Arkansas Short-Term Incentive Plan

Description

How to fill out Short-Term Incentive Plan?

If you wish to full, acquire, or print lawful document templates, use US Legal Forms, the most important selection of lawful types, that can be found on-line. Take advantage of the site`s simple and easy convenient research to find the documents you will need. Different templates for organization and personal uses are sorted by categories and suggests, or keywords. Use US Legal Forms to find the Arkansas Short-Term Incentive Plan in a few mouse clicks.

Should you be currently a US Legal Forms buyer, log in to the account and click on the Download key to have the Arkansas Short-Term Incentive Plan. You can even entry types you formerly acquired from the My Forms tab of your own account.

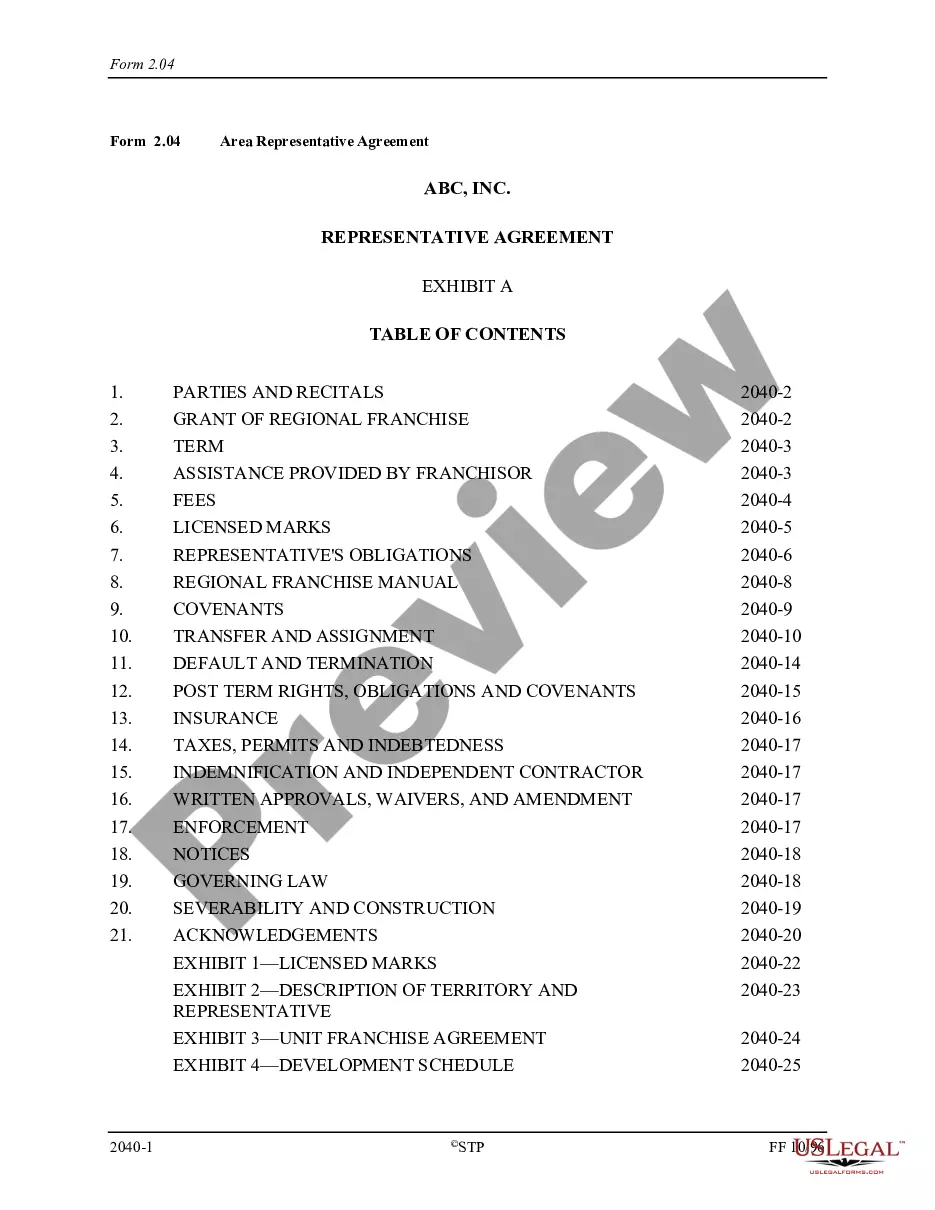

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the right town/nation.

- Step 2. Take advantage of the Review method to look through the form`s content material. Do not neglect to read through the description.

- Step 3. Should you be not happy together with the develop, utilize the Research industry at the top of the monitor to get other versions of the lawful develop web template.

- Step 4. After you have found the shape you will need, go through the Get now key. Opt for the costs plan you prefer and include your accreditations to sign up on an account.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal account to finish the deal.

- Step 6. Pick the formatting of the lawful develop and acquire it on the gadget.

- Step 7. Comprehensive, change and print or sign the Arkansas Short-Term Incentive Plan.

Every single lawful document web template you acquire is the one you have permanently. You have acces to every single develop you acquired inside your acccount. Click the My Forms area and pick a develop to print or acquire again.

Remain competitive and acquire, and print the Arkansas Short-Term Incentive Plan with US Legal Forms. There are thousands of specialist and state-specific types you may use for your organization or personal requirements.

Form popularity

FAQ

Under the PITL and CTL, this bill would, for each taxable year beginning on or after January 1, 2020, and before January 1, 2024, allow a taxpayer a credit in an amount equal to $1 for each hour a registered apprentice worked during the taxable year, up to $1,000 for each registered apprentice trained by the taxpayer ...

Arkansas allows credits for taxes paid to another state by its residents. This credit is available only when Arkansas and the other state both seek to tax the same income and is only allowable for income taxes. Arkansas also allows a childcare credit equal to 20 percent of the federal credit.

The State of Arkansas rewards companies that employ apprentices by offering employer tax credits. Companies with USDOL Registered Apprenticeship (RA) programs are eligible for a tax credit of up to $2,000 per apprentice up to a maximum amount of $10,000 per year, or 10% of the wages earned in a taxable year.

ArkPlus Income Tax Credit (ACA §15-4-2706(b)) The Consolidated Incentive Act 182 of 2003, as amended, allows the Arkansas Economic Development Commission (AEDC) to provide a ten percent (10%) income tax credit to eligible businesses based on the total investment in a new location or expansion project.

New Arkansas tax cut bill The latest Arkansas tax cut bill signed into law by Gov. Sanders on Sept. 14 further reduces the state's top income tax rate from 4.7% to 4.4%, (This rate was previously reduced from 4.9% in April 2023.)

Job Creation Income Tax Credit (Advantage Arkansas) ? Act 182 of 2003, as amended, § 15-4-2705. The Advantage Arkansas program provides an Arkansas income tax credit based upon a percentage of the annual payroll paid to the new full-time permanent employees hired as a result of an approved project.

Homeowners in Arkansas may receive a homestead property tax credit of up to $375 per year. Begining with the 2024 tax bills the general assembly has authorized an increase up to $425. The credit is applicable to the ?homestead?, which is defined as the dwelling of a person used as their principal place of residence.