Arkansas Memorandum to Stop Direct Deposit

Description

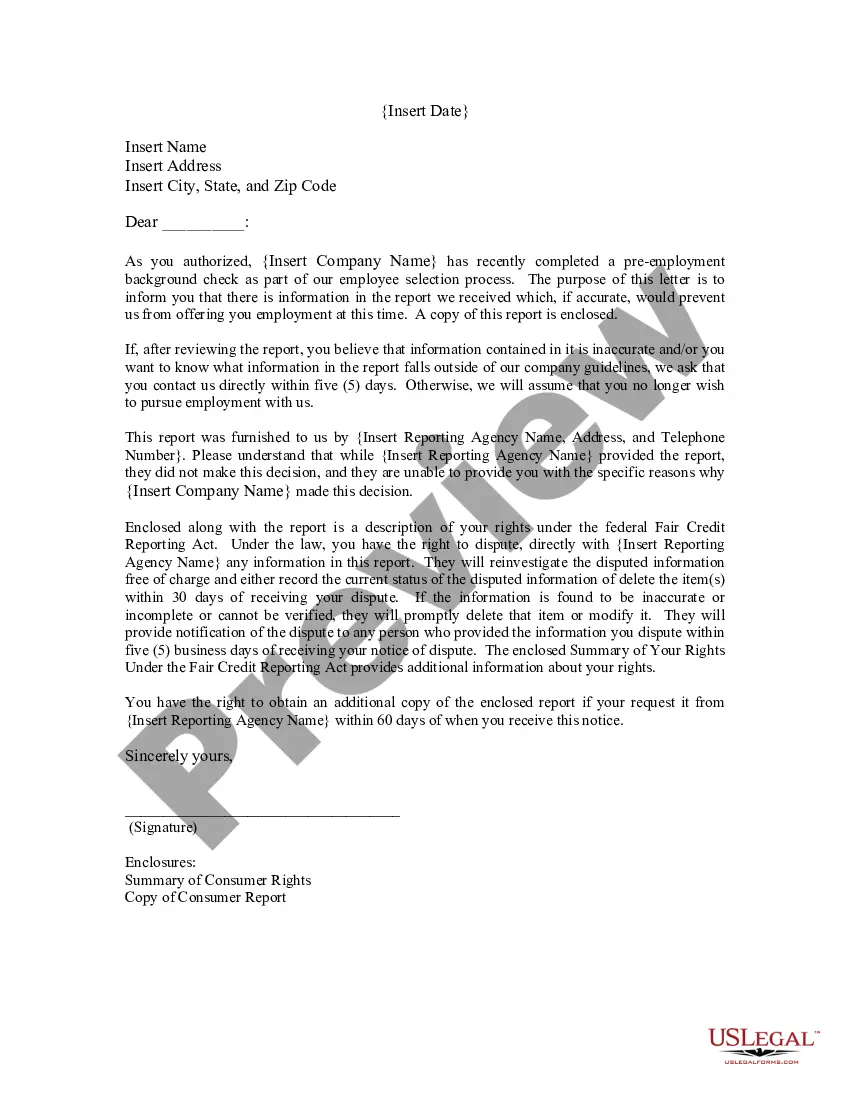

How to fill out Memorandum To Stop Direct Deposit?

If you wish to be thorough, download, or print valid document templates, utilize US Legal Forms, the largest selection of official forms that are accessible online.

Employ the site's straightforward and user-friendly search function to acquire the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 5. Process the transaction. You may use your Visa, MasterCard, or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Arkansas Memorandum to Halt Direct Deposit.

- Utilize US Legal Forms to obtain the Arkansas Memorandum to Halt Direct Deposit with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Arkansas Memorandum to Halt Direct Deposit.

- You can also retrieve forms you have previously purchased from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form design.

- Step 4. Once you have found the form you want, click the Download now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Sales and Use Tax The Arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services.

AR-OI (R 06/02/2020) ARKANSAS INDIVIDUAL INCOME TAX. OTHER INCOME/LOSS AND DEPRECIATION DIFFERENCES.

Form AR1000RC5 "Certificate for Individuals With Developmental Disabilities" - Arkansas.

AR1000F Full Year Resident Individual Income Tax Return.

All non-residents must file a state tax return if they receive any in- come from an Arkansas source. Part-year residents must file a return if they re- ceive any income from any source while a resident of Arkansas.

NONRESIDENTS (Use Form AR1000NR) Part year residents who received any gross income while an Arkansas resident must file a return (regardless of marital status, filing status, or amount).

Employers should withhold 6.6% of the payment for state income tax. Employees should be advised that the amount withheld may result in overwithholding, but the employee cannot recover the overpayment until the state income tax return is filed. (Withholding tax employer instructions, effective March 1, 2020.)

Arkansas State Income Tax ID Number You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

Arkansas Taxpayer Access Point (ATAP) Sales and Use Tax Return File Upload Information. ATAP is a web-based service that will give taxpayers, or their designated representative, online access to their tax accounts and offers the following services: Register a business. File a return on-line (except Individual Income

More about the Arkansas Form AR1000NR Tax Return We last updated Arkansas Form AR1000NR in January 2022 from the Arkansas Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.