Arkansas Payout Agreement

Description

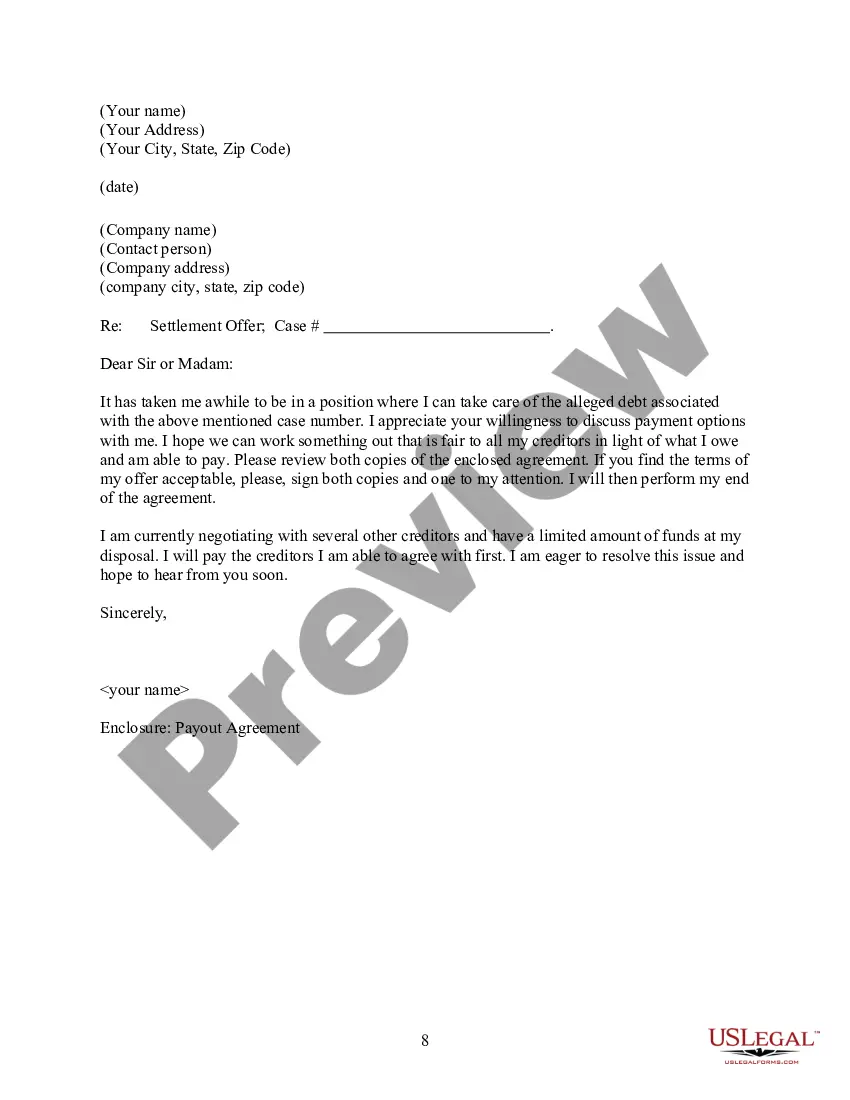

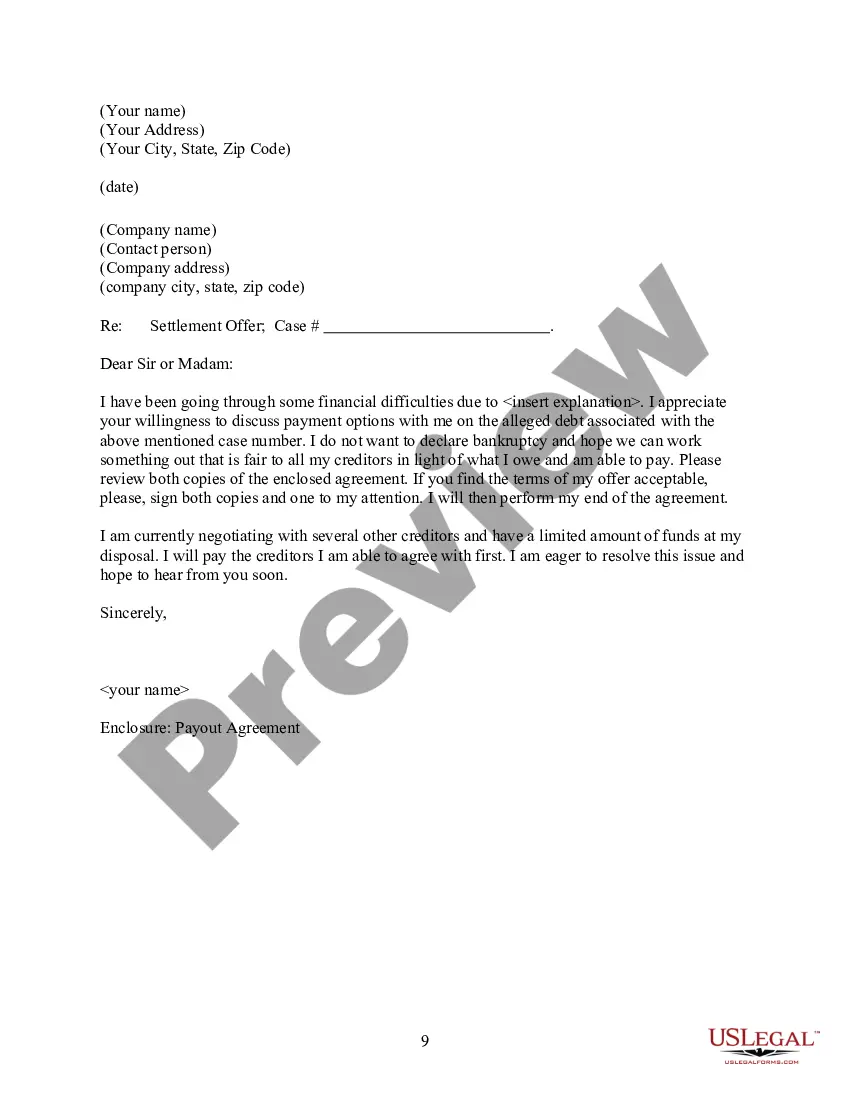

How to fill out Payout Agreement?

Selecting the appropriate legal document template can be challenging. Obviously, there are numerous templates available online, but how do you find the legal form you need? Use the US Legal Forms website.

This service offers thousands of templates, including the Arkansas Payout Agreement, suitable for both business and personal needs. All forms are reviewed by professionals and meet federal and state standards.

If you are already registered, Log In to your account and click the Download button to obtain the Arkansas Payout Agreement. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account to get an additional copy of the document you require.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Arkansas Payout Agreement. US Legal Forms is the largest repository of legal forms where you can explore various document templates. Utilize this service to procure professionally crafted documents that comply with state regulations.

- First, ensure you have selected the correct form for your locality/region.

- You can browse the form using the Preview option and review the form description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search section to find the appropriate form.

- Once you are certain that the form is accurate, click the Buy Now button to obtain the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and pay for your purchase using your PayPal account or credit card.

Form popularity

FAQ

If you receive a notice from the AR-DFA stating that you owe back taxes it's a good idea to contact the state right away. There will be a phone number listed on your most recent notice or you could call AR-DFA directly at (501) 682-5000.

Paying online is convenient, secure, and helps make sure we get your payments on time. Please visit our secure site ATAP (Arkansas Taxpayer Access Point) at . ATAP allows taxpayers or their representatives to log on, make payments and manage their account online.

New users sign up at or click on the ATAP link on our web site . ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

Arkansas Taxpayer Access Point (ATAP) Sales and Use Tax Return File Upload Information. ATAP is a web-based service that will give taxpayers, or their designated representative, online access to their tax accounts and offers the following services: Register a business. File a return on-line (except Individual Income

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

The due date for filing your Arkansas Individual Income Tax return is April 15. If April 15 falls on a weekend or holiday, your return is due on the next business day.

In Arkansas, there is no set process to apply for a payment plan on back taxes, and the state publishes very limited information about how to qualify. To learn more about payment plans, taxpayers can call the state directly at 501-682-5000 or 1-800-292-9829.

You have three options for filing and paying your Arkansas sales tax:File online File online at the Arkansas Taxpayer Access Point (ATAP). You can remit your payment through their online system.File by mail You can use Form ET-1 and file and pay through the mail.AutoFile Let TaxJar file your sales tax for you.

New users sign up at or click on the ATAP link on our web site . ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

Credit card payments may be made over the telephone by calling 1-800-2PAY-TAX (1-800-272-9829) or over the internet by visiting and clicking the "State Payments" link and either choosing Arkansas or entering the jurisdiction code 1400. Both of these options are available 24 hours a day.