Purchase Agreement between Buyer and Seller LLC

Definition and meaning

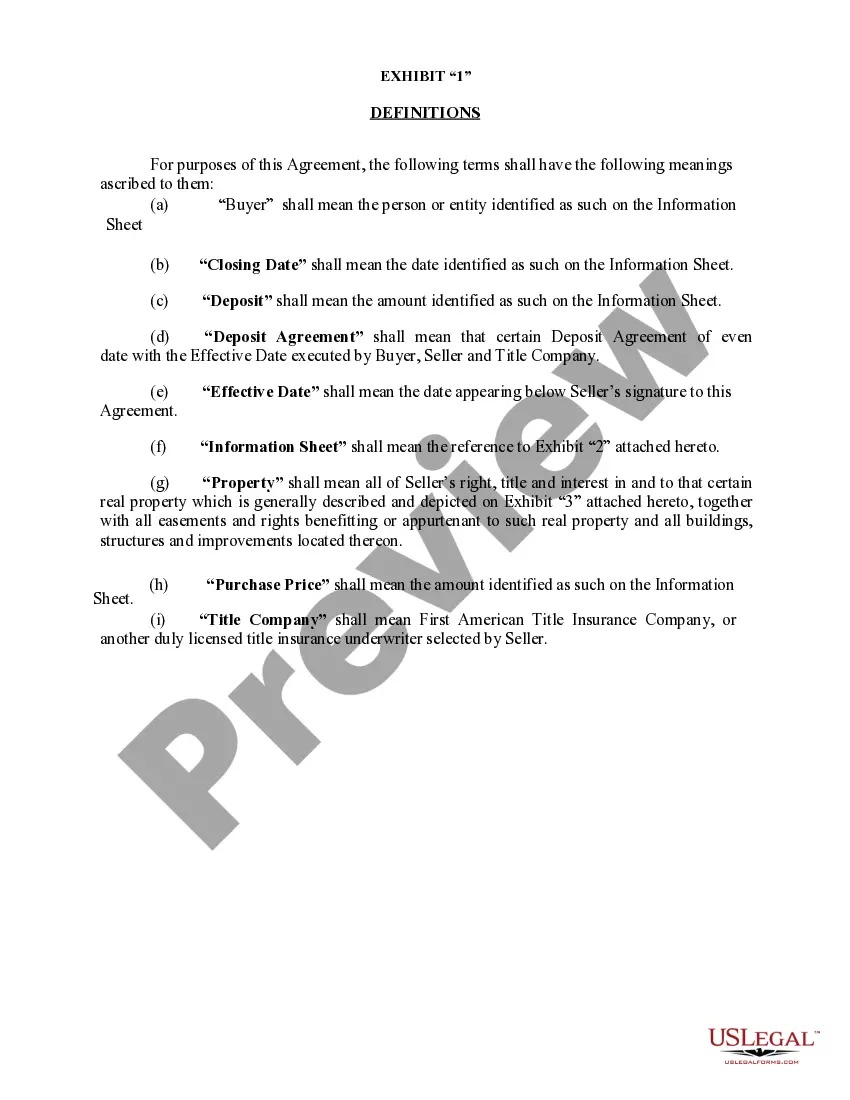

A Purchase Agreement between Buyer and Seller LLC is a legally binding contract that outlines the terms and conditions related to the sale of property. This document is crucial in real estate transactions as it protects the interests of both buyer and seller, detailing the price, property description, and specific obligations of each party.

Key components of the form

The Purchase Agreement typically includes several key components:

- Purchase Price: The total amount agreed upon for the sale.

- Closing Date: The date by which the transaction should be completed.

- Deposit: An upfront payment made by the buyer to secure the agreement.

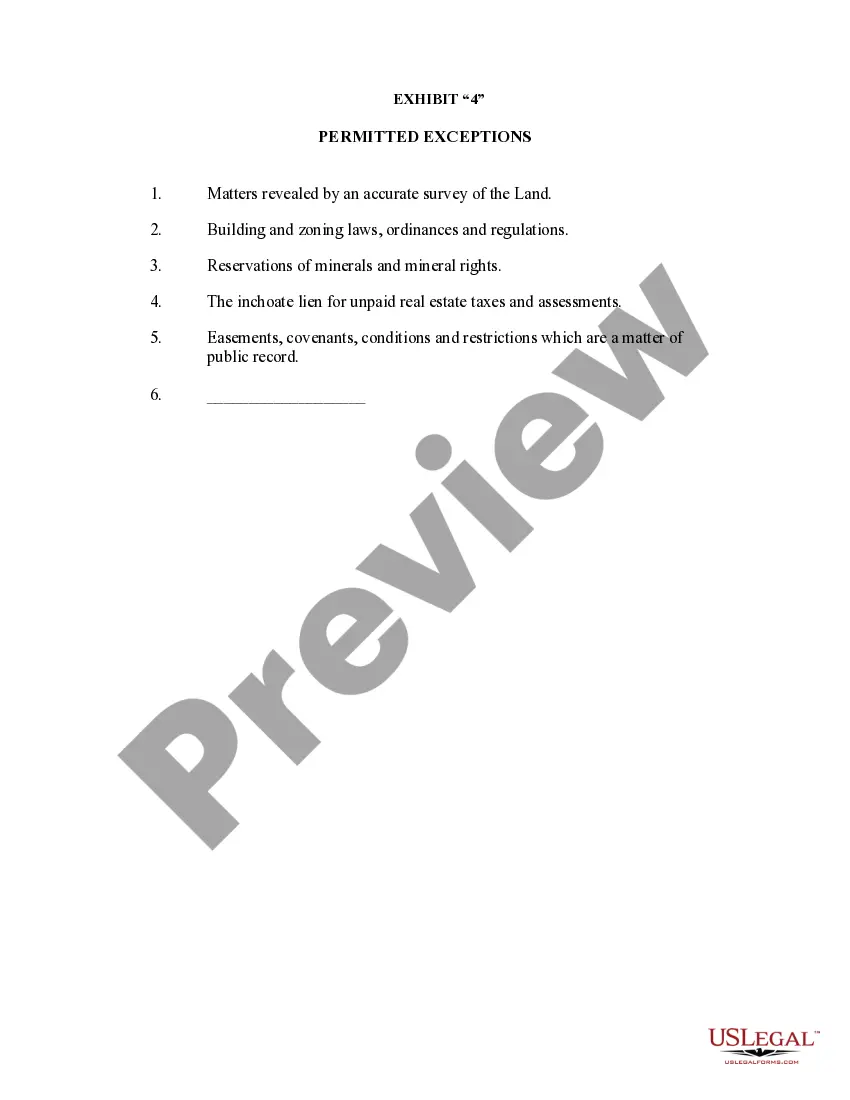

- Property Description: A detailed description of the property being sold.

- Seller and Buyer Obligations: Outline of responsibilities each party must fulfill prior to closing.

How to complete a form

To complete the Purchase Agreement form, both parties should follow these steps:

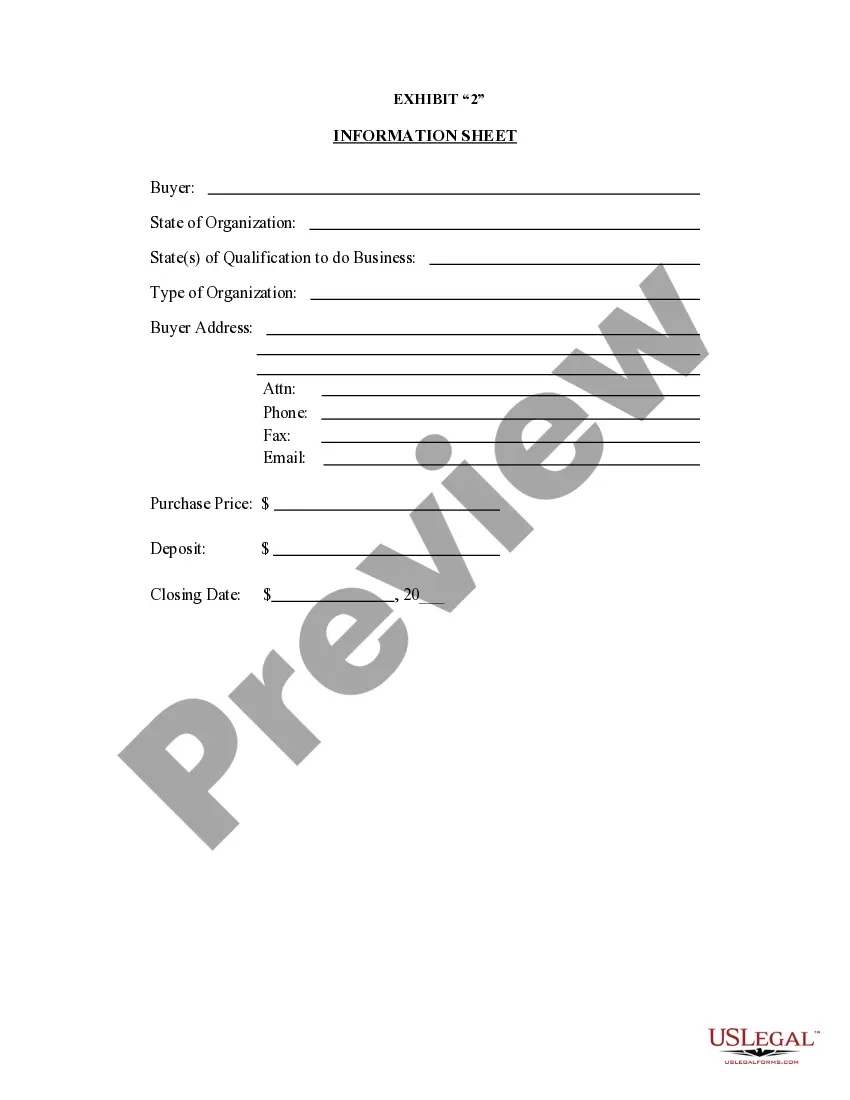

- Fill in the Buyer and Seller Information: Include the legal names and contact details.

- Describe the Property: Provide a detailed description, including address and boundaries.

- Specify the Purchase Price: Clearly state the agreed amount and payment terms.

- Select a Closing Date: Agree on a date for finalizing the sale.

- Sign and Date: Both parties must sign the agreement to make it valid.

Who should use this form

This form is ideal for individuals or entities engaging in real estate transactions, particularly those structured as limited liability companies (LLCs). It is beneficial for:

- Property buyers wanting to formalize their purchase offer.

- Sellers looking to outline their sale process clearly.

- Real estate agents who facilitate transactions between buyers and sellers.

Form popularity

FAQ

A purchase agreement is an offer that evolves into a contract. A purchase agreement, also known as a real estate sales contract, is the document the buyer and seller use to detail the sale price and terms.

A sales and purchase agreement (SPA) is a binding legal contract between two parties that obligates a transaction to occur between a buyer and seller. SPAs are typically used for real estate transactions, but they are found in other areas of business.

How do I create a Business Purchase Agreement? Specify whether the transaction involves a sale of assets or a sale of shares. Provide the business's information, including its name and address. Outline the nature of the business. If the transaction involves a sale of assets, specify the business's incorporation status.

A purchase and sale agreement, also called a sales and purchase agreement or a purchase and sales contract, is a legally binding document that parties in a transaction use to stipulate the terms and conditions that will guide the sale and transfer of goods or property.

Discussing and compromising on the different points of negotiation Agree on the purchase price and payment structure. Outline the responsibilities of each party. Decide on the timeline for the buyout. Address any existing contracts and agreements. Establish the method of transfer of ownership.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.