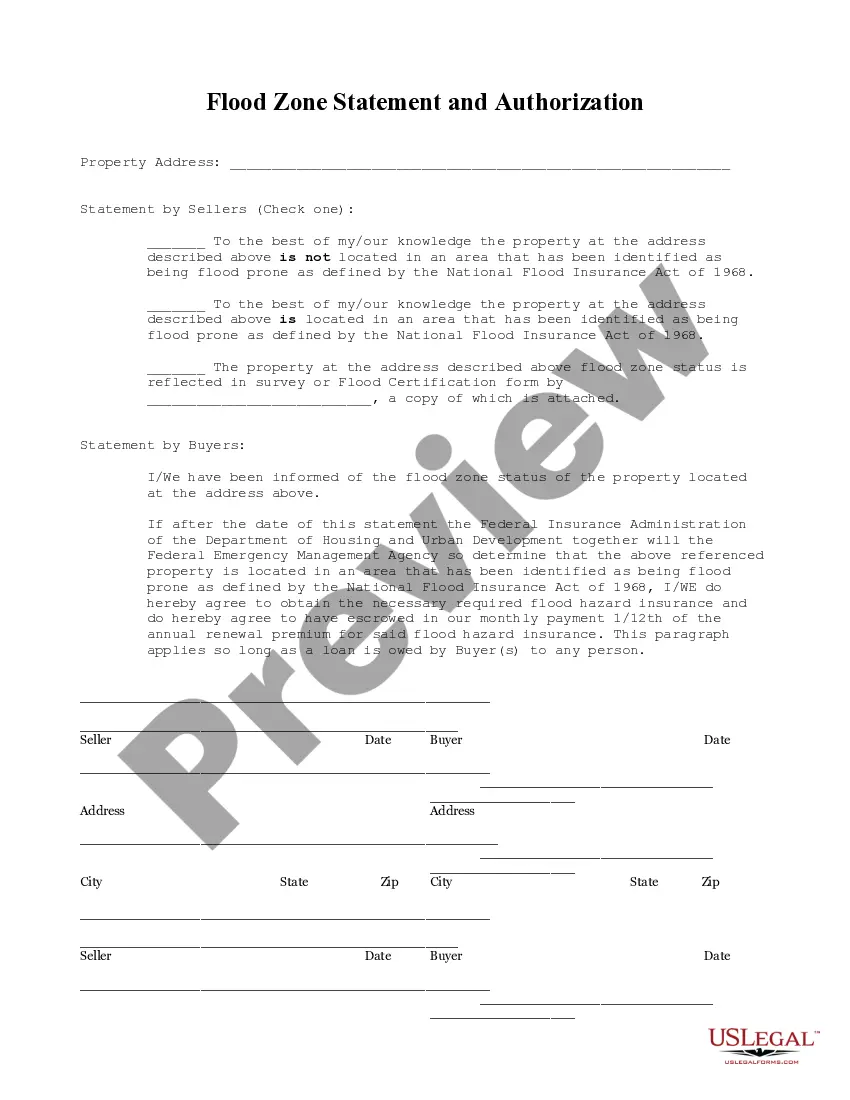

Michigan Flood Zone Statement and Authorization

Understanding this form

The Flood Zone Statement and Authorization is a legal document used by sellers to disclose the flood zone status of a property. This form is essential for ensuring that buyers are informed of any flood-related risks associated with the property. Unlike other real estate forms, this statement specifically addresses the property's flood zone status under the National Flood Insurance Act of 1968, making it crucial for both sellers and buyers to acknowledge potential insurance requirements in the event that the property is later designated as flood prone.

What’s included in this form

- Property address: Clearly specify the property's location.

- Seller's statement: Indicate whether the property is in a flood-prone area.

- Buyer's acknowledgment: Buyers confirm awareness of the flood zone status and agree to obtain flood insurance if required.

- Flood certification: Option to attach a survey or certification confirming flood zone status.

- Signatures and dates: Required from both sellers and buyers to finalize the agreement.

When this form is needed

This form is necessary when selling or buying a property in areas potentially affected by flooding. It should be used when the property is located in a designated flood zone or when there is uncertainty about its status. This document helps protect both parties by ensuring that all flood-related risks are disclosed and acknowledged prior to completing the sale.

Who should use this form

- Sellers of residential properties located in or near flood-prone areas.

- Buyers who want to be informed about the flood risk associated with a property before completing the purchase.

- Real estate agents or attorneys involved in real estate transactions where flood zone disclosures are relevant.

Steps to complete this form

- Identify the property: Enter the complete address of the property being sold.

- Sellers' declaration: Check the appropriate box to indicate the flood zone status based on your knowledge.

- Attach any necessary documentation: Include a survey or flood certification if applicable.

- Buyerâs acknowledgment: Buyers should read and understand their responsibilities regarding flood insurance.

- Sign and date: Ensure both sellers and buyers provide their signatures and the date to validate the agreement.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to disclose the correct flood zone status, leading to legal issues.

- Not attaching required flood certification documentation.

- Leaving the form incomplete or unsigned, which can invalidate the agreement.

- Overlooking state-specific regulations that may impose additional requirements.

Advantages of online completion

- Convenience: Easily access and download the form from anywhere.

- Editability: Make necessary modifications to the form before finalizing it.

- Reliability: Use professionally drafted templates that adhere to legal standards.

Looking for another form?

Form popularity

FAQ

To determine if you need flood insurance, first check if your property is in a designated flood zone. The Michigan Flood Zone Statement and Authorization can provide valuable insights into this classification. Additionally, consult your local zoning office or an insurance agent familiar with flood insurance requirements. If your area is at high risk, obtaining flood insurance may be a wise financial decision.

To obtain a flood certificate, you should start by contacting a licensed provider or your local municipality. The process typically involves a review of flood maps and property records to determine if the property is in a flood zone, resulting in a Michigan Flood Zone Statement and Authorization. You can simplify this process by using platforms like uslegalforms, which offer resources to help you easily acquire the necessary documentation.

Flood zone AE in Michigan refers to areas that are at risk of flooding, particularly those that are determined to have a one percent or greater chance of flooding annually. Properties in these zones typically require a Michigan Flood Zone Statement and Authorization to address flood insurance needs. Understanding your flood zone is crucial for mitigating risk and ensuring compliance with local regulations, especially if you plan to buy or build in these areas.

A flood certificate is an official document that confirms whether a property is located within a designated flood zone. Specifically, it provides information about the flood risk associated with the property and outlines the required Michigan Flood Zone Statement and Authorization. This certificate can be essential for property owners and lenders during real estate transactions, helping to ensure that homeowners understand their insurance needs and obligations.

Getting a flood zone certificate involves a straightforward process. Start by requesting a flood zone report from a reliable source or your community's planning office. Through USLegalForms, you can access ready-to-use Michigan Flood Zone Statement and Authorization forms, making it easier to secure this essential certification.

If only a portion of your property lies within a flood zone, you still face certain requirements for flood insurance based on federal guidelines. It's crucial to review the flood map provided by your local government to understand how this affects your property. Utilizing resources such as the USLegalForms platform can help you obtain the necessary Michigan Flood Zone Statement and Authorization to address your unique situation.

Acceptable proof of flood insurance typically includes a copy of the flood insurance policy and the declaration page that outlines coverage details. In Michigan, lenders may require this documentation to issue a mortgage in a designated flood zone. Ensuring you have the correct Michigan Flood Zone Statement and Authorization in place can ease the mortgage approval process.

To obtain a flood zone determination certificate in Michigan, you should start by contacting your local municipality or the appropriate zoning office. They can provide guidance on the necessary steps and documentation required. Additionally, you can utilize services such as USLegalForms that specialize in providing Michigan Flood Zone Statement and Authorization templates, streamlining the process for you.