Arkansas Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

If you require to complete, obtain, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to sign up for an account.

Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Arkansas Business Deductibility Checklist in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to download the Arkansas Business Deductibility Checklist.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

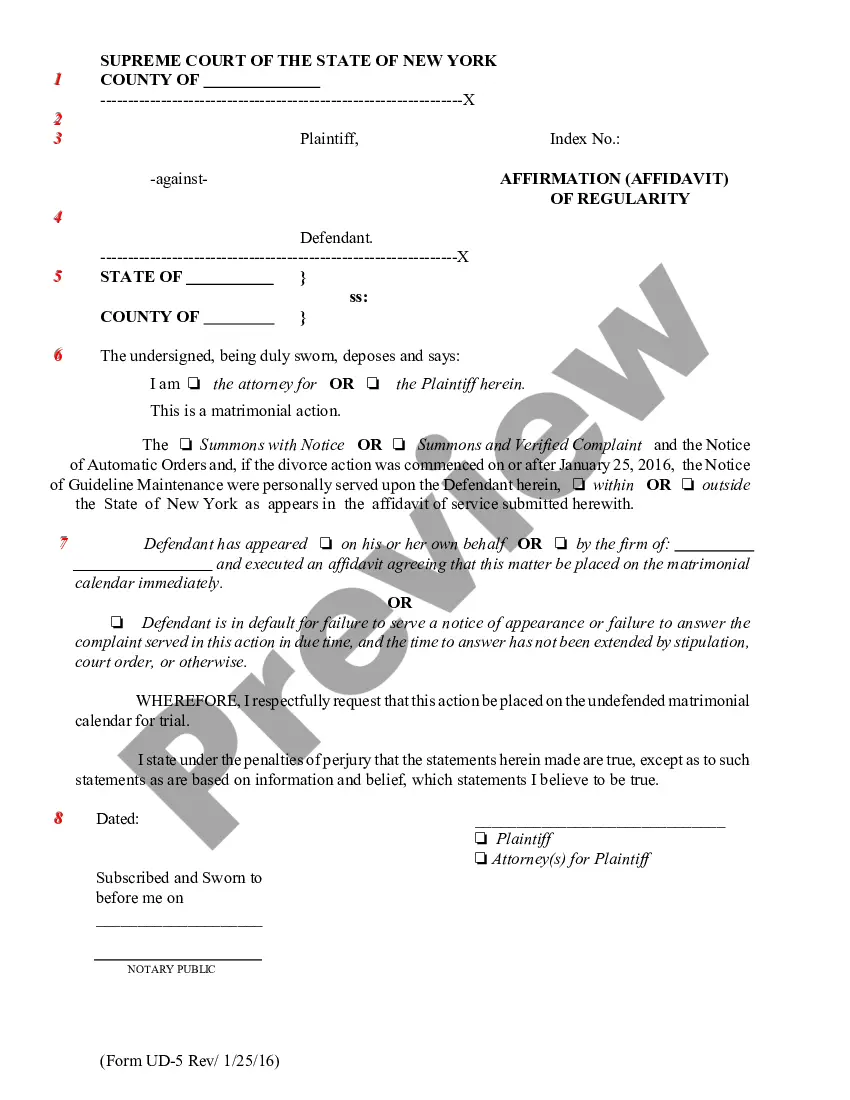

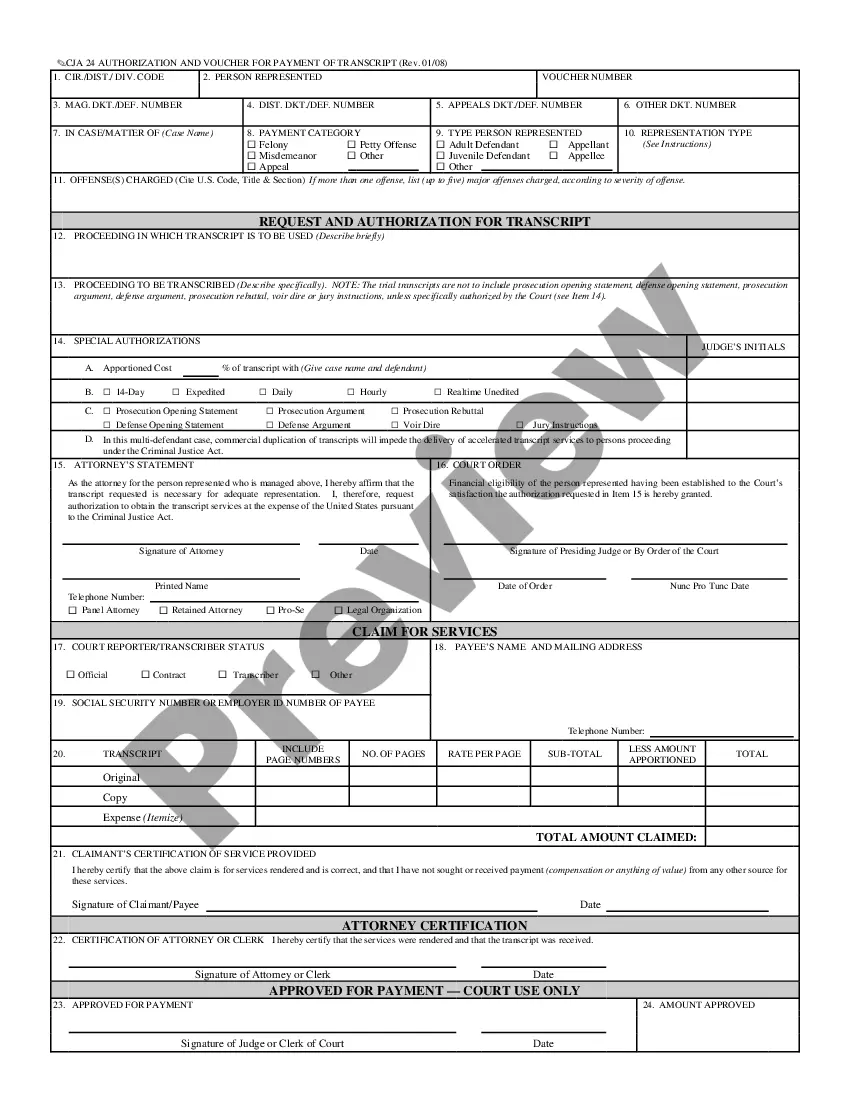

- Step 2. Use the Preview feature to review the form’s details. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

You wouldn't write off these expenses as business expenses because they're not ordinary and necessary costs of carrying on your trade or business. Personal, living, or family expenses are generally not deductible. It's a good idea to keep separate business and personal accounts as this makes it easier to keep records.

The IRS allows you to deduct $5,000 in business startup costs and $5,000 in organizational costs, but only if your total startup costs are $50,000 or less. If your startup costs in either area exceed $50,000, the amount of your allowable deduction will be reduced by the overage.

Qualified Business Income Basically, if you own a small business and it generates $100,000 in profit in 2019, you can deduct $20,000 before ordinary income tax rates are applied.

Begin by adding up all your startup costs and costs for organizing your new business. Subtract the costs for the of $5,000 for startup costs and $5,000 for organizational costs that you can deduct in the first year.

Types of Deductible ExpensesSelf-Employment Tax.Startup Business Expenses.Office Supplies and Services.Advertisements.Business Insurance.Business Loan Interest and Bank Fees.Education.Depreciation.More items...?

21 Small-business tax deductionsStartup and organizational costs. Our first small-business tax deduction comes with a caveat it's not actually a tax deduction.Inventory.Utilities.Insurance.Business property rent.Auto expenses.Rent and depreciation on equipment and machinery.Office supplies.More items...

Federal tax laws allow LLCs to deduct initial startup costs, as long as the expenses occurred before it begins conducting business. A business is considered active the first time the company's services are offered to the public. The IRS sets a $5,000 deduction limit on startup and organizational costs.

Business expenses incurred during the startup phase are capped at a $5,000 deduction in the first year. This limit applies if your costs are $50,000 or less. 3fefffeff So if your startup expenses exceed $50,000, your first-year deduction is reduced by the amount over $50,000.

To claim small-business tax deductions as a sole proprietorship, you must fill out a Schedule C tax form. The Schedule C form is used to determine the taxable profit in your business during the tax year. You then report this profit on your personal 1040 form and calculate the taxes due from there.

The IRS allows you to deduct $5,000 in business startup costs and $5,000 in organizational costs, but only if your total startup costs are $50,000 or less. If your startup costs in either area exceed $50,000, the amount of your allowable deduction will be reduced by the overage.