Arkansas Worksheet for Location of Important Documents

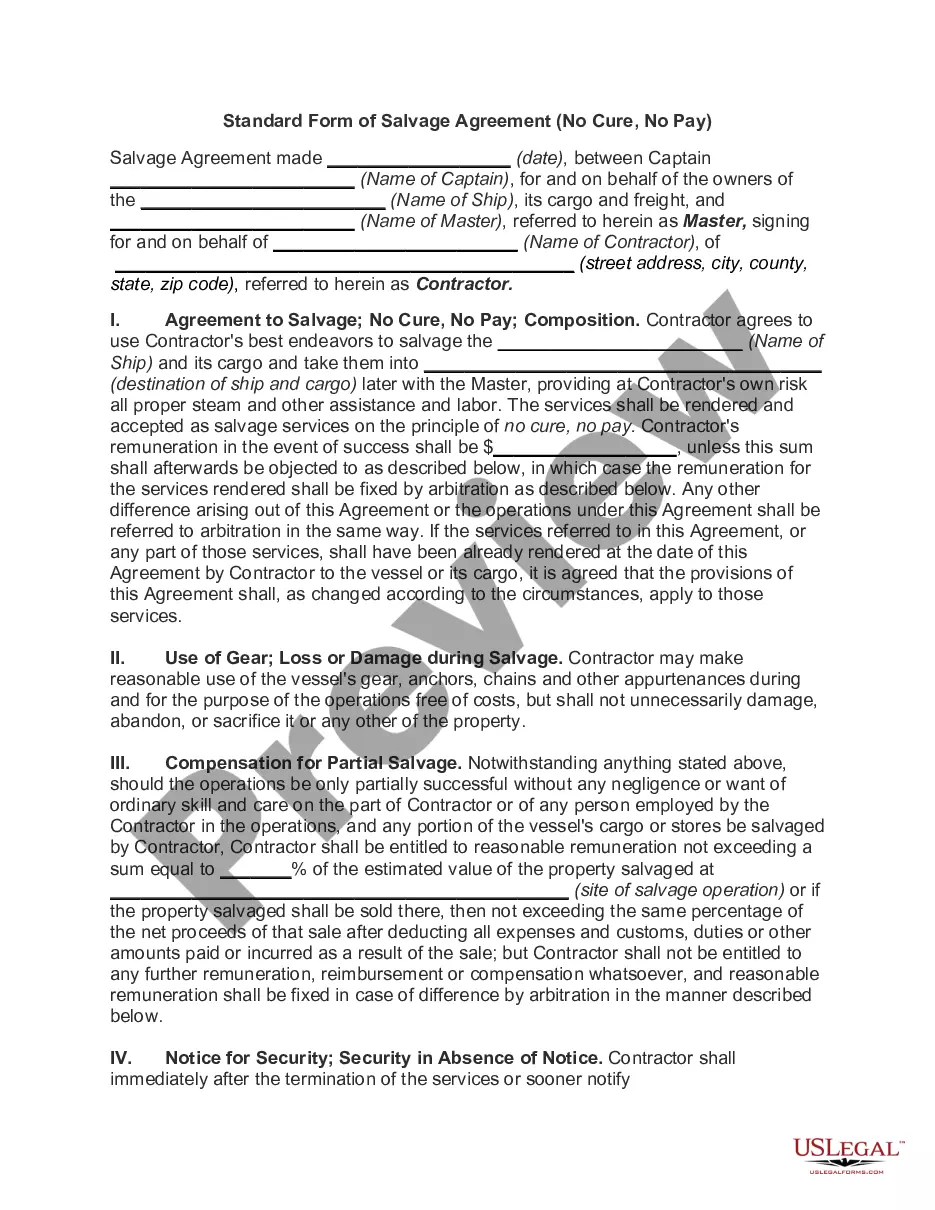

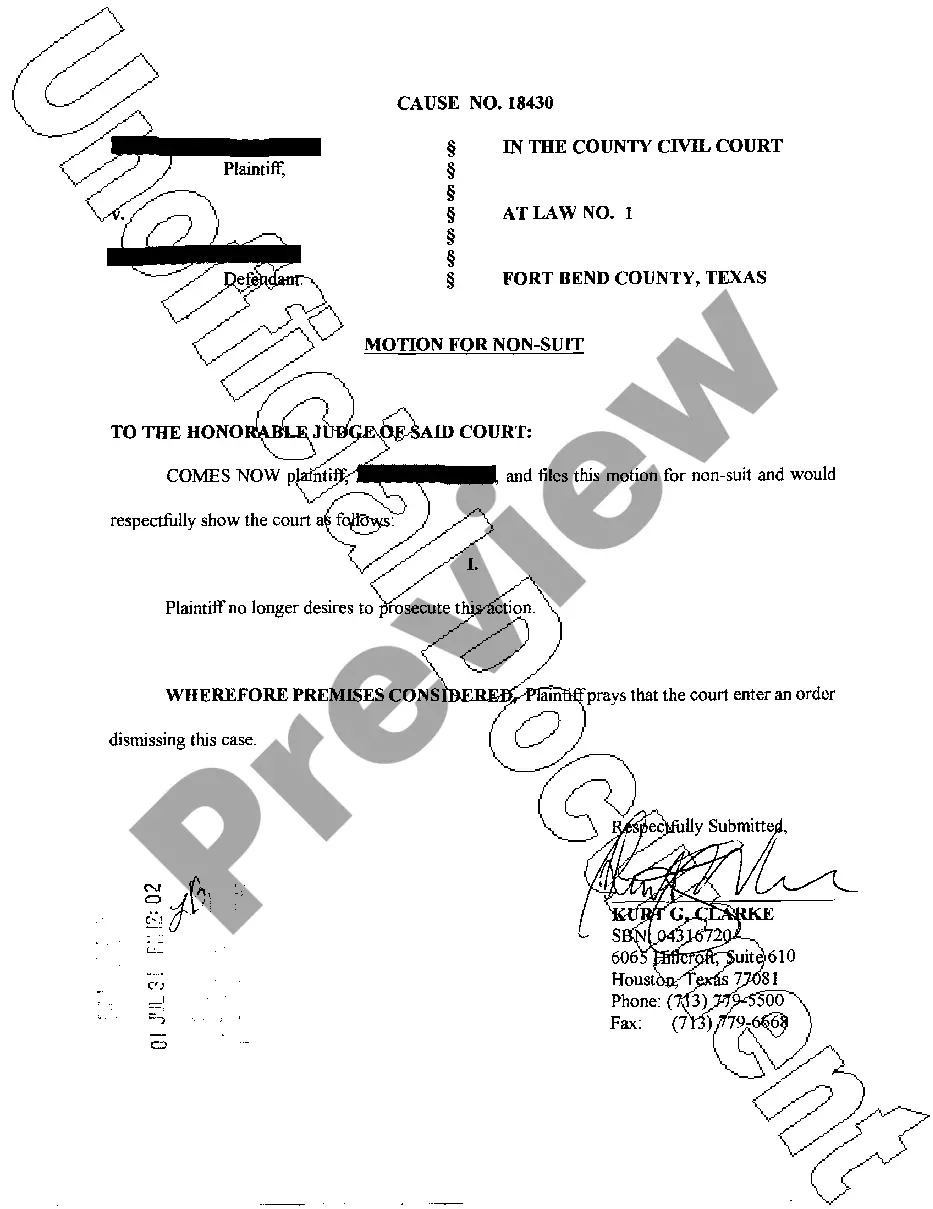

Description

How to fill out Worksheet For Location Of Important Documents?

It is feasible to spend multiple hours online searching for the proper legal document template that aligns with the federal and state requirements you seek.

US Legal Forms offers a vast assortment of legal templates that are evaluated by experts.

You can easily download or print the Arkansas Worksheet for Location of Important Documents from the service.

If you wish to find another version of your form, use the Lookup section to identify the template that fulfills your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- Subsequently, you can complete, edit, print, or sign the Arkansas Worksheet for Location of Important Documents.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Employers must obtain an exemption certificate, Form AR-4EC, from each employee. Employees with income below certain thresholds are exempt from Arkansas withholding and should file Form AR-4ECSP (Special) with their employer.

NONRESIDENTS (Use Form AR1000NR) Part year residents who received any gross income while an Arkansas resident must file a return (regardless of marital status, filing status, or amount).

All non-residents must file a state tax return if they receive any in- come from an Arkansas source. Part-year residents must file a return if they re- ceive any income from any source while a resident of Arkansas.

Texarkana, Arkansas ResidentsArkansas residents whose permanent residence is within the city limits of Texarkana, Arkansas are exempt from Arkansas individual income taxes. All income received is exempt while the taxpayer is a resident of Texarkana, Arkansas.

AR1000F Full Year Resident Individual Income Tax Return.

The Department no longer requires that a copy of federal Form 4868 be attached to your state tax return. When your Arkansas return is complete and ready to file, simply check the box on the face of the return indicating you filed a federal extension.

Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

The AR4EC Employee's Withholding Exemption Certificate must be completed by employees so employers know how much state income tax to withhold from wages. This form should be provided to employees at time of hire or upon request and should be maintained in conjunction with the federal Form W-4.

Just like the federal government, if you earn an income, you must pay income taxes in Arkansas. As a traditional W-2 employee, your Arkansas taxes will be drawn on each payroll automatically.

Form AR-TX is a form you should receive from your employer. Use the information on the form to complete the Texarkana portion of the Arkansas interview. Go into your Arkansas return and continue to the Border City Exemption page.