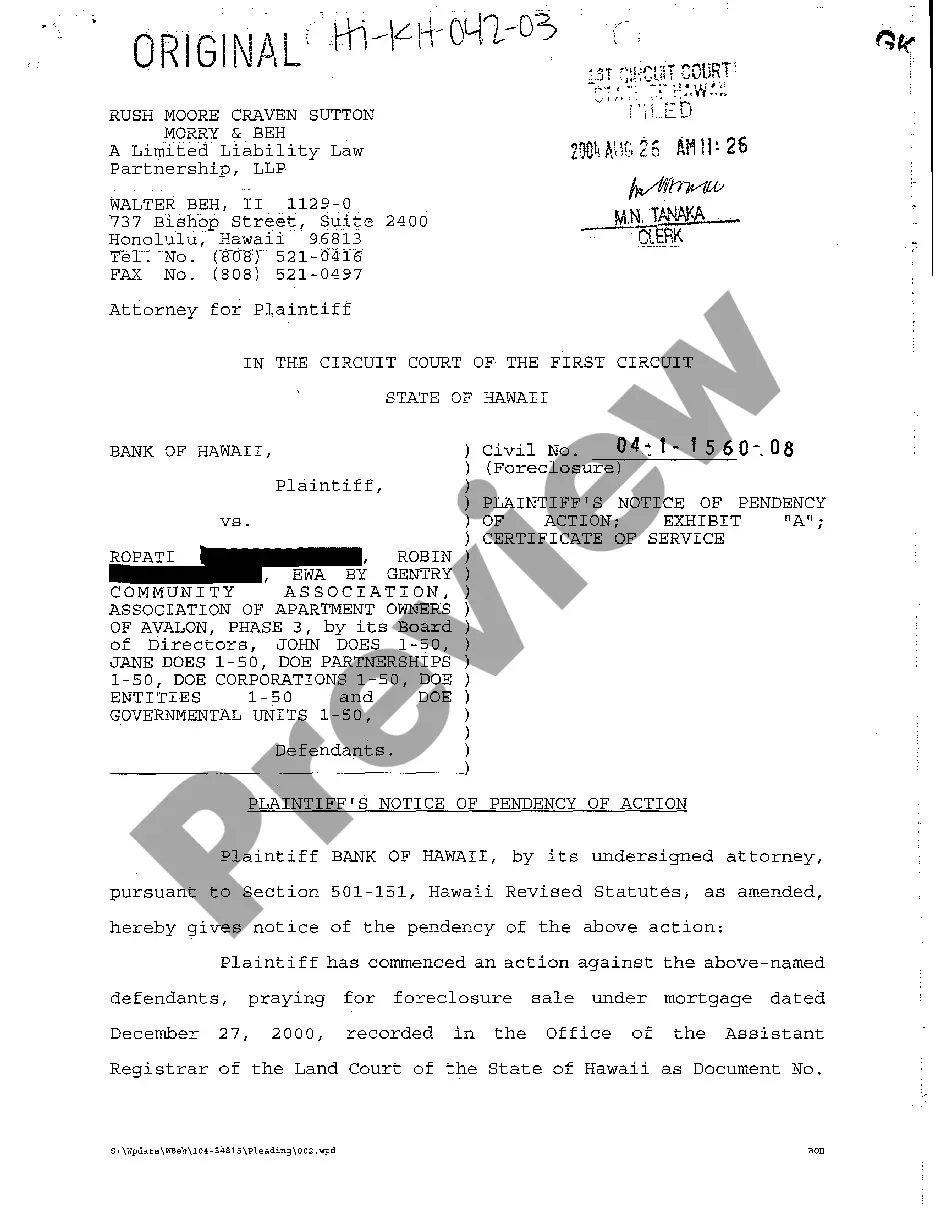

This form is a Transfer on Death Deed, or Beneficiary Deed, where the Grantors are husband and wife and the Grantee is a Trust. If Grantee is dissolved prior to the death of the last Grantor, this transfer fails and is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to grantor's deaths. This deed complies with all state statutory laws.

Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To A Trust?

Utilizing an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Trust templates crafted by experienced attorneys allows you to sidestep difficulties when filing paperwork.

Simply acquire the form from our site, complete it, and request a lawyer to verify it. Doing so can help you conserve significantly more time and expenses than searching for an attorney to create a document from scratch that fits your requirements.

If you have already purchased a US Legal Forms subscription, just Log In to your account and return to the form page. Locate the Download button next to the templates you are reviewing. After downloading a file, all your saved documents can be found in the My documents section.

Once you have completed all the steps mentioned above, you will be able to fill in, print, and sign the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Trust template. Don’t forget to verify all the entered information for accuracy before submitting or mailing it. Minimize the time spent on document completion with US Legal Forms!

- If you lack a subscription, don't worry.

- Just follow the step-by-step instructions below to register for an account online, obtain, and complete your Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Trust template.

- Double-check and ensure that you’re selecting the correct state-specific form.

- Utilize the Preview function and examine the description (if available) to ascertain whether you need this particular example and if so, just click Buy Now.

- Search for another document using the Search field if necessary.

- Choose a subscription that suits your needs.

- Begin with your credit card or PayPal.

- Select a document format and download your file.

Form popularity

FAQ

Yes, a trust can indeed serve as a transfer on death beneficiary under the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust. This arrangement allows you to streamline the transfer of property, avoiding probate while ensuring that your assets go directly to your designated trust. By designating your trust as a beneficiary, you can maintain control over the assets during your lifetime, and facilitate a smoother transition for your heirs. For additional guidance on how to implement this effectively, consider utilizing U.S. Legal Forms, which offers resources tailored to facilitate this process.

It's not mandatory to hire an attorney for completing a transfer on death deed in Arkansas, but having legal assistance can be advantageous. An attorney can help you navigate the specific requirements and ensure that your Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust properly reflects your wishes. You can also find helpful templates and guidance on platforms like US Legal Forms, making the process simpler.

A beneficiary deed does not act as proof of ownership while the grantor is alive; it simply specifies who will receive the property after death. The grantor retains full ownership rights until their passing. Therefore, it is critical to keep other forms of ownership documentation current and accurate throughout your lifetime. The Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust is a tool for future transfer, not current ownership proof.

While you do not legally need a lawyer to create a beneficiary deed in Arkansas, consulting one can be beneficial. An attorney can ensure that your Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust meets all legal requirements and aligns with your estate planning goals. If you prefer to do it yourself, resources like US Legal Forms can guide you through the process.

Writing a beneficiary deed involves including specific information such as the property description, the name of the beneficiary, and the date of execution. Generally, this deed needs to comply with the Arkansas laws regarding transfer on death. Make sure to sign the deed and have it notarized for legal validity. Platforms like US Legal Forms provide templates to help you create an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust easily.

Yes, a beneficiary deed generally overrides a will concerning the property specified in the deed. If you designate a beneficiary in your Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust, that beneficiary will receive the property directly, bypassing the will. This can sometimes lead to unintended consequences, so it is essential to keep your estate planning documents aligned.

To create a transfer on death deed in Arkansas, you need to draft the deed according to state guidelines. You can designate a beneficiary, ensuring they receive the property upon your death, while retaining control during your lifetime. It's advisable to file the deed with your county's recorder office to make it legally effective. Using a platform like US Legal Forms can streamline the process for the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust.

While a beneficiary deed simplifies the transfer of property upon death, there are some downsides to consider. First, it may not provide the same level of control as a trust, as the property automatically transfers without going through probate. Additionally, if the grantor needs to sell or mortgage the property, they may encounter challenges if the deed is not properly structured. Therefore, it's important to weigh these factors for the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust.

While it is not mandatory to have a lawyer when creating an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust, consulting an attorney can be beneficial. Legal guidance ensures that your deed meets all requirements and aligns with your overall estate plan. Furthermore, platforms like uslegalforms can provide valuable resources to help you navigate this process confidently. Seeking assistance can lead to better outcomes.

Currently, many states in the U.S. recognize transfers on death deeds, including Arkansas. Each state has its laws governing this estate planning tool, but the basic concept remains consistent. Utilizing an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust allows for efficient property transfers in several states. It’s advisable to check your state’s specific regulations.