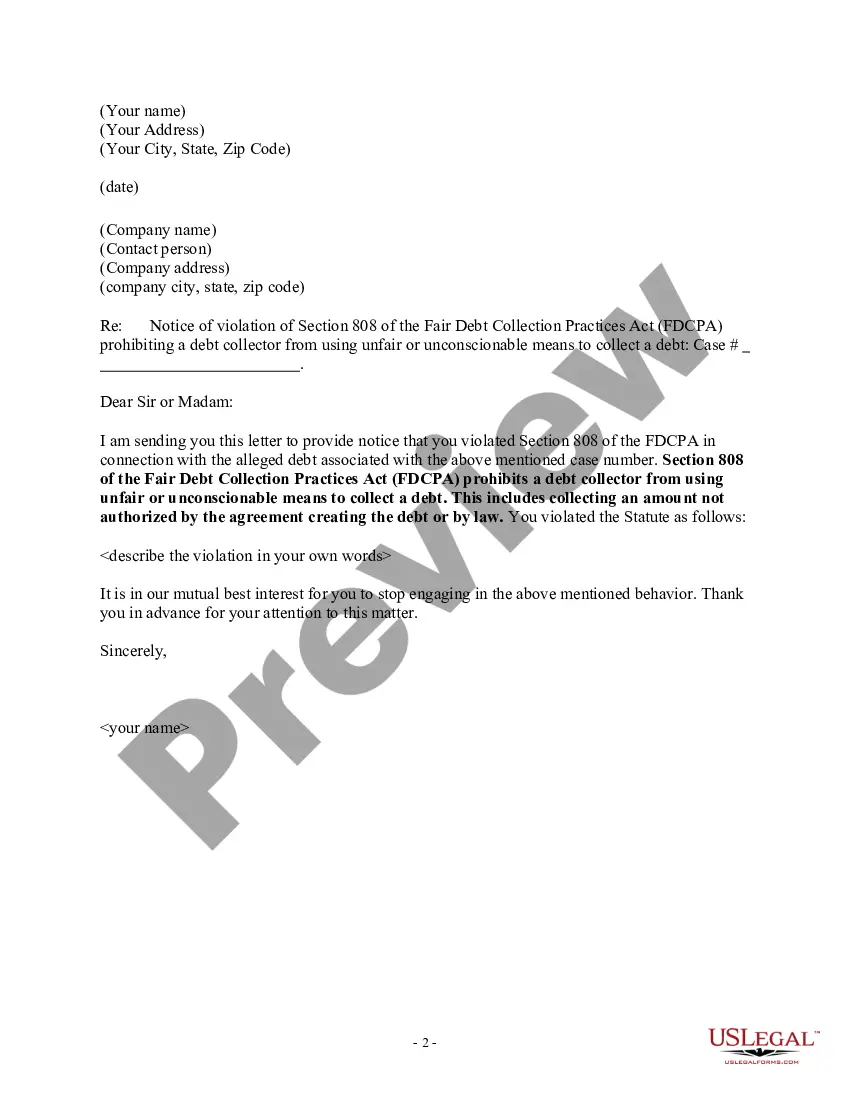

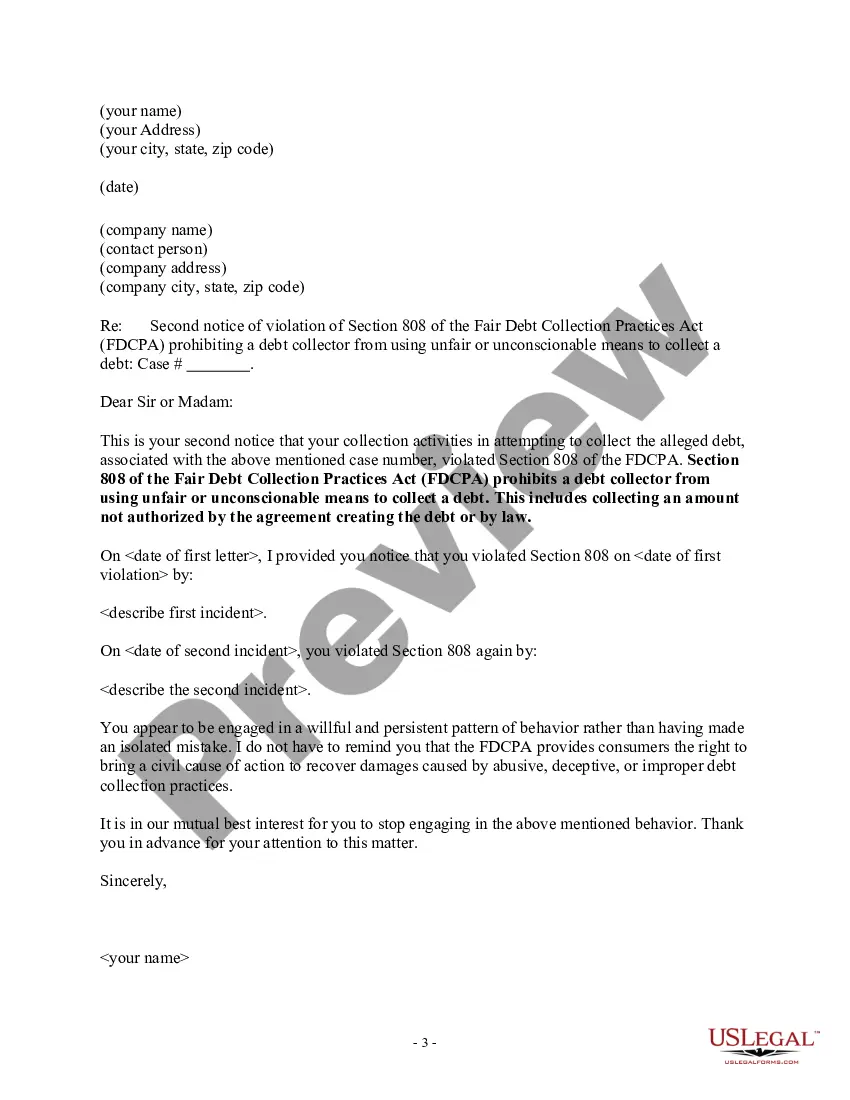

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Arkansas Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

If you want to be thorough, retrieve, or print sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Employ the website's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Access US Legal Forms to find the Arkansas Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law in just a few clicks.

Each legal document format you purchase is yours forever. You have access to every form you downloaded in your account. Click on the My documents section to select a form to print or download again.

Complete and download, and print the Arkansas Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are a current US Legal Forms customer, Log In to your account and select the Download option to obtain the Arkansas Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

- You can also view forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

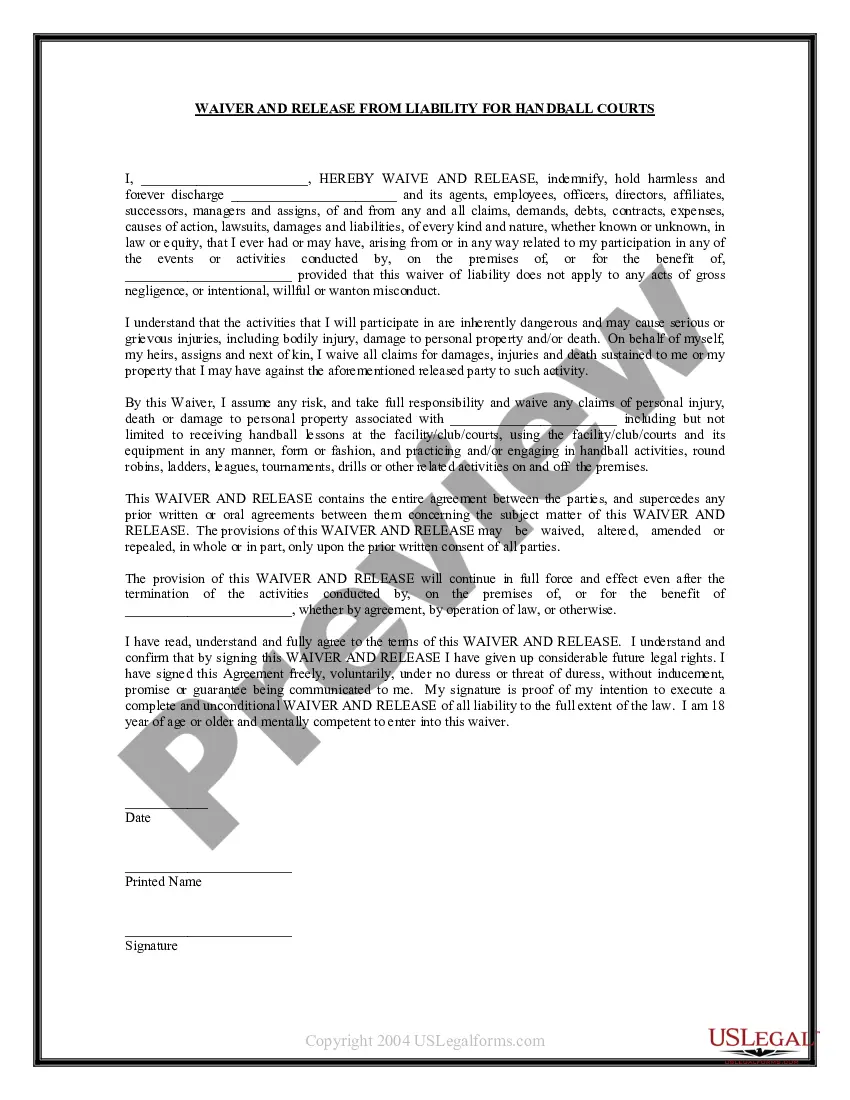

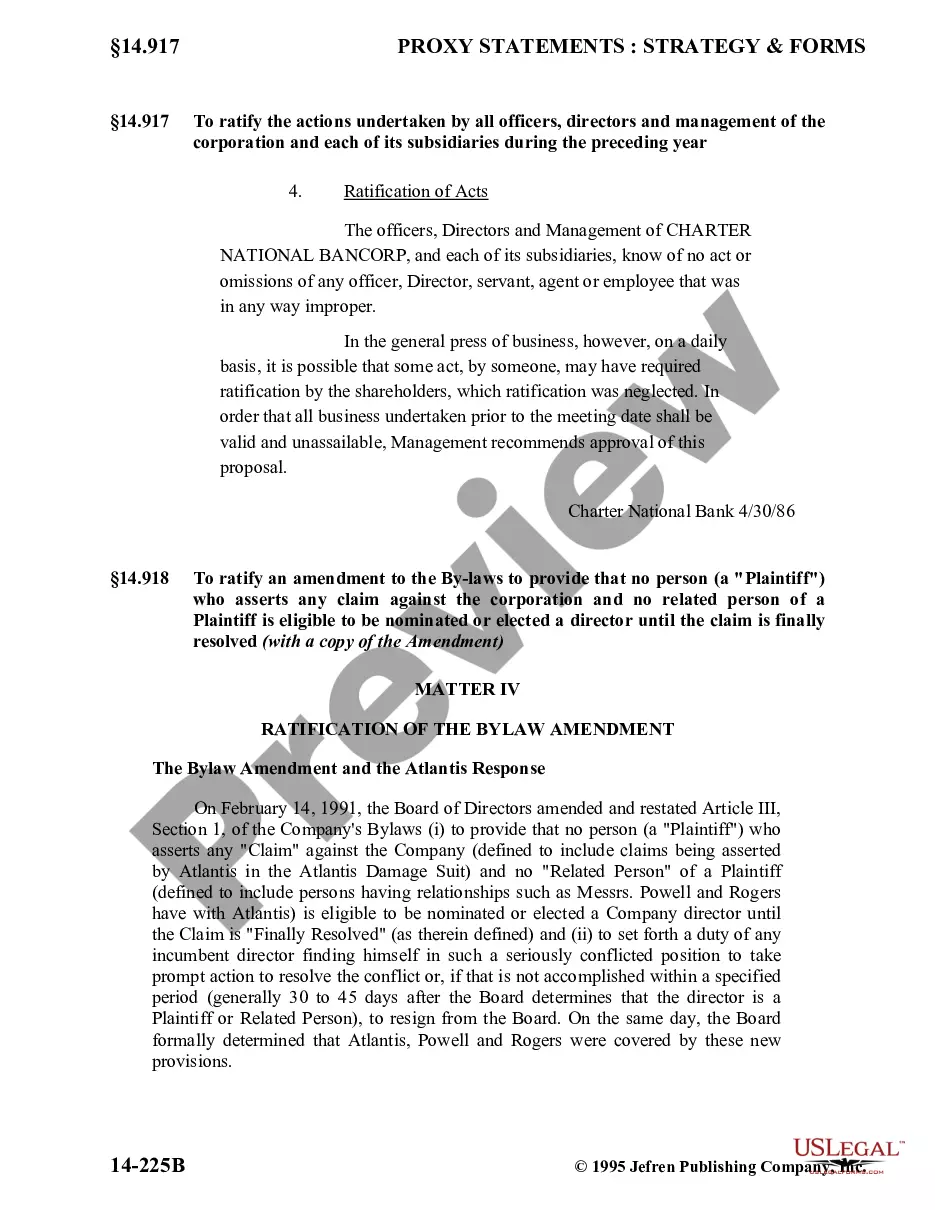

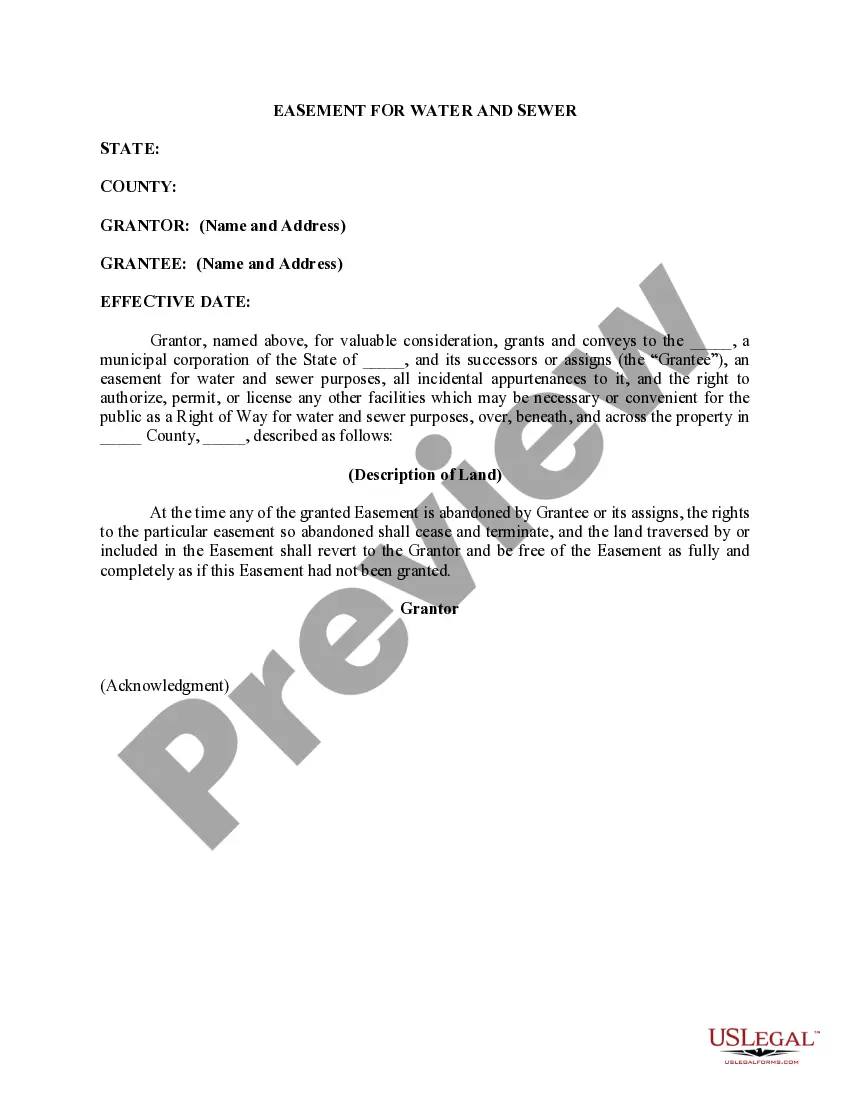

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, make use of the Search field at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have located the form you desire, click on the Get now option. Select the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to process the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Arkansas Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Form popularity

FAQ

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

The statute of limitations for most debts, under Arkansas law, ranges from two to five years. Debt collectors are not allowed to call you at work. Ever. If they call after you have asked them to stop, you may have a claim under the Fair Debt Collection Practices Act.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

Although rarely asserted in the context of a collection action, under Arkansas law, an individual who is married or is the head of a family may claim as exempt up to $500 of their personal property (up to $200 if they are not married or the head of a family). Ark.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.