This form is used when the Assignor wishes to convey, assign and sell to the Assignee an undivided working interest in an oil and gas lease but reserves an overriding royalty interest payable on all oil, gas, and associated hydrocarbons produced, saved and sold from the Lands.

Alabama Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease

Description

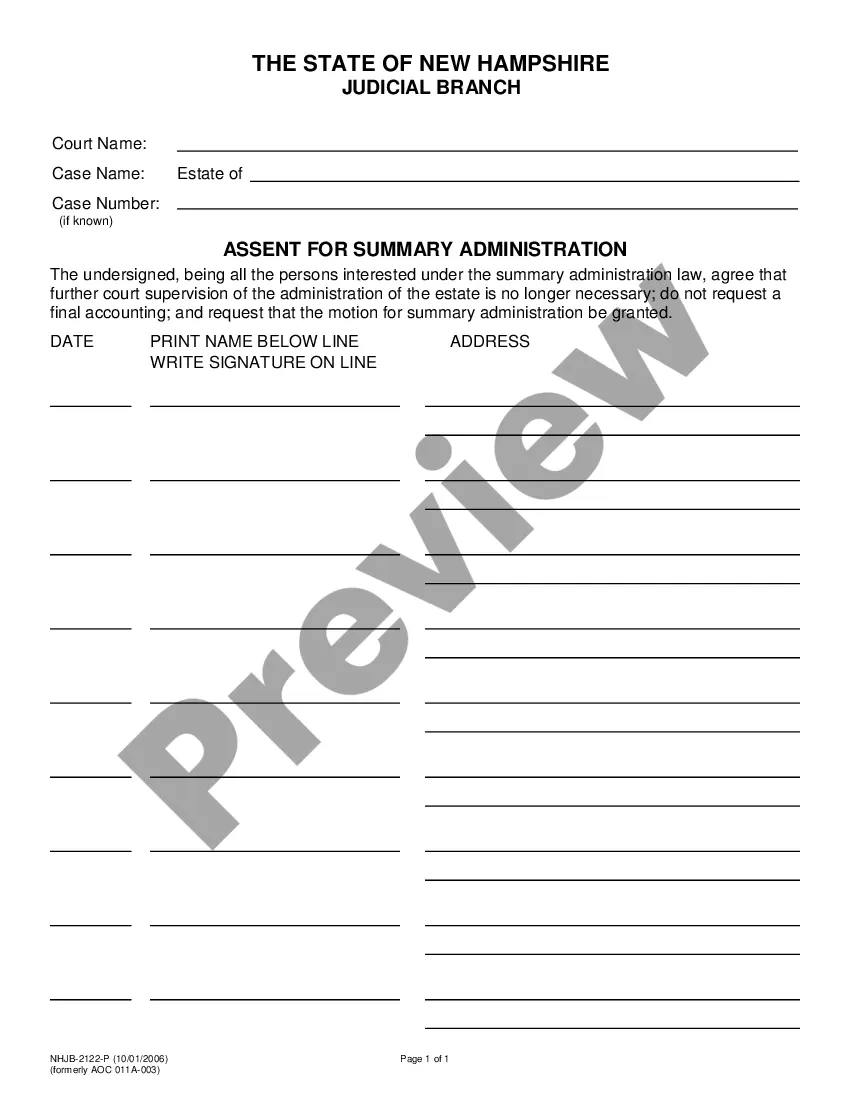

How to fill out Partial Assignment Of Oil And Gas Lease For Part Of Lands Subject To Nonproducing Lease?

Choosing the right legal file format might be a have a problem. Of course, there are plenty of layouts available online, but how can you find the legal form you want? Utilize the US Legal Forms web site. The service delivers a large number of layouts, for example the Alabama Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease, that can be used for company and private demands. All of the kinds are checked out by specialists and meet state and federal specifications.

If you are currently signed up, log in to the accounts and click the Download button to find the Alabama Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease. Use your accounts to search with the legal kinds you possess ordered previously. Proceed to the My Forms tab of your respective accounts and obtain one more copy in the file you want.

If you are a brand new consumer of US Legal Forms, here are straightforward instructions that you should stick to:

- First, ensure you have chosen the proper form for the city/county. You are able to look over the shape while using Preview button and look at the shape outline to guarantee this is the right one for you.

- If the form fails to meet your preferences, make use of the Seach discipline to find the right form.

- When you are positive that the shape is acceptable, click the Get now button to find the form.

- Select the rates strategy you would like and enter in the needed information and facts. Create your accounts and pay for the order using your PayPal accounts or charge card.

- Select the data file file format and acquire the legal file format to the device.

- Total, edit and print and sign the acquired Alabama Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease.

US Legal Forms will be the greatest collection of legal kinds where you can see various file layouts. Utilize the service to acquire skillfully-made papers that stick to status specifications.

Form popularity

FAQ

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

But not every acre of that land is being developed for energy. About 23 million Federal acres were under lease to oil and gas developers at the end of FY 2022. Of that, about 12.4 million acres are producing oil and gas in economic quantities.

Partial Assignments: When an assignor conveys 100% record title interest in a portion of the lands in a lease, it creates a partial assignment. Partial assignments segregate the lease into two separate leases. Normally we assign a new lease number to the conveyed portion of the lease.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

Suspensions under Section 39 of the MLA suspend both operations and production activities. Section 39 suspensions may be directed or granted by the Authorized Officer (AO) only in the interest of conservation of natural resources.