Wisconsin Executor's Deed of Distribution

Description

How to fill out Executor's Deed Of Distribution?

US Legal Forms - one of many most significant libraries of authorized forms in the States - gives a wide range of authorized file web templates you are able to down load or produce. While using web site, you may get a huge number of forms for business and specific uses, categorized by groups, suggests, or keywords.You can find the latest variations of forms much like the Wisconsin Executor's Deed of Distribution in seconds.

If you already possess a registration, log in and down load Wisconsin Executor's Deed of Distribution from the US Legal Forms local library. The Down load button can look on every develop you perspective. You get access to all previously acquired forms within the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, allow me to share easy directions to get you started out:

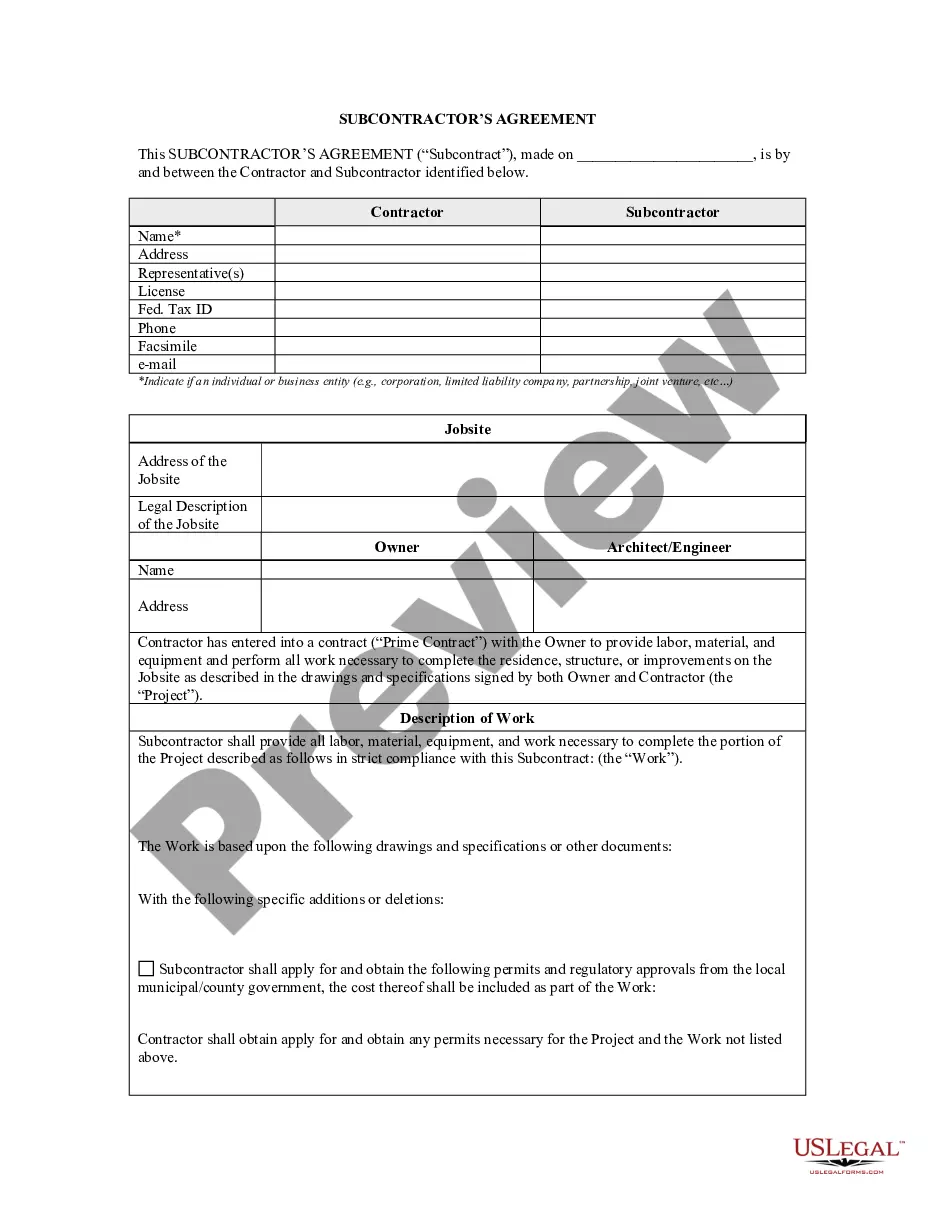

- Ensure you have picked out the correct develop for your personal area/state. Click the Review button to review the form`s content. Read the develop outline to ensure that you have chosen the correct develop.

- If the develop doesn`t fit your needs, utilize the Look for field near the top of the display to obtain the the one that does.

- In case you are pleased with the shape, verify your option by clicking the Purchase now button. Then, opt for the prices prepare you like and provide your credentials to sign up on an accounts.

- Method the deal. Make use of your Visa or Mastercard or PayPal accounts to accomplish the deal.

- Select the format and down load the shape on your own device.

- Make alterations. Complete, change and produce and signal the acquired Wisconsin Executor's Deed of Distribution.

Each and every template you added to your bank account does not have an expiration time and it is the one you have forever. So, if you would like down load or produce yet another duplicate, just proceed to the My Forms section and click on the develop you need.

Obtain access to the Wisconsin Executor's Deed of Distribution with US Legal Forms, probably the most substantial local library of authorized file web templates. Use a huge number of skilled and state-distinct web templates that satisfy your small business or specific demands and needs.

Form popularity

FAQ

Probate is unnecessary if the property solely owned by the decedent totals less than $50,000 in value. Then all that's required to transfer property is completing a "transfer by affidavit" form. Also exempt from probate is property titled in joint ownership, which automatically passes to the surviving owner.

Spousal Inheritance If you die without a will, your surviving spouse inherits everything?with one important caveat. If you have children or descendants from a previous relationship, those children inherit your share of the marital property and half of your separate property.

WI Form PR-1806, which may also referred to as Proof Of Heirship (Informal And Formal Administration), is a probate form in Wisconsin. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

If all inheritors do not agree then the property cannot be sold. Chill! If the majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.

If you do not leave behind a spouse or children, state laws generally leave your assets to your other relatives in this order of priority: Your grandchildren. Your parents. Your siblings; if they are deceased, then your nieces and nephews.

Wisconsin probate laws require an estate to be settled within 18 months. Generally, some counties in Wisconsin request that an executor settle an estate in 12 months. Executors should work toward completing probate within that time.

Dying Without a Will in Wisconsin The court will then follow intestate succession laws to determine who inherits your assets, and how much they get. If there isn't a will, the court will appoint someone, usually a relative, financial institution, or trust company to fill the role of executor or personal representative.

It is not unusual for the entire process to take 6 months to 18 months (sometime more) to fully complete. If you've been named a beneficiary and are dealing with a trustee or executor who is not properly handling the estate and you have yet to receive your inheritance, please let us know.