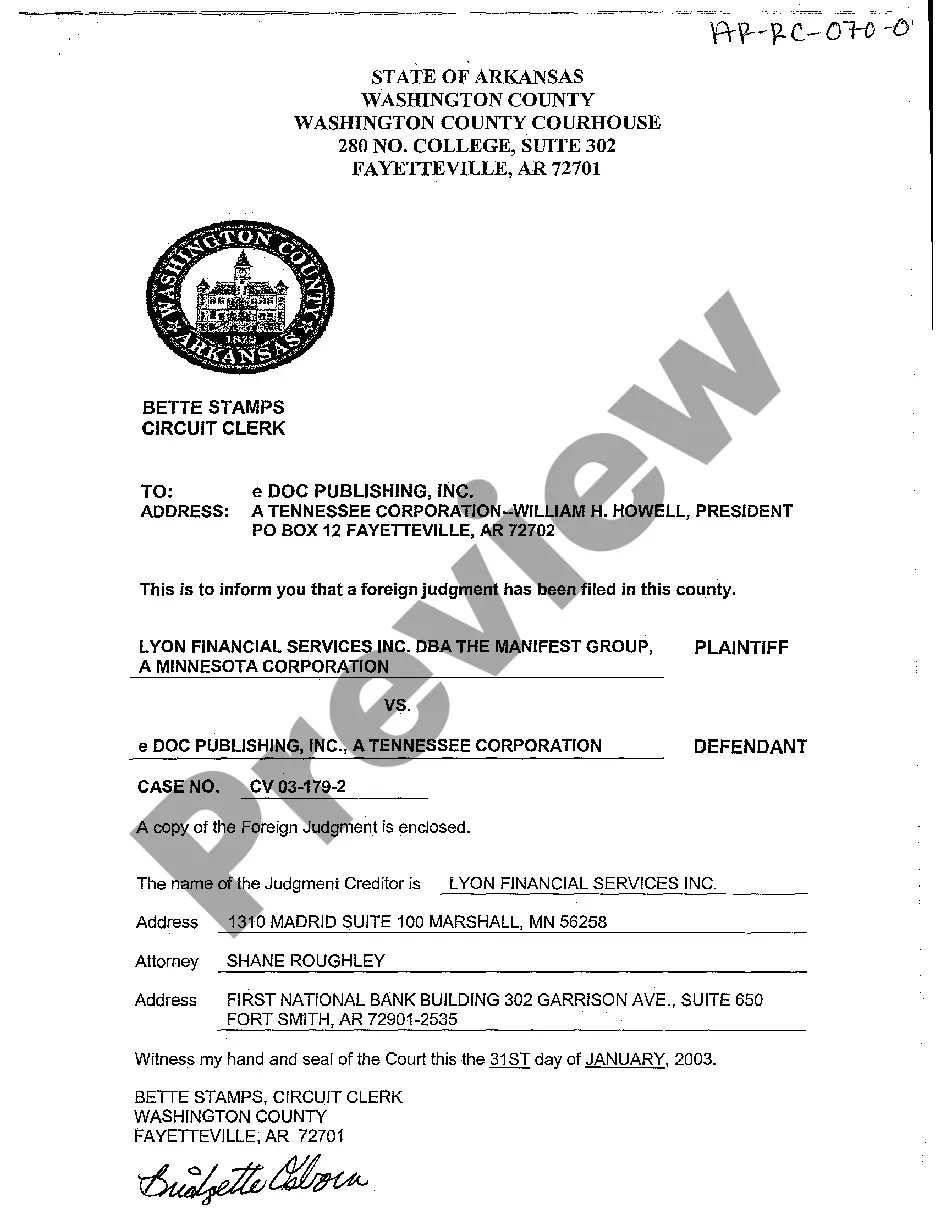

Arkansas Letter regarding filing of foreign judgment

Description

How to fill out Arkansas Letter Regarding Filing Of Foreign Judgment?

Among numerous paid and free templates available on the internet, you cannot be assured of their precision and dependability.

For instance, who created them or whether they possess the necessary expertise to handle your requirements.

Always remain composed and utilize US Legal Forms! Discover Arkansas Letter concerning the filing of foreign judgment templates crafted by experienced attorneys and evade the costly and time-consuming process of searching for a lawyer and subsequently compensating them to compose a document for you that you can easily obtain yourself.

Select a pricing plan and establish an account. Subsequently, process the payment for the subscription with your credit/debit card or PayPal. Download the form in your desired format. Once you've registered and completed your subscription purchase, you can utilize your Arkansas Letter regarding the filing of foreign judgment as often as necessary or for as long as it remains valid in your state. Alter it in your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you already have a membership, Log In to your account and find the Download button adjacent to the file you’re seeking.

- You'll also have access to your previously saved documents in the My documents section.

- If you’re using our service for the first time, adhere to the instructions below to acquire your Arkansas Letter concerning the filing of foreign judgment swiftly.

- Ensure that the document you view is legitimate in your state.

- Examine the template by reading the description using the Preview function.

- Click Buy Now to initiate the ordering process or search for another template using the Search field in the header.

Form popularity

FAQ

In Arkansas, the statute of limitations on enforcing a judgment is typically 10 years, which can be renewed for additional periods. This renewal process ensures that you can continue to seek payment for an outstanding judgment. When utilizing an Arkansas Letter regarding filing of foreign judgment, understanding this timeline is essential for maximizing your legal options. Being proactive can greatly enhance your chances of successful debt recovery.

For most civil suits in Arkansas, you generally have three years from the time the cause of action arises to file your case. This timeline highlights the importance of acting promptly to protect your rights. If you are dealing with the enforcement of a foreign judgment, utilizing an Arkansas Letter regarding filing of foreign judgment can assist in navigating this time-sensitive process. Taking timely action can lead to better outcomes.

In Arkansas, debt collectors can pursue repayment for debts within the statute of limitations, which is typically between three to six years. They cannot continue to contact you indefinitely; after this period, the debt is considered 'time-barred' and cannot be legally enforced. It's important to understand how this impacts any Arkansas Letter regarding filing of foreign judgment, as it relates to enforcement of debts. Awareness of your rights can empower you during financial disputes.

The statute of limitations in Arkansas can vary depending on the type of claim. Generally, most civil claims have a statute of limitations of three to six years. If you're dealing with judgments or enforcing financial obligations through an Arkansas Letter regarding filing of foreign judgment, it's crucial to be aware of these limits. This knowledge helps ensure timely legal action.

In Arkansas, a judgment is generally valid for 10 years from the date it is entered. However, if you file an Arkansas Letter regarding filing of foreign judgment, you may extend the enforceability of the judgment. After the initial 10 years, you can seek to renew the judgment to maintain its effectiveness. This extension ensures you have ongoing recourse for debt recovery.

Foreign judgments can be enforceable in the US, but they typically require going through a recognition process in the relevant state. Each state has different rules, so it’s important to follow the requirements specific to Arkansas. Utilizing an Arkansas Letter regarding filing of foreign judgment can significantly enhance your chances of successful enforcement.

To register a foreign judgment in Arkansas, you must file it with the local circuit court. This process usually requires an Arkansas Letter regarding filing of foreign judgment, as it helps establish the judgment's legitimacy. Completing this step ensures that your foreign judgment is recognized and enforceable in the state.

Yes, foreign debts can be collected in the US, but certain legal procedures must be followed. You will typically need to convert the foreign judgment into a US judgment. An Arkansas Letter regarding filing of foreign judgment can simplify this process and ensure your claim is recognized.

To collect a judgment in Arkansas, you should start by filing your judgment with the proper court. This may involve submitting an Arkansas Letter regarding filing of foreign judgment, as it provides necessary details for your case. Once filed, you can take steps such as garnishing wages or placing liens on property to recover the amount owed.

Generally, a foreign judgment is not directly enforceable under international law unless specific agreements exist, such as the Hague Convention. However, countries may recognize judgments based on bilateral treaties or domestic law. In the US, you must file a suitable Arkansas Letter regarding filing of foreign judgment to facilitate enforcement in your state.