Arkansas Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of forms such as the Arkansas Employee Payroll Records Checklist in just moments.

If you already hold a membership, Log In and obtain the Arkansas Employee Payroll Records Checklist from the US Legal Forms library. The Download option will be available on each form you view. You can access all your previously acquired forms from the My documents tab of your account.

Choose the format and download the form onto your device.

Make modifications. Fill out, edit, and print and sign the acquired Arkansas Employee Payroll Records Checklist. Every template you add to your account has no expiration date and belongs to you indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the form you need. Access the Arkansas Employee Payroll Records Checklist with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you’re using US Legal Forms for the first time, here are simple instructions to get you started.

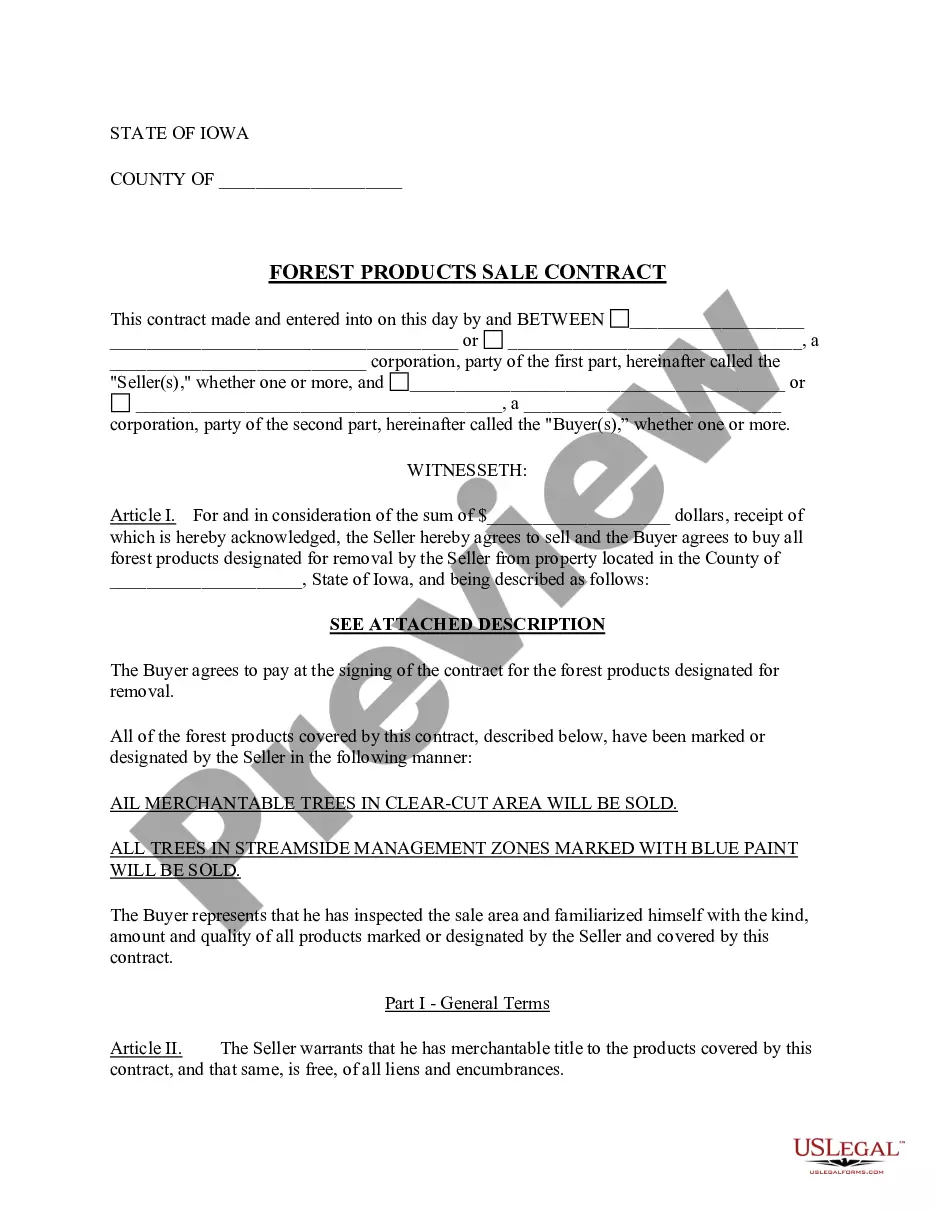

- Ensure you have selected the correct form for the city/state. Click the Preview option to review the content of the form.

- Check the form summary to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- Once you’re satisfied with the form, confirm your selection by clicking the Get now button. Then, select your desired pricing plan and provide your details to register for an account.

- Process the payment. Use a Visa or Mastercard or PayPal account to complete the transaction.

Form popularity

FAQ

You can store payroll records via paper or online files. Develop a recordkeeping system that works best for you. With paper-based recordkeeping, you can store files in locked cabinets. Be sure to label each of your folders so you can easily access your records.

Examples of items that should not be included in the personnel file are: Pre-employment records (with the exception of the application and resume) Monthly attendance transaction documents. Whistleblower complaints, notes generated from informal discrimination complaint investigations, Ombuds, or Campus Climate.

Types of Employee RecordsBasic Information. This category includes personal information such as the employee's full name, social security number, address, and birth date.Hiring Documents.Job Performance and Development.Employment-Related Agreements.Compensation.Termination and Post-Employment Information.

What to Include in an Employee Files ChecklistJob description.Job application and/or resume.Job offer.IRS Form W-4.Receipt or signed acknowledgment of employee handbook.Performance evaluations.Forms relating to employee benefits.Forms providing emergency contacts.More items...?

Seven Types of Records an Employer Should Keep Under Fair Work LegislationGeneral Records.Wages & Pay Records.Payslip Records.Hours of Work Records.Leave Records.Superannuation Records.Termination Records.Recordkeeping with Cloud Payroll.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

Whether you use paper, electronic files or both, consistency is the key to effective recordkeeping. For example, if your hiring records are sorted by employee name, organize payroll records the same way. Keep the same system across all types of records, and make sure your file folders have accurate, uniform names.

Payroll records contain information about the compensation paid to employees and any deductions from their pay. These records are needed by the payroll staff to calculate gross pay and net pay for employees. Payroll records typically include information about the following items: Bereavement pay. Bonuses.

A payroll register is tool that records wage payment information about each employee gross pay, deductions, tax withholding, net pay and other payroll-related information for each pay period and pay date.

Documents must be kept on file for a minimum of 3 years (AR Code Sec.