Arkansas Equity Incentive Plan

Description

How to fill out Equity Incentive Plan?

US Legal Forms - one of the greatest libraries of legal kinds in America - provides a variety of legal file layouts you are able to down load or print out. While using site, you can get thousands of kinds for business and personal uses, categorized by categories, says, or keywords and phrases.You will find the most up-to-date versions of kinds such as the Arkansas Equity Incentive Plan within minutes.

If you currently have a monthly subscription, log in and down load Arkansas Equity Incentive Plan from the US Legal Forms catalogue. The Obtain option will show up on every single type you look at. You get access to all formerly downloaded kinds within the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, allow me to share straightforward instructions to get you started off:

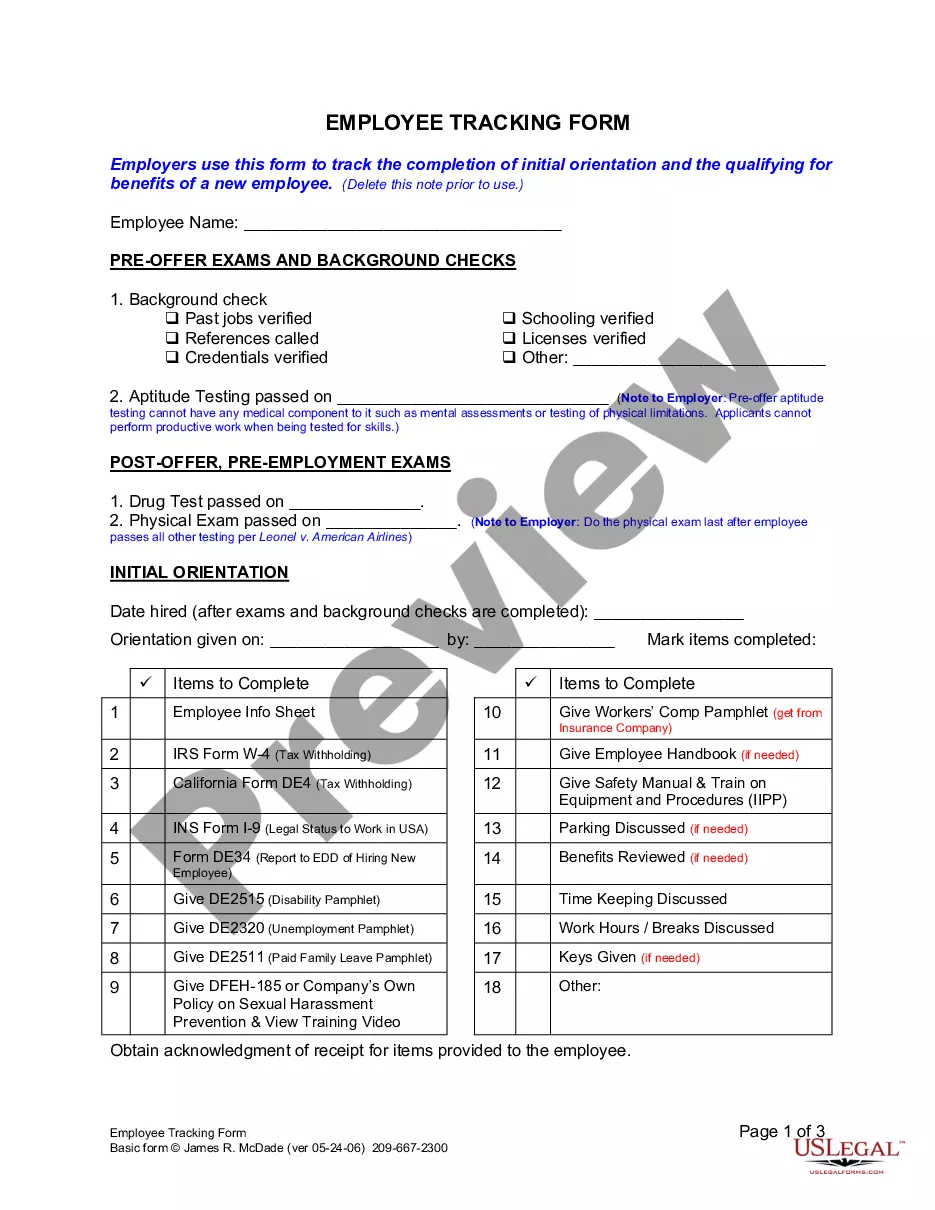

- Be sure to have chosen the proper type for your personal city/region. Click on the Preview option to check the form`s articles. Browse the type explanation to actually have selected the right type.

- In the event the type does not suit your requirements, make use of the Lookup industry on top of the monitor to find the one that does.

- In case you are content with the shape, confirm your selection by simply clicking the Buy now option. Then, choose the prices plan you want and supply your accreditations to sign up for an profile.

- Process the purchase. Make use of Visa or Mastercard or PayPal profile to complete the purchase.

- Choose the format and down load the shape on the device.

- Make modifications. Load, modify and print out and sign the downloaded Arkansas Equity Incentive Plan.

Each and every design you included with your account does not have an expiration particular date and is your own property permanently. So, if you wish to down load or print out an additional backup, just proceed to the My Forms area and click about the type you require.

Get access to the Arkansas Equity Incentive Plan with US Legal Forms, by far the most comprehensive catalogue of legal file layouts. Use thousands of professional and state-certain layouts that meet up with your small business or personal requirements and requirements.

Form popularity

FAQ

Tax credits reduce the amount of income tax you owe to the federal and state governments. Credits are generally designed to encourage or reward certain types of behavior that are considered beneficial to the economy, the environment, or to further any other purpose the government deems important.

ArkPlus Income Tax Credit (ACA §15-4-2706(b)) The Consolidated Incentive Act 182 of 2003, as amended, allows the Arkansas Economic Development Commission (AEDC) to provide a ten percent (10%) income tax credit to eligible businesses based on the total investment in a new location or expansion project.

Arkansas income taxes Retirees age 59.5 or older can exempt the first $6,000 of an IRA distribution. Up to $6,000 of income from private or government employer sponsored retirement plans is also tax-exempt in Arkansas. Arkansas income tax rates currently max out at 4.7%. The top tax rate will reduce to 4.4% in 2024.

2021 Low Income Tax Tables To qualify for the Low Income Tax Table, you must earn less than $32,200 and if you're married, you must file a joint tax return. If you itemized your tax deductions, you must use the Regular Income Tax Table.

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

Homeowners in Arkansas may receive a homestead property tax credit of up to $375 per year. Begining with the 2024 tax bills the general assembly has authorized an increase up to $425. The credit is applicable to the ?homestead?, which is defined as the dwelling of a person used as their principal place of residence.