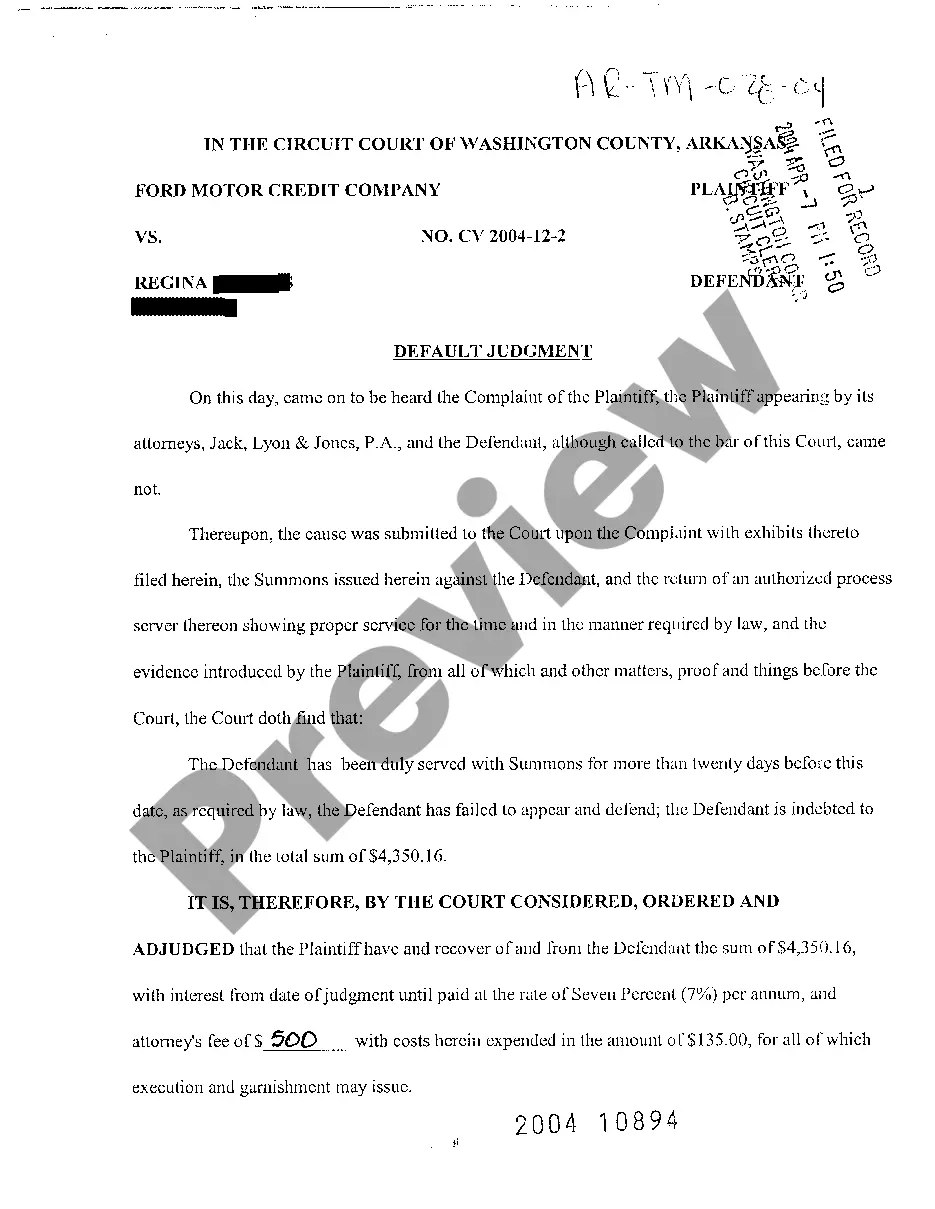

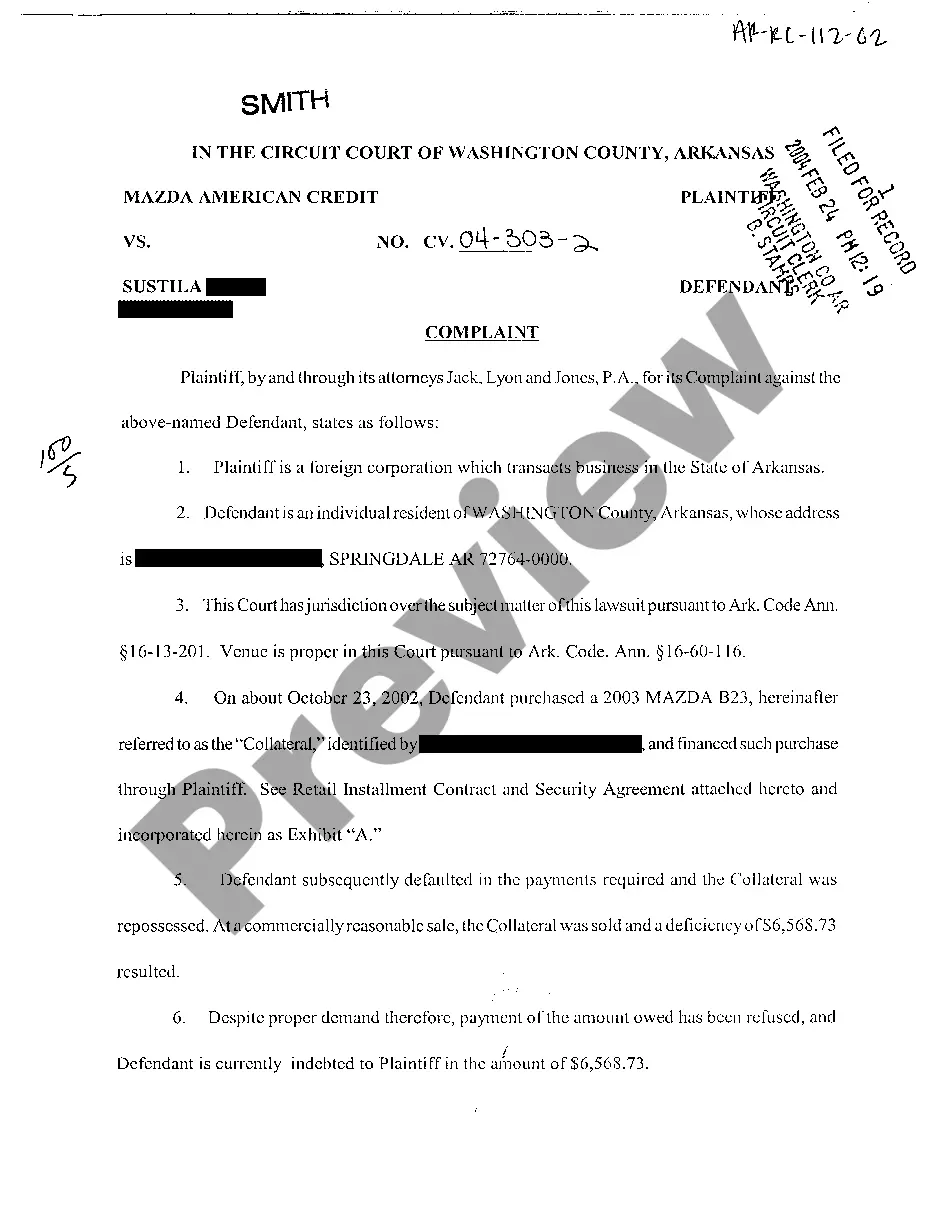

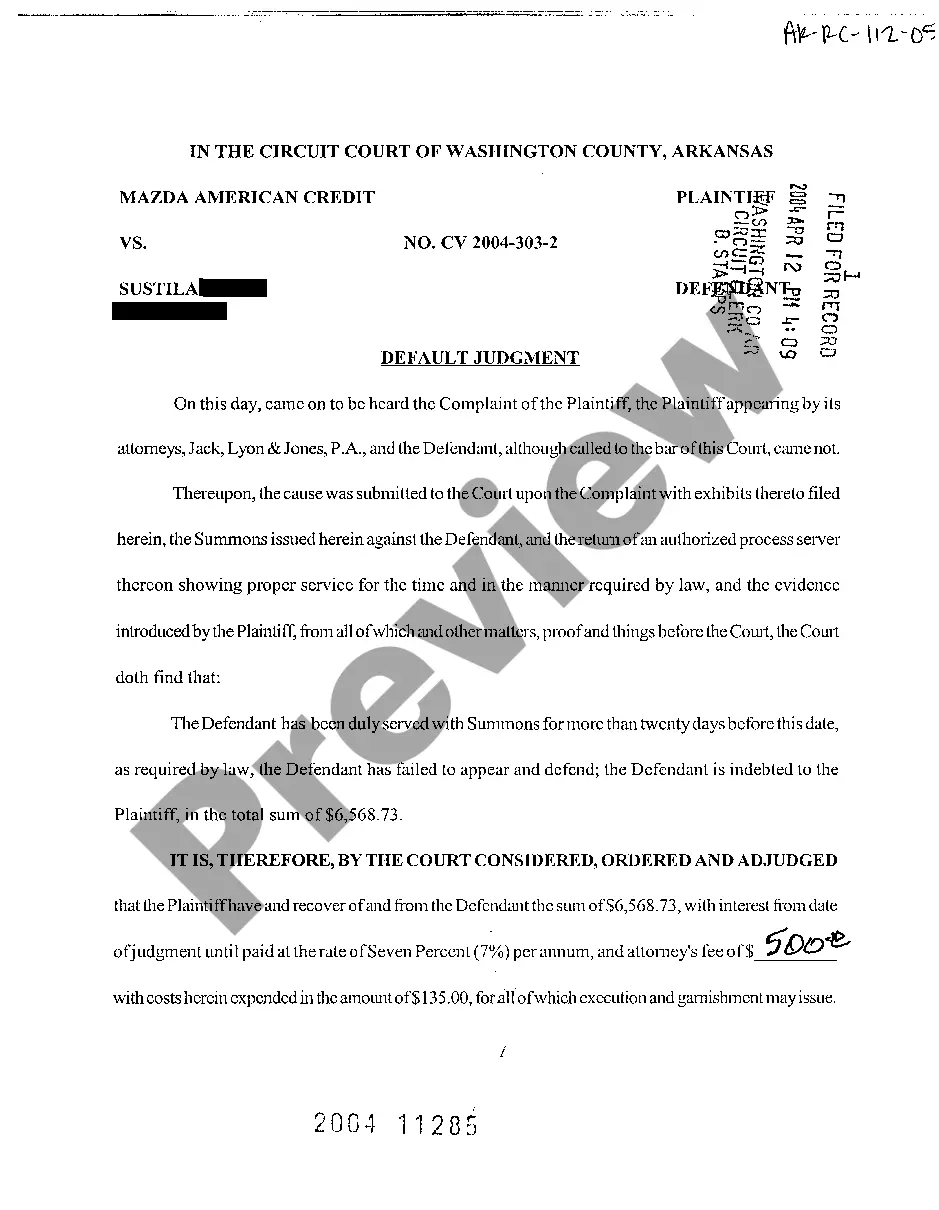

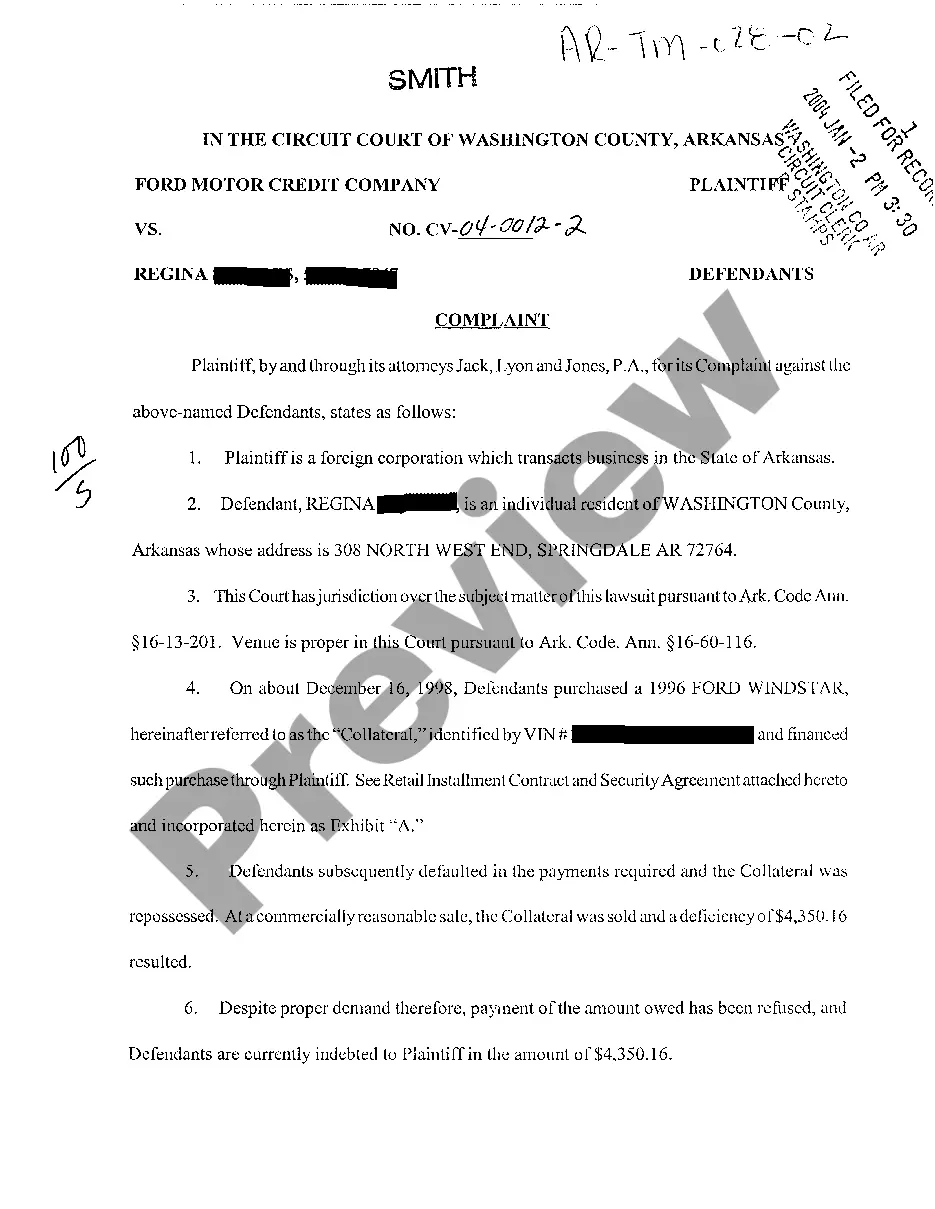

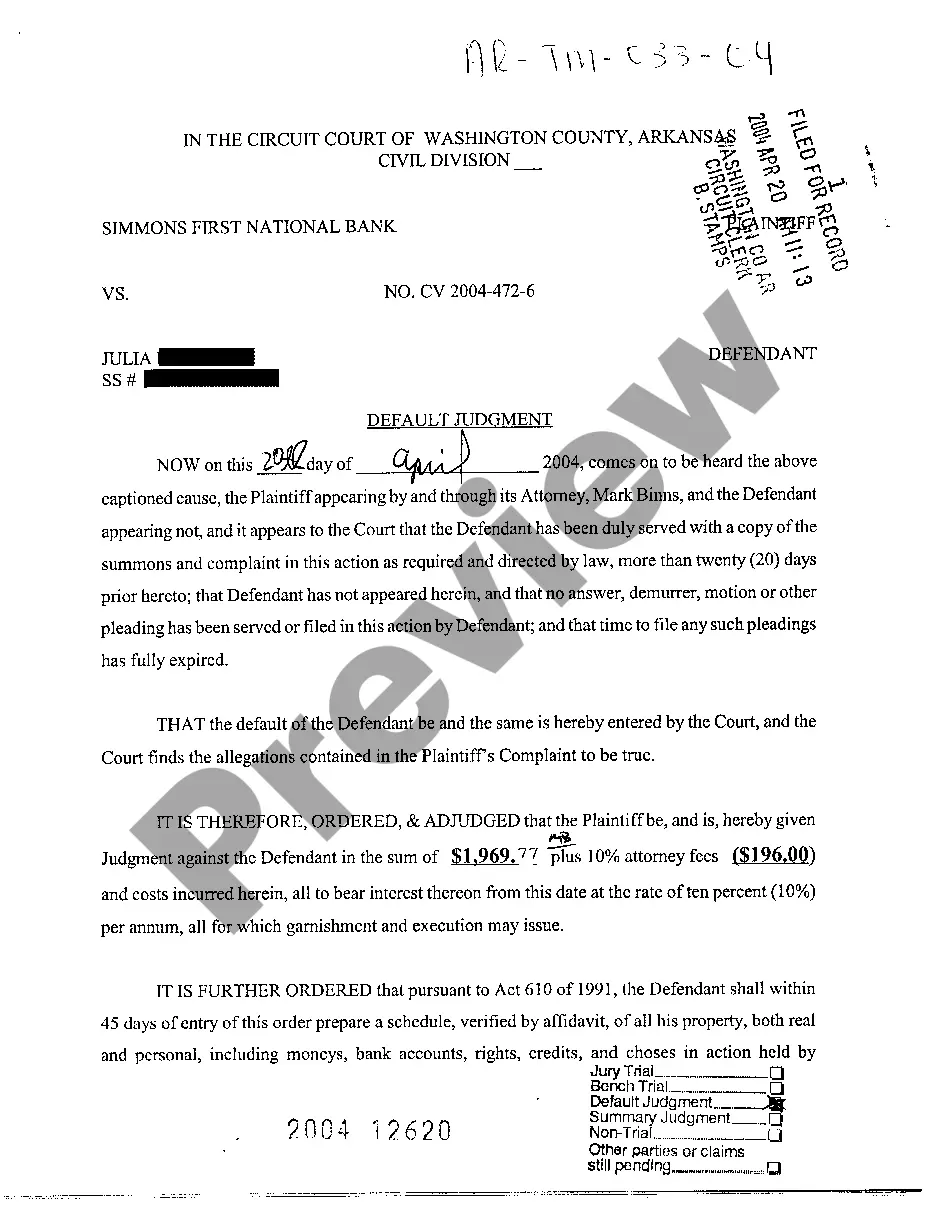

Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile

Description

How to fill out Arkansas Default Judgment On Complaint For Deficiency After Repossession And Sale Of Automobile?

Amid a multitude of complimentary and premium examples available online, you cannot guarantee their dependability.

For instance, do you know who produced them or whether they possess the necessary expertise to address your requirements.

Stay calm and take advantage of US Legal Forms!

Ensure the document you find is applicable in your state. Review the template using the Preview function. Click Buy Now to initiate the purchase process or search for another example using the Search bar located in the header. Select a pricing option and create an account. Remit payment for the subscription using your card or PayPal. Download the form in the desired format. After registering and purchasing your subscription, you can utilize your Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile as frequently as required or as long as it remains valid in your state. Edit it in your preferred online or offline editor, complete it, sign it, and print a hard copy. Achieve more for less with US Legal Forms!

- Obtain Arkansas Default Judgment on Complaint for Deficiency following Repossession and Sale of Automobile templates crafted by proficient attorneys.

- Avoid the expensive and labor-intensive process of searching for a lawyer and subsequently compensating them to draft a document that you can easily obtain by yourself.

- If you currently have a membership, sign in to your account and locate the Download button adjacent to the form you are looking for.

- You'll also have access to all your previously saved documents in the My documents section.

- If you are using our service for the first time, adhere to the following instructions to quickly retrieve your Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile.

Form popularity

FAQ

If your car is repossessed in Arkansas, the lender will typically sell the vehicle to recover their losses. You may be held liable for any deficiency if the sale does not cover your debt, leading to an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile. It's vital to stay informed about your rights and the potential repercussions of repossession. Seeking guidance from a legal professional can provide you with the necessary support during this time.

Arkansas repossession laws allow lenders to reclaim property, like a car, without court intervention. They must provide proper notice, and the repossession must occur peacefully. In cases where an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile arises, understanding these laws is crucial. It's important to familiarize yourself with your rights and obligations to navigate this process effectively.

Arkansas has various statutes of limitations depending on the type of claim. Generally, most civil actions, including contract disputes, have a three to six-year limit. For judgments, as mentioned, it is up to ten years. Knowing the correct timeline for your situation, especially if you are dealing with an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, ensures you take appropriate steps to protect yourself legally.

In Arkansas, repossession laws allow creditors to reclaim vehicles without a court order, provided they do so without breaching the peace. However, borrowers must be notified of the repossession and the subsequent sale of the vehicle. If a creditor successfully obtains an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, they may seek to recover any remaining balance owed following the sale. It’s essential to know your rights in this process.

For car repossession in Arkansas, the statute of limitations is generally governed by the type of breach involved. Typically, creditors have around six years to initiate legal action regarding the deficiency after repossession. If you’re facing an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, understanding this timeline helps you address any legal consequences. Staying informed allows you to manage your responsibilities effectively.

In Arkansas, the statute of limitations for collecting a judgment is generally ten years. This means that if you obtain an Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, you have a decade to enforce that judgment. After this period, the creditor may lose the ability to collect the debt. It's critical to remain aware of these timeframes to protect your financial interests.

The statute of limitations for car repossession debt in Arkansas is typically three years. This means that creditors have three years to initiate legal action to collect what you owe. Recognizing the nuances of Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile can help you protect your rights and respond appropriately if you face a lawsuit.

Debts are generally written off after six months of non-payment. At that point, creditors often categorize the debt as a loss for tax purposes. Even with this timeline, understanding the implications of Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile allows you to be proactive in handling your financial situation.

Yes, a debt collector can restart the statute of limitations by getting you to acknowledge the debt or by taking legal action. This means that you might be caught off guard if you do not manage your communication with collectors carefully. Being informed about Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile can help in navigating these issues effectively.

In Arkansas, the statute of limitations on most debts is typically three to six years. After this period, debt collectors cannot legally pursue payment. Understanding how this relates to Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile can empower you by limiting how much debt collectors can pursue.