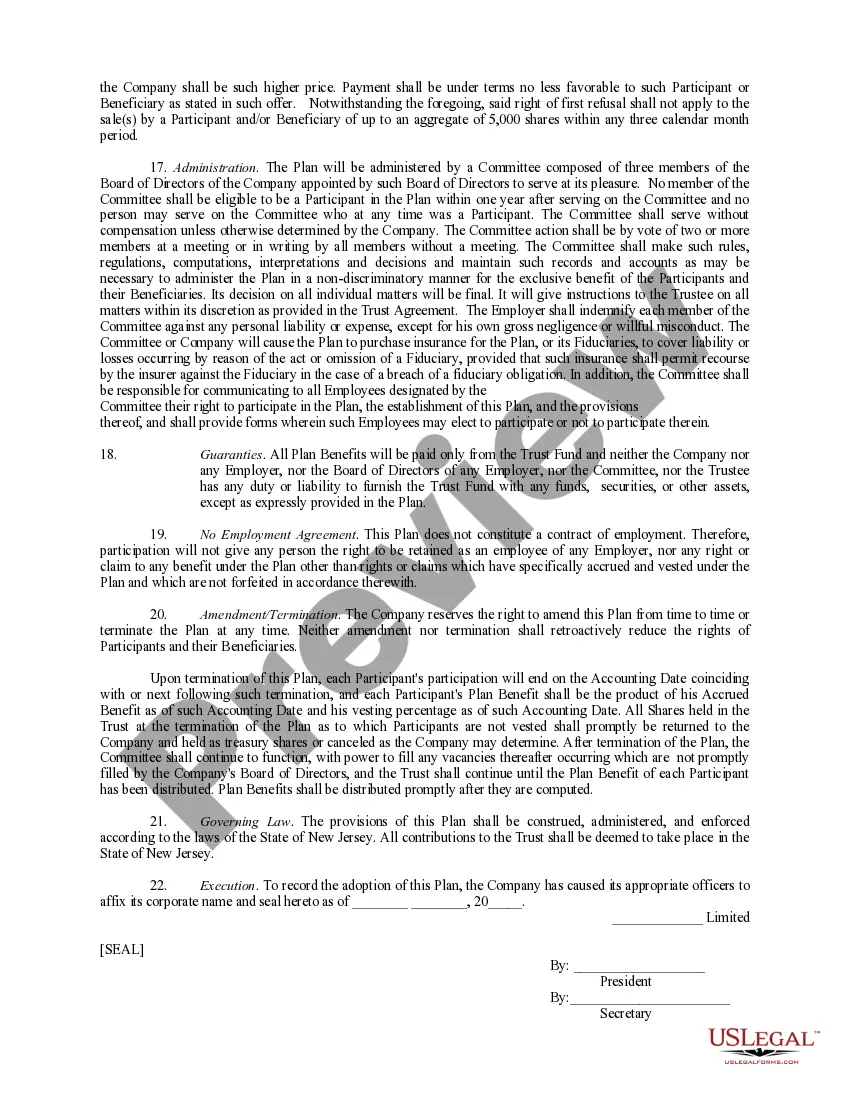

Arkansas Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

Selecting the finest legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps you can follow.

- The service offers thousands of templates, including the Arkansas Executive Employee Stock Incentive Plan, which you can utilize for business and personal purposes.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Arkansas Executive Employee Stock Incentive Plan.

- Use your account to browse the legal forms you have purchased previously.

- Navigate to the My documents tab in your account and download another copy of the document you need.

Form popularity

FAQ

An Employee Stock Ownership Plan (ESOP) is a retirement plan that invests primarily in the stock of the sponsoring employer, allowing employees to benefit from company growth. An equity incentive plan, however, provides employees with stock options or other equity-based compensation. Understanding these distinctions is crucial for businesses exploring the Arkansas Executive Employee Stock Incentive Plan, as each approach has different advantages for employee engagement and retention.

An employee stock ownership incentive plan is a program that provides employees with an ownership stake in the company, often through shares or options. This type of plan aligns employee interests with company performance, enhancing motivation and productivity. In Arkansas, the Executive Employee Stock Incentive Plan serves as a strategic tool for companies looking to engage employees meaningfully.

Generally, incentive stock options (ISOs) can only be granted to employees. The IRS mandates that to qualify for favorable tax treatment, ISOs must be provided exclusively to employees, which excludes non-employees such as contractors or advisors. If you're looking for options for non-employees, you may want to explore other equity compensation features available through the Arkansas Executive Employee Stock Incentive Plan.

Incentive stock options (ISOs) come with certain disadvantages that you should consider. One major drawback is that ISOs can be subject to alternative minimum tax (AMT), which could result in unexpected tax liabilities. Additionally, if your company does not perform well, the stock's value may decrease, leaving you with options that have little to no worth. If you're exploring options through the Arkansas Executive Employee Stock Incentive Plan, it's crucial to weigh these risks.

Incentive stock options (ISOs) are typically offered to key employees in the company, including executives and certain qualified individuals. To qualify, employees must meet specific requirements set by the Internal Revenue Code, such as being an employee of the company for a designated time. This ensures that the available benefits support long-term employment and performance. The Arkansas Executive Employee Stock Incentive Plan can help businesses structure these options to attract qualified individuals and strengthen their workforce.

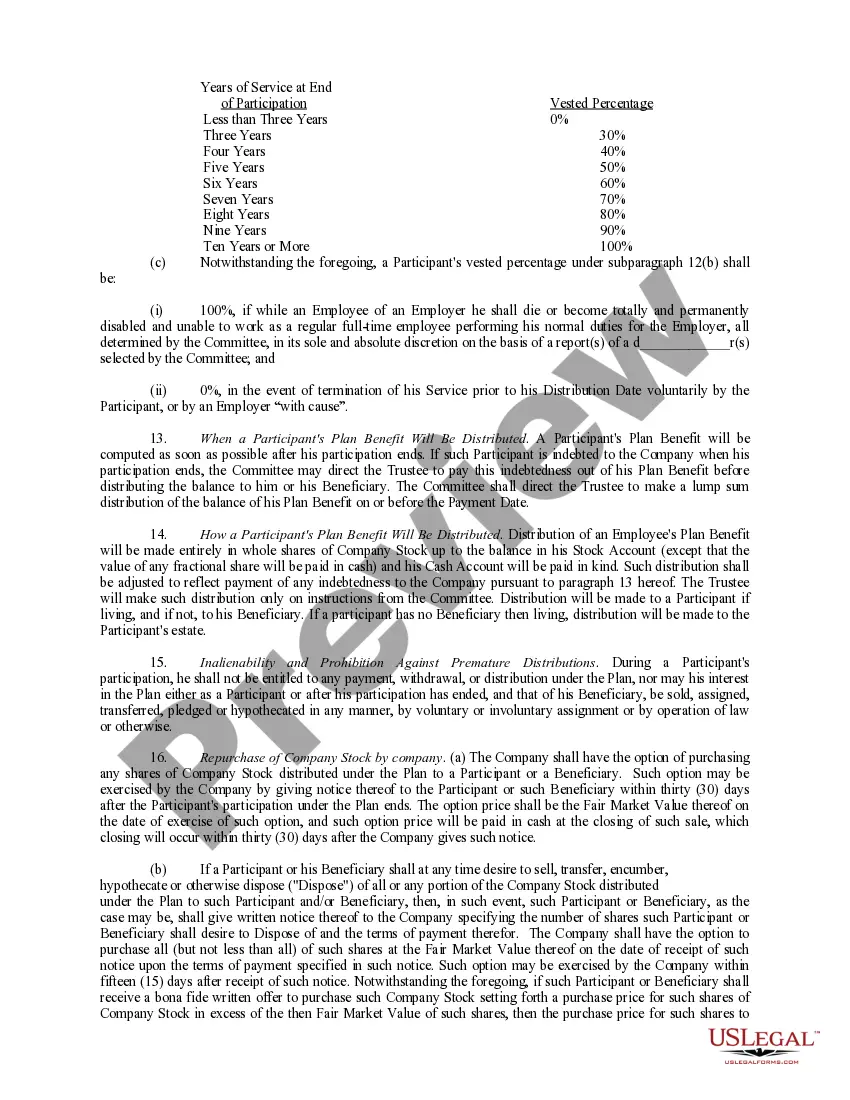

Stock incentive plans, like the Arkansas Executive Employee Stock Incentive Plan, provide employees with shares or options as part of their overall compensation. This approach incentivizes employees to work towards the company's success since their financial outcomes directly relate to the company's performance. Additionally, these plans often come with vesting periods, ensuring that employees remain involved with the company over time. By leveraging stock incentive plans, companies can enhance motivation and retention among their workforce.

The $100,000 rule pertains to incentive stock options (ISOs) and dictates that an employee can only exercise ISOs worth up to $100,000 in value per year. If options exceed this threshold, the excess will be treated as non-qualified stock options. This rule, part of the tax considerations surrounding the Arkansas Executive Employee Stock Incentive Plan, impacts both tax treatment and the financial planning for executives. Therefore, it is essential to plan carefully to maximize the benefits of stock options.

Stock incentives, such as those found in the Arkansas Executive Employee Stock Incentive Plan, reward employees with shares in the company. These incentives align the interests of employees and shareholders, encouraging employees to contribute to the company's success. When the company performs well, the value of these shares increases, benefiting employees significantly. Understanding how these incentives function can empower executives and businesses to attract and retain top talent.