Connecticut General Journal

Description

How to fill out General Journal?

If you intend to accumulate, retrieve, or create authentic document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the website's straightforward and convenient search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Connecticut General Journal with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of your official document and download it to your device. Step 7. Complete, modify and print or sign the Connecticut General Journal.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to locate the Connecticut General Journal.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, please adhere to the following steps.

- Step 1. Ensure you have selected the form for the correct city/state.

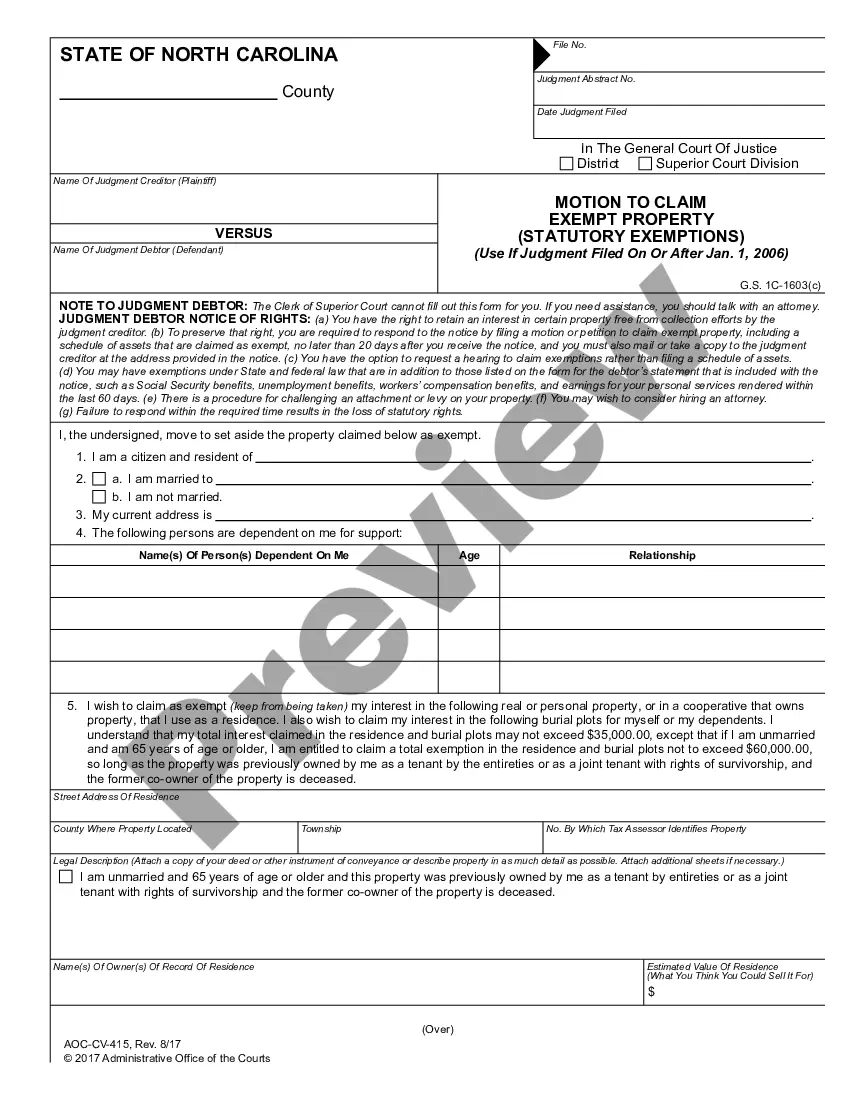

- Step 2. Use the Review option to examine the form's content. Make sure to read the overview.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find other versions of the official document format.

- Step 4. Once you have identified the form you need, click the Purchase now button. Choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

The process of recording transactions in the general journal involves several steps. Start by identifying the transaction details and determining which accounts are affected. Next, write down the date, the accounts involved, and the corresponding debit and credit amounts. By implementing these steps through the Connecticut General Journal method, you ensure that your financial records stay accurate and organized.

To record in a general journal, identify the transaction details, including the date, amounts, and affected accounts. Write down the information in chronological order, ensuring that debits and credits balance. Utilizing the Connecticut General Journal framework aids in preparing accurate financial statements and enhances your bookkeeping process.

Writing in a general journal involves a clear and consistent method. Make sure to log entries in chronological order, indicating the date first. Use separate lines for each transaction, clearly noting debits and credits. Following the Connecticut General Journal practices will help you maintain clarity in your financial documentation.

Writing general journal entries requires you to be precise and detailed. Begin by stating the date, followed by the accounts that will receive debit and credit amounts. Include a clear description for each transaction to shed light on its purpose. By adhering to the standards of the Connecticut General Journal, you create reliable records.

The format of a general journal typically includes the date of the transaction, the accounts involved, debits and credits, and a brief description. Each entry is recorded in a structured way to maintain clarity. Following the Connecticut General Journal structure helps ensure simplicity and organization in your financial records.

To record a general journal, you should start by identifying the transactions that need documentation. Gather all necessary details, including date, amounts, and accounts affected. Next, enter this information chronologically according to the Connecticut General Journal guidelines. This systematic approach ensures accurate tracking of financial activity.

To file an income tax return in Connecticut, your gross income must meet or exceed the established minimum limits for your specific situation. This includes considering your filing status and age. The Connecticut General Journal serves as a comprehensive reference to help you navigate these requirements effectively.

The minimum income level required to file taxes in Connecticut varies based on your filing status and age. Generally, if you earn income above certain thresholds, you need to file a return. Referring to the Connecticut General Journal will help clarify these thresholds and guide you in making an informed decision.

Closing a business in Connecticut involves several steps, including properly notifying the state and settling any outstanding obligations. You will need to file a dissolution form with the Secretary of State. For detailed guidance on this process, the Connecticut General Journal is a valuable resource, ensuring you follow all legal steps correctly.

Certain groups are exempt from Connecticut income tax, such as some low-income earners and individuals whose income falls below specific thresholds. Additionally, certain types of income, like Social Security benefits, can also be exempt. The Connecticut General Journal can guide you through the various exemptions to help you determine your status.