Agreement with Sales and Marketing Representative

Description

Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors. In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.

Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no magic or set number of factors that makes the worker an employee or an independent contractor, and no one factor stands alone in making this determination. Also, factors which are relevant in one situation may not be relevant in another.

How to fill out Agreement With Sales And Marketing Representative?

Aren't you sick and tired of choosing from countless samples each time you need to create a Agreement with Sales and Marketing Representative? US Legal Forms eliminates the lost time an incredible number of American people spend exploring the internet for appropriate tax and legal forms. Our skilled crew of lawyers is constantly upgrading the state-specific Samples collection, to ensure that it always provides the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription need to complete easy steps before having the ability to download their Agreement with Sales and Marketing Representative:

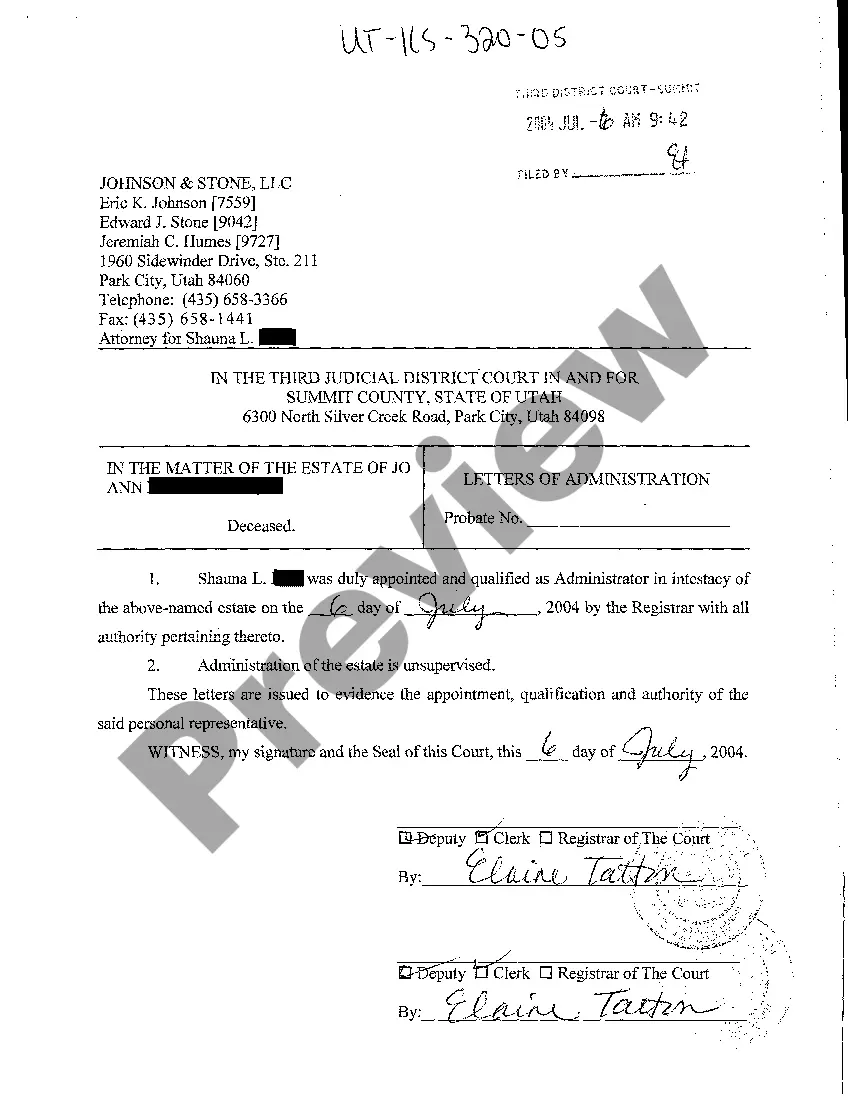

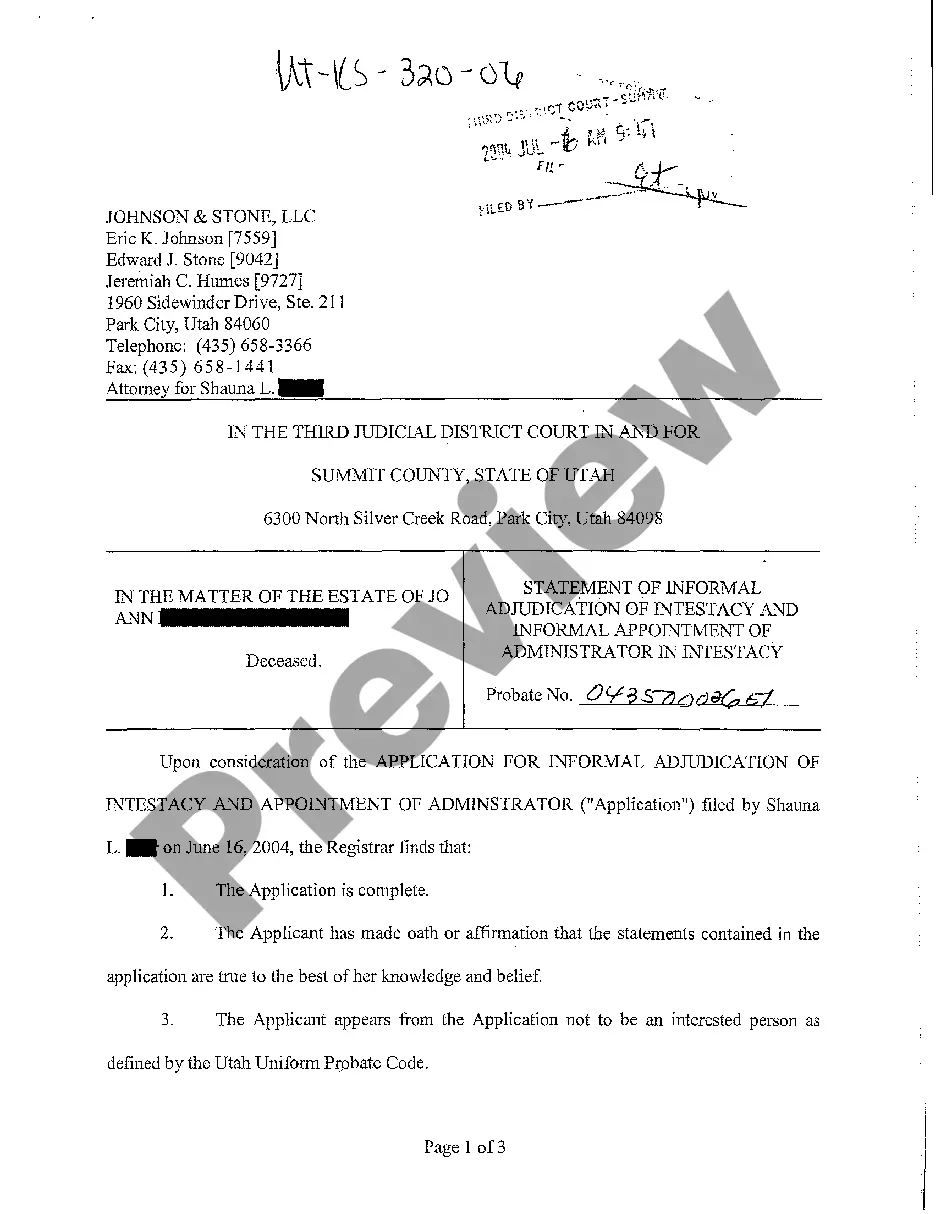

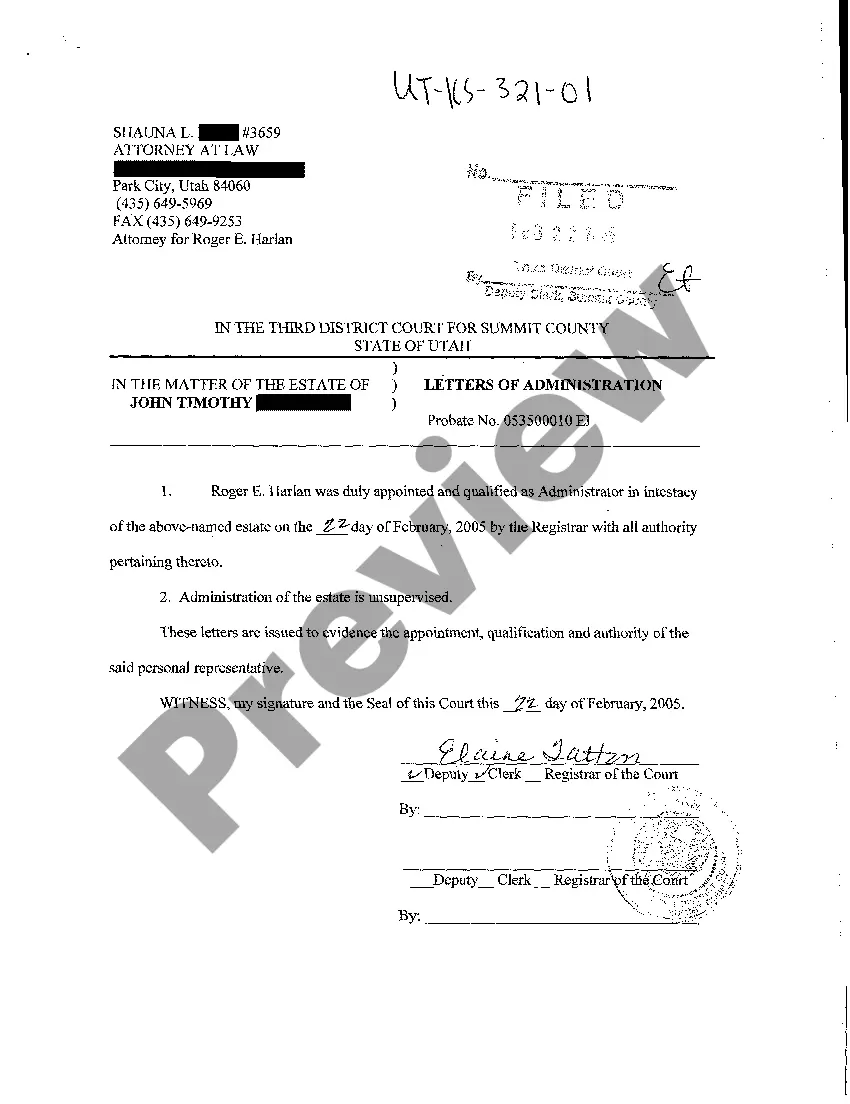

- Utilize the Preview function and look at the form description (if available) to be sure that it is the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct template to your state and situation.

- Make use of the Search field at the top of the web page if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a convenient format to finish, print, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever document you need for whatever state you require it in. With US Legal Forms, finishing Agreement with Sales and Marketing Representative templates or other official paperwork is simple. Begin now, and don't forget to recheck your samples with certified lawyers!

Form popularity

FAQ

Bonus Commission. Commission Only. Salary + Commission. Variable Commission. Graduated Commission. Residual Commission. Draw Against Commission.

A sales representative is the public face of a company.The enclosed document is an exclusive sales representative agreement. This means that the company is not entitled to hire additional representatives to sell the same products.

Commission rates for independent reps vary from 5% to 40%. In practice, most independent reps receive either ~25-35% of profit, or ~1017% of revenue. However, many organizations with revenue-based commission plans also use scoring to handle the fact that some products may be easier to sell than others.

A commission is a percentage of total sales as determined by the rate of commission. To find the commission on a sale, multiply the rate of commission by the total sales.

A commission is a formal document issued to appoint a named person to high office or as a commissioned officer in a territory's armed forces. Commissions are typically issued in the name of or signed by the head of state.

A commission agreement form includes some important information. It should contain the name and address of the business. Also, it should contain the name of the agent or employee involved in the contract. Finally, it should contain all the details of the commission-based payment.

1Sell to key retail accounts.2Contact new and existing customers to meet and exceed sales objectives.3Organize, rotate, and stock shelves during each store visit.4Participate in sales meetings and on-site training.5Negotiate and use persuasion skills to overcome objections.Sales Representative Job Description: Salary, Skills, & More\nwww.thebalancecareers.com > what-does-a-sales-representative-do-526065

A marketing representative works for an insurance company, promoting the company's products and services through its sales force the brokers to insurance consumers.Develop products, pricing, test them in the marketplace and manage the processes of promotion, selling and distribution.

This agreement makes few assumptions about the arrangements giving rise to the commission payment obligation.It may be used, for instance, in relation to commission payments that arise out of the referral of a new customer. The agreement also includes a payment procedure and an audit clause.