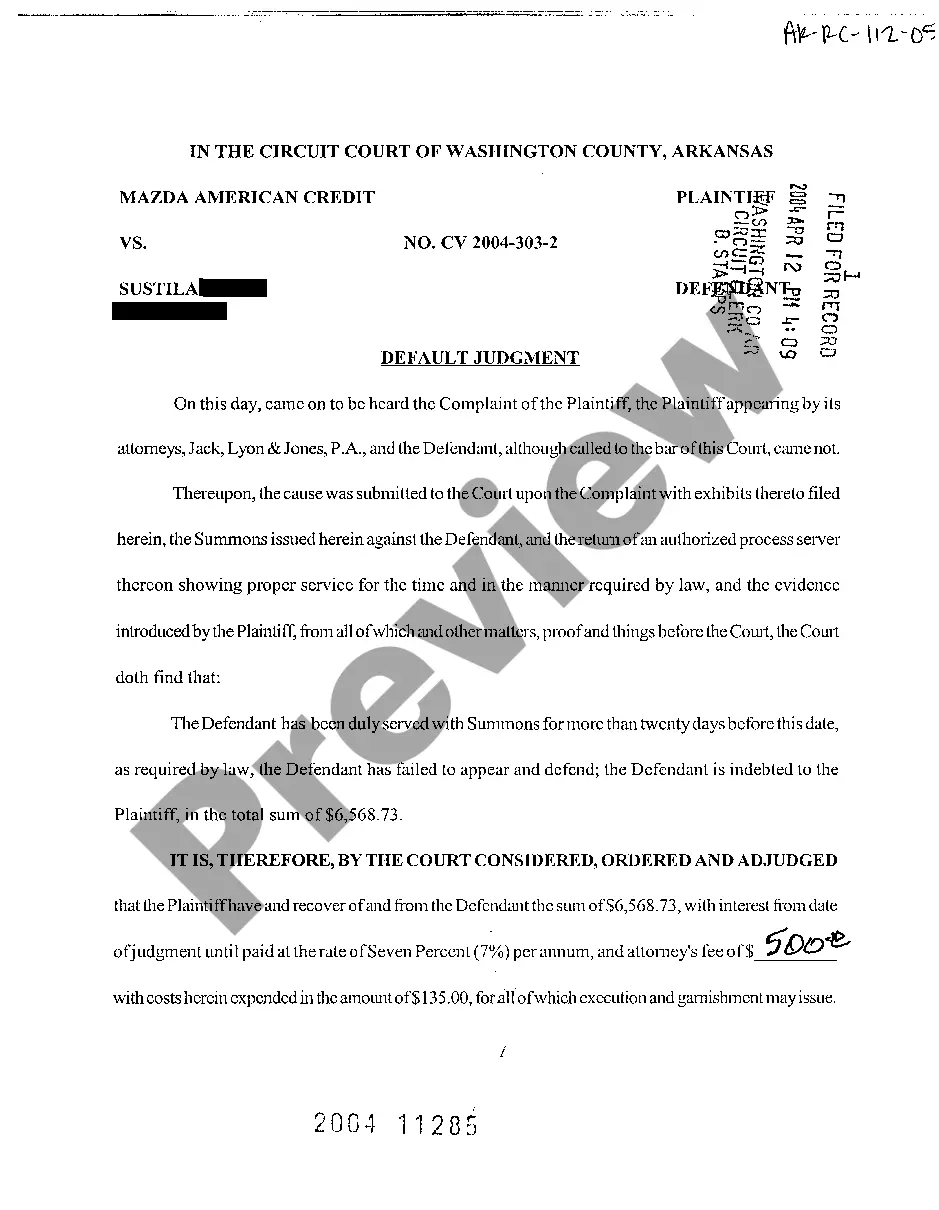

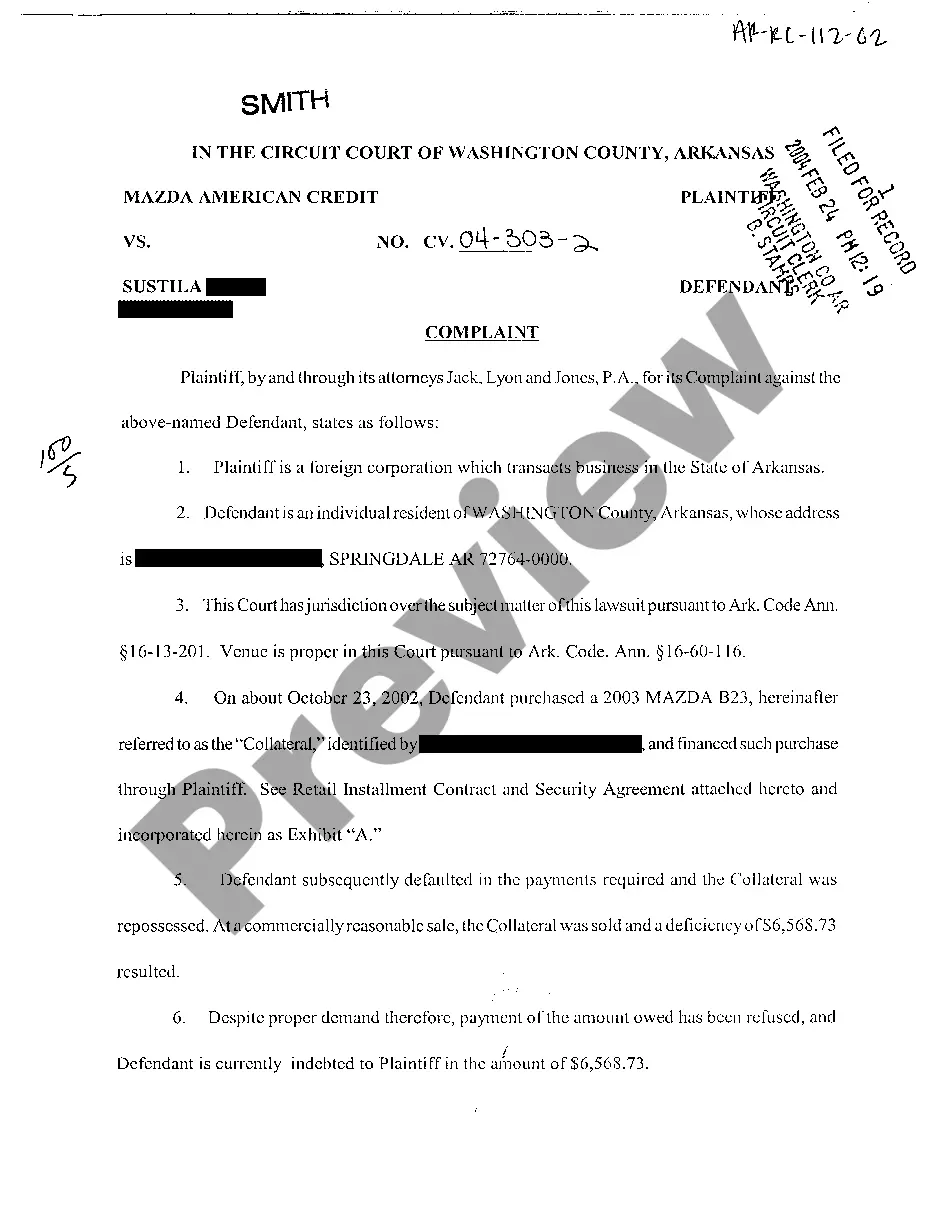

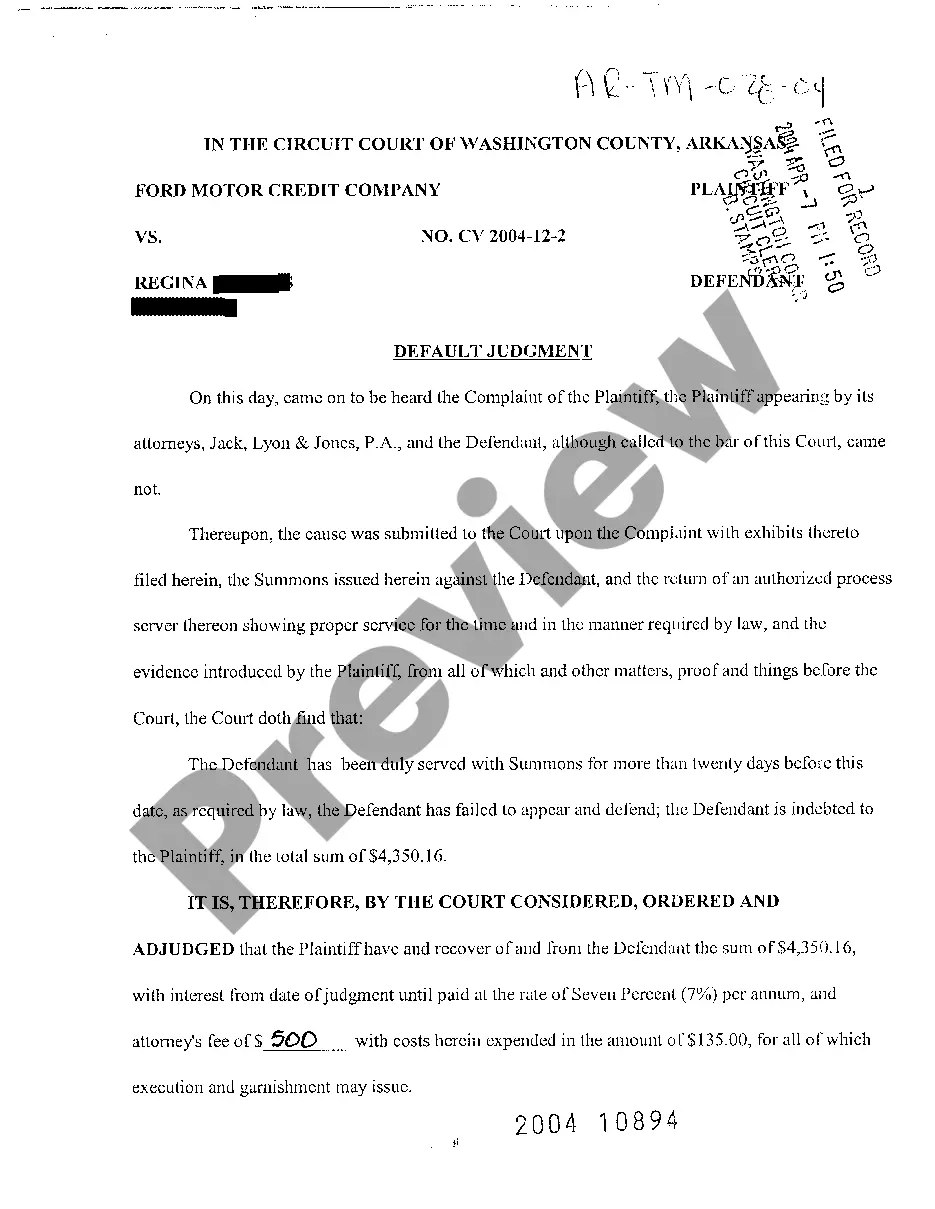

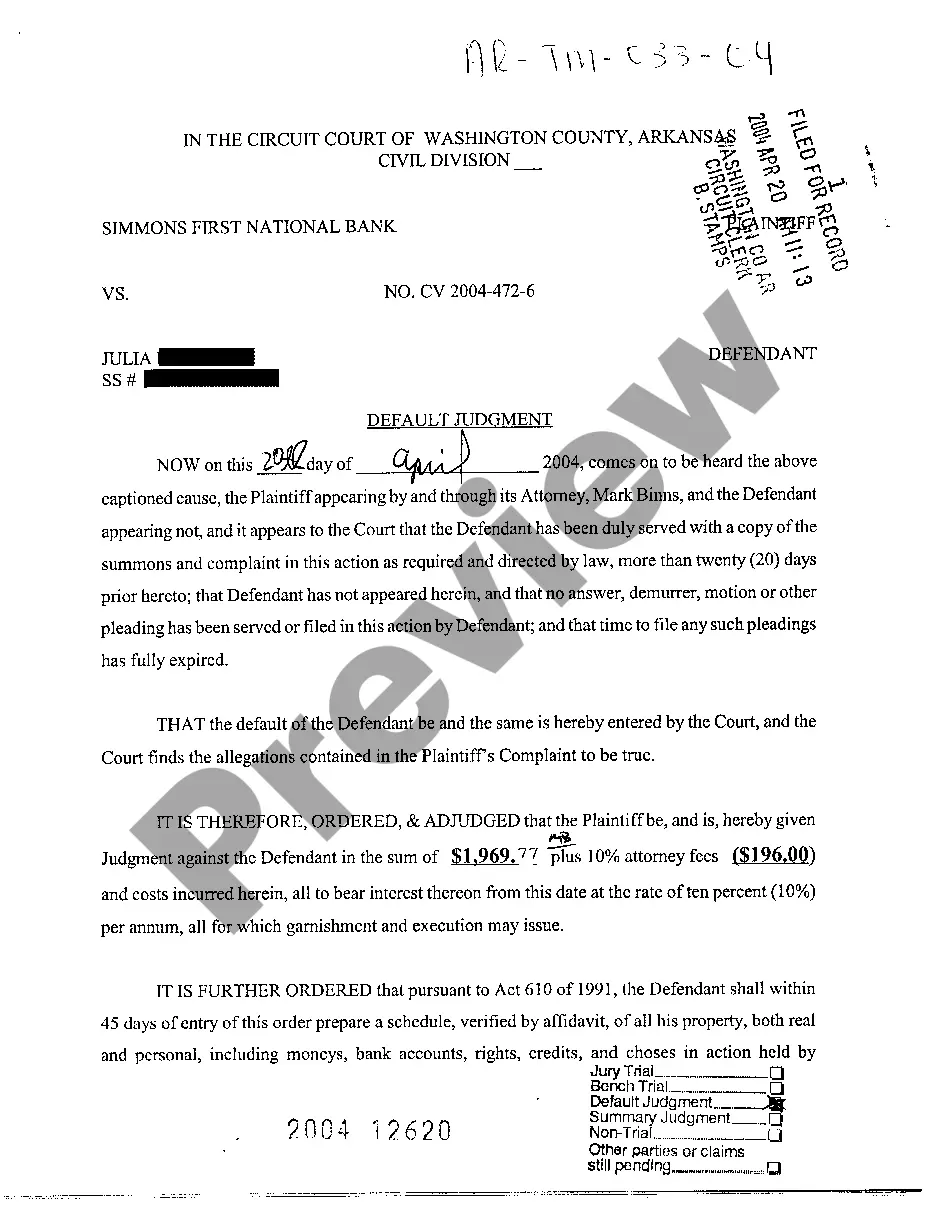

Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile

Description

How to fill out Arkansas Default Judgment On Complaint For Deficiency After Repossession And Sale Of Automobile?

Among countless complimentary and paid illustrations that you can discover online, you cannot guarantee their correctness and dependability.

For instance, who made them or if they possess the expertise necessary to address your requirements.

Always remain calm and make use of US Legal Forms!

Review the document by examining the description using the Preview function. Click Buy Now to initiate the purchasing procedure or seek another template using the Search field at the top. Choose a pricing plan to create an account. Complete the payment for the subscription with your credit/debit card or Paypal. Download the form in the desired file format. Once you have registered and purchased your subscription, you can utilize your Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile as often as needed, as long as it remains valid in your area. Modify it with your preferred editor, fill it in, sign it, and print it. Achieve more for less with US Legal Forms!

- Locate Arkansas Default Judgment on Complaint for Deficiency following Repossession and Sale of Automobile templates crafted by expert legal professionals.

- Avoid the costly and laborious process of searching for a lawyer and subsequently paying them to produce a document that you could easily locate on your own.

- If you hold a subscription, Log In to your account and identify the Download button beside the file you need.

- You will also have access to your previously saved templates in the My documents section.

- If you are visiting our site for the first time, adhere to the steps outlined below to effortlessly acquire your Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile.

- Ensure that the document you find is applicable in your jurisdiction.

Form popularity

FAQ

Creditors often write off debts after they have been uncollectible for a specific period, usually around six months to a year. However, this does not erase your responsibility if they choose to pursue it. The implications of Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile can affect this timeline. Utilizing platforms like uslegalforms can guide you through the complexities of debt management and resolution.

In Arkansas, the statute of limitations for most debts is typically three years. After this time, creditors cannot legally sue you for unpaid debts. Knowing about Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile helps you navigate any intimidating situations. To ensure you understand your rights, consider reaching out to legal professionals.

Yes, in some cases, a debt collector can restart the statute of limitations on your old debt. For instance, if you make a payment or acknowledge the debt, they may consider it active. Understanding Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile is crucial. You should consult a qualified attorney for personalized advice on your situation.

The statute of limitations on a judgment in Arkansas is determined by the type of action taken against you. Typically, it is ten years for civil judgments. This means that if you have an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, the creditor has ten years to enforce it, potentially through collection actions. It’s wise to stay informed and consider your options for addressing any judgments effectively.

In Arkansas, the statute of limitations for car repossession is generally the same as for contract actions, which is three years. After this period, a lender may lose the right to collect on a deficiency balance following a repossession. Understanding these timelines is critical, especially if you face an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile. Always seek legal guidance to navigate these rules effectively.

In Arkansas, the statute of limitations for most civil claims is three years. This means that if you're dealing with an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, you have three years from the date of the event to file your claim. It's important to act promptly because once this period passes, the law generally prevents you from pursuing the case. This timeframe can vary with specific circumstances, so consult a legal expert for advice.

Arkansas repossession laws allow lenders to reclaim vehicles when borrowers default on their loans. The process must be conducted without a breach of peace, meaning lenders cannot use force or threats. Familiarizing yourself with these laws can help you understand your rights and protect yourself from potential repercussions, including an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile.

Yes, you may be able to retrieve your car after repossession in Arkansas, often by paying the overdue balance and any fees associated with the repossession. Contact your lender as soon as possible to discuss this option, as there may be a limited time frame to act. Be proactive to avoid any further complications, particularly those related to an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile.

In Arkansas, the statute of limitations on car repossession debt is generally three years. This means that after three years from the date of the default, lenders can no longer sue you for the remaining debt if they haven't taken action. Knowing this is important because it may affect your response to an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile.