Wisconsin Direct Deposit Form for Stimulus Check

Description

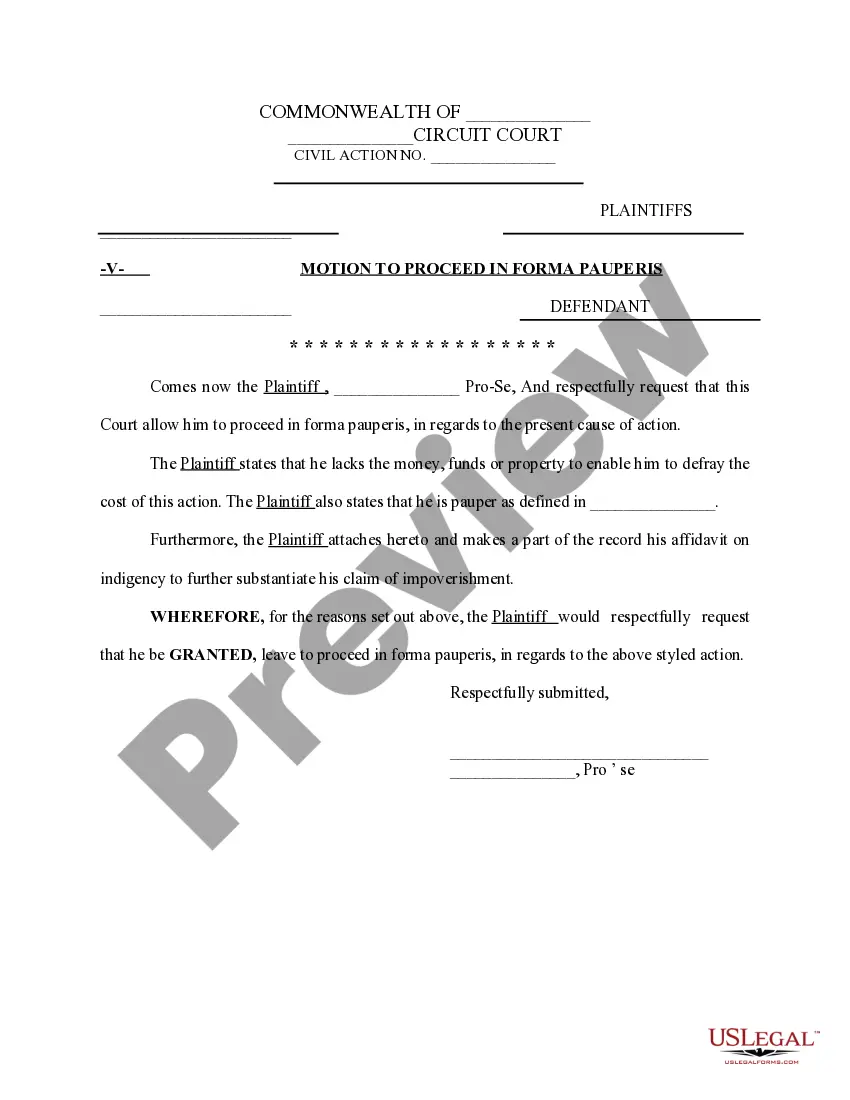

How to fill out Direct Deposit Form For Stimulus Check?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Wisconsin Direct Deposit Form for Stimulus Check in just a few minutes.

If you already have an account, Log In and download the Wisconsin Direct Deposit Form for Stimulus Check from the US Legal Forms database. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content. Refer to the form description to confirm you have chosen the correct one. If the form does not meet your requirements, use the Search field at the top of the page to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your credentials to register for the account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Complete, edit, and print and sign the downloaded Wisconsin Direct Deposit Form for Stimulus Check. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Wisconsin Direct Deposit Form for Stimulus Check with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

To claim your 3rd stimulus check, file your tax return and look for the Recovery Rebate Credit on your form. If you missed the payment, you can still receive the funds by filling out the necessary forms. Make sure to include the Wisconsin Direct Deposit Form for Stimulus Check for efficient payment delivery.

It is not too late to claim your $1400 stimulus check if you have not received it yet. You can still file your tax return and claim the Recovery Rebate Credit for the amount owed to you. Using the Wisconsin Direct Deposit Form for Stimulus Check can expedite the payment process by ensuring direct deposit.

To apply for the 3rd stimulus check, you must file your federal tax return, which determines your eligibility. Ensure that your financial information is up to date with the IRS. For a smoother process, you can use the Wisconsin Direct Deposit Form for Stimulus Check to provide your bank details for direct deposit.

To claim your $1400 stimulus check, you need to file your tax return for the year in which you qualify. If you have not received your payment, you can claim it as a Recovery Rebate Credit. Completing the Wisconsin Direct Deposit Form for Stimulus Check will help ensure your payment is deposited directly into your account.

Yes, Wisconsin residents are eligible for stimulus checks, provided they meet the income requirements set by the IRS. The amount may vary based on your filing status and number of dependents. To facilitate the receipt of your payment, consider using the Wisconsin Direct Deposit Form for Stimulus Check.

You can still claim your stimulus check if you have not received it. The IRS allows individuals to claim missing payments through the Recovery Rebate Credit when filing your tax return. Utilizing the Wisconsin Direct Deposit Form for Stimulus Check can streamline the process and ensure you receive your funds directly.

Yes, you may still be eligible for a stimulus check even if you didn't file taxes. The IRS uses additional information, such as Social Security records, to determine eligibility. To ensure you receive your payment, consider using the Wisconsin Direct Deposit Form for Stimulus Check to provide the necessary details for direct deposit.