Alabama Employee Time Report (Nonexempt)

Description

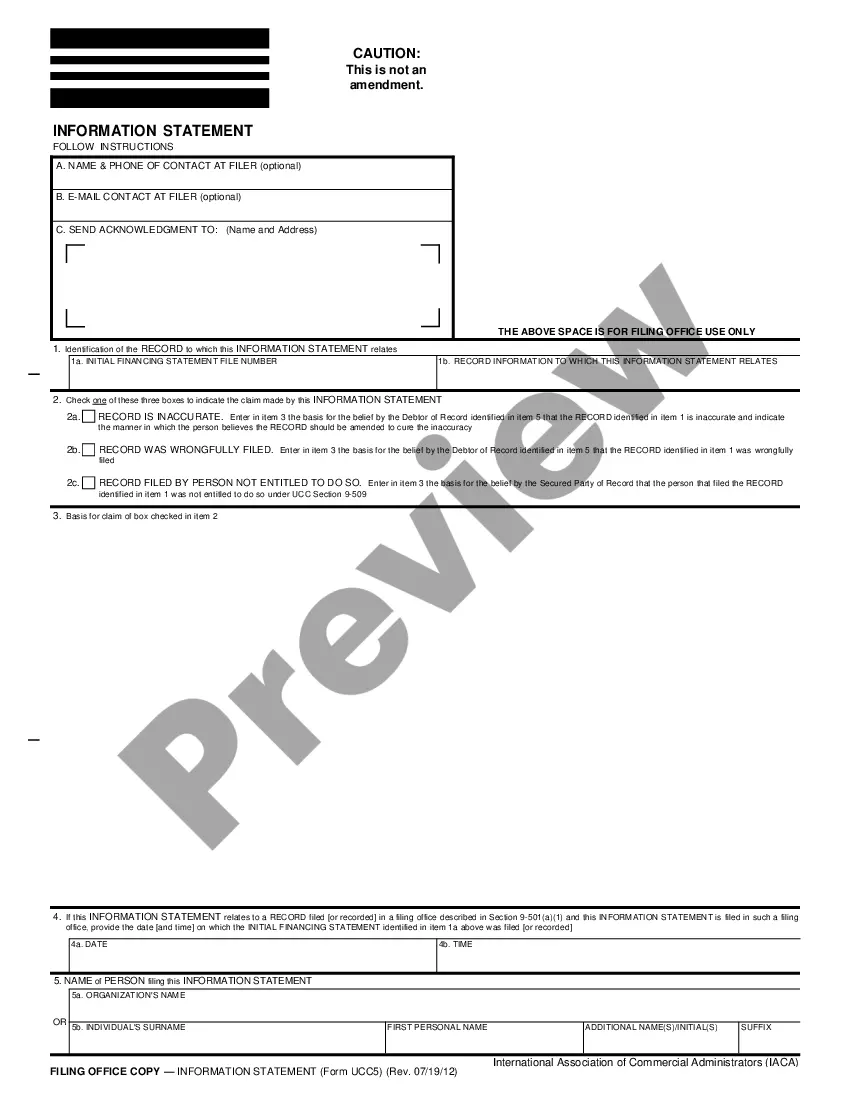

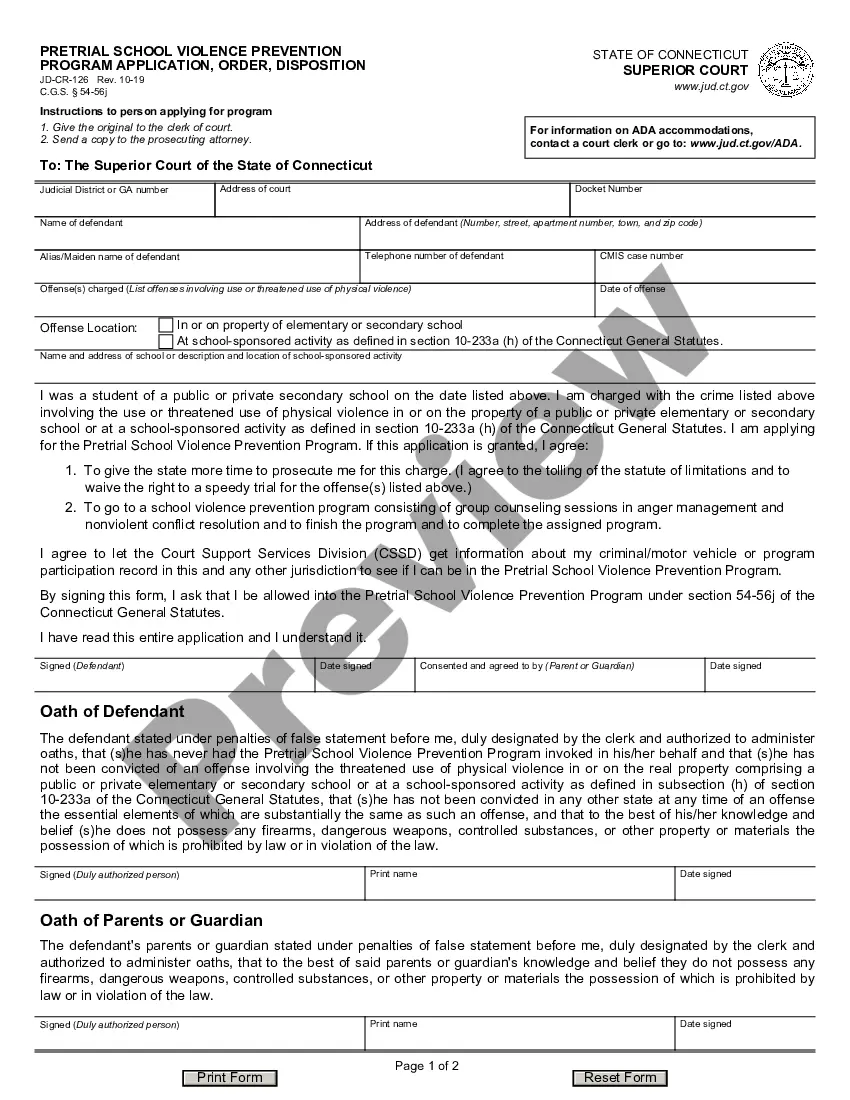

How to fill out Employee Time Report (Nonexempt)?

Selecting the appropriate legal document template may feel like a struggle. Obviously, there are plenty of online templates available, but how do you find the legal form you require.

Take advantage of the US Legal Forms website. This service provides an extensive array of templates, such as the Alabama Employee Time Report (Nonexempt), which you can utilize for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Alabama Employee Time Report (Nonexempt). Use your account to search through the legal forms you have previously purchased. Navigate to the My documents tab in your account to retrieve another copy of the document you need.

Choose the file format and download the legal document template to your device. Fill out, revise, and print the received Alabama Employee Time Report (Nonexempt). US Legal Forms is the largest collection of legal forms where you can discover various document templates. Utilize this service to acquire professionally crafted paperwork that adheres to state regulations.

- Firstly, confirm you have selected the correct form for your city/area.

- You can review the form by using the Review button and examining the form details to ensure it is suitable for your purposes.

- If the form does not meet your needs, use the Search field to find the appropriate document.

- Once you are certain the form is acceptable, click the Get now button to obtain the document.

- Select the pricing plan you require and provide the necessary information.

- Create your account and complete the payment using your PayPal account or Visa or MasterCard.

Form popularity

FAQ

In Alabama, not all salaried employees are required to work overtime. The rules depend on the employee's classification as exempt or nonexempt under the Fair Labor Standards Act (FLSA). Using the Alabama Employee Time Report (Nonexempt), employers can keep accurate calculations of hours worked, helping to ensure employees are fairly compensated for any overtime hours worked.

Under the Act, an employer may not prohibit an employee from: Disclosing their own wages; Discussing the wages of others; Inquiring about another employee's wages; or.

Work Hours in Alabama Paying Overtime: There are no overtime laws in Alabama, so employers are beholden to the federal laws. This stipulates that workers must receive 1 1/2 times their regular pay rate for every hour worked over 40 hours in a week.

There's no legal right to pay for working extra hours and there are no minimum statutory levels of overtime pay, although your average pay rate must not fall below the National Minimum Wage. Your contract of employment should include details of overtime pay rates and how they're worked out.

Executives, administrators, and other professionals earning at least $455 per week do not have to be paid overtime under Section 13(a)(1) of the Fair Labor Standards Act. External salespeople (who often set their own hours) are also exempted from AL overtime requirements, as are some types of computer-related workers.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

Examples of non-exempt employees include contractors, freelancers, interns, servers, retail associates and similar jobs. Even if non-exempt employees earn more than the federal minimum wage, they still take direction from supervisors and do not have administrative or executive positions.

To qualify for exemption, employees generally must meet certain tests regarding their job duties and be paid on a salary basis at not less than $684 per week effective Jan. 1.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Alabama Wage Law Explained Overtime is considered any hours worked over 40 hours per workweek, and the premium pay for overtime hours is at least one-and-a-half times an employee's regular pay rate.