Alabama Employee Lending Agreement

Description

How to fill out Employee Lending Agreement?

Have you found yourself in a situation where you require documents for both business or personal purposes every day.

There are numerous legal document templates accessible online, but locating reliable versions can be challenging.

US Legal Forms provides thousands of form templates, including the Alabama Employee Lending Agreement, which can be generated to meet state and federal requirements.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Alabama Employee Lending Agreement anytime you need. Simply click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and hold an account, simply Log In.

- After that, you can download the Alabama Employee Lending Agreement template.

- If you do not have an account and wish to use US Legal Forms, take these steps.

- Find the form you require and ensure it is for the right area/state.

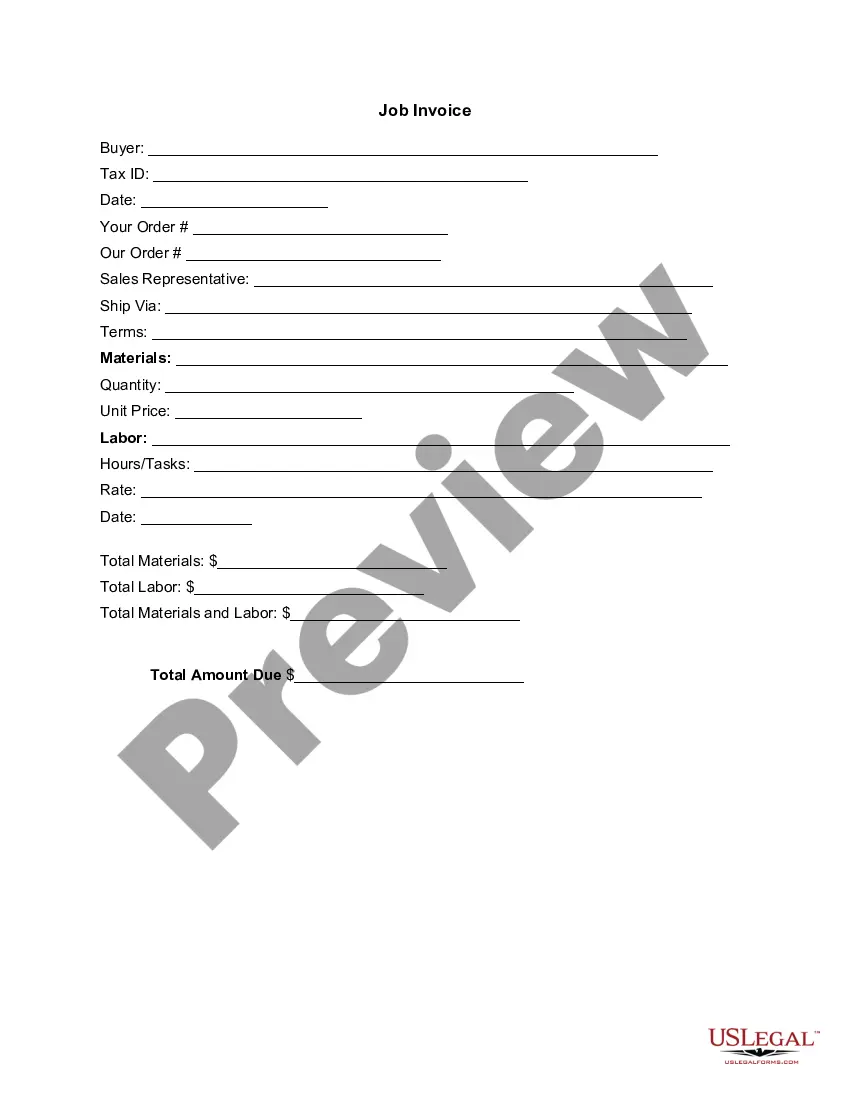

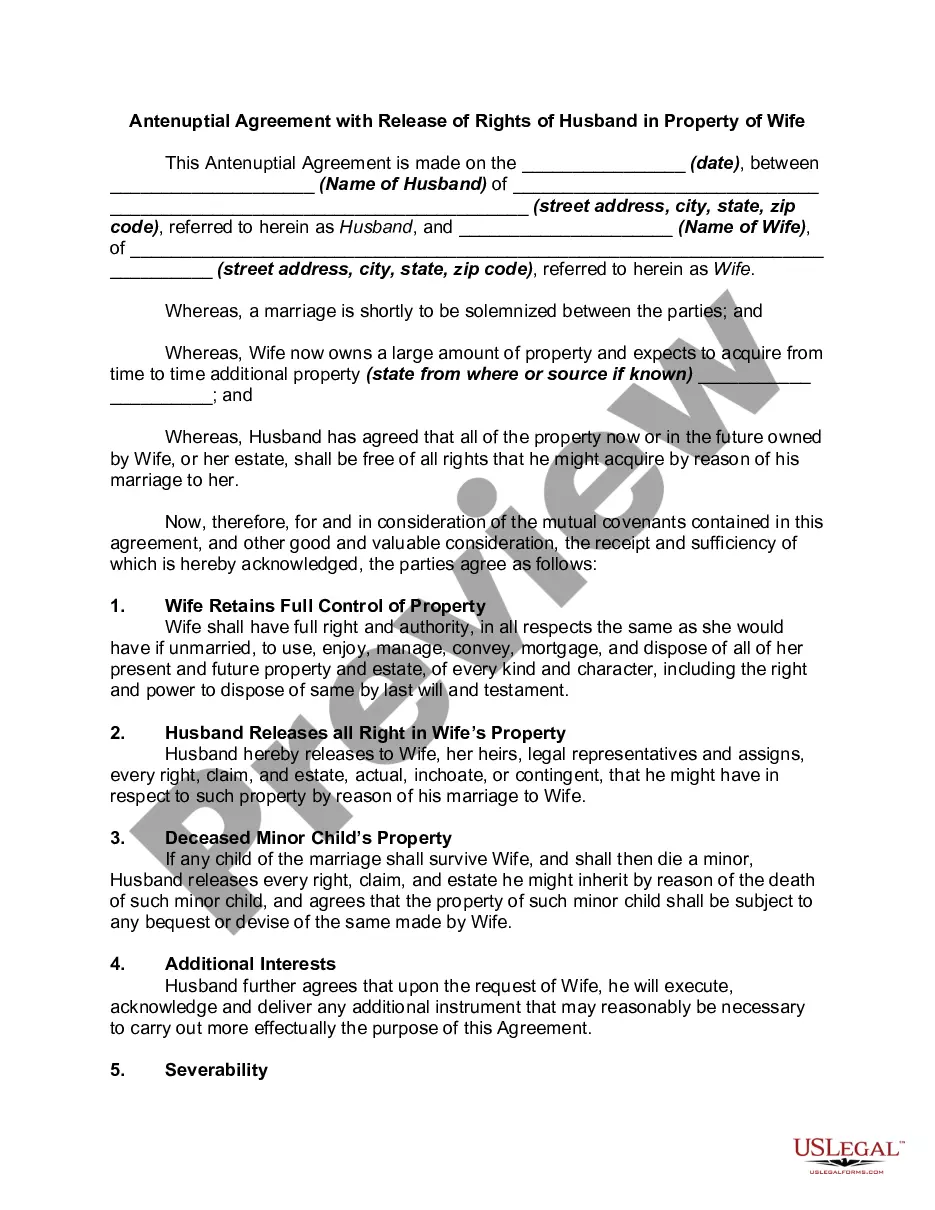

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs.

- Once you locate the appropriate form, click on Buy now.

- Choose the payment plan you desire, fill in the necessary information to create your account, and process the transaction using your PayPal or credit card.

Form popularity

FAQ

Section 810-3-28-. 01 - Partnership Returns (1) (a) All partnerships having "substantial nexus" from property owned or business conducted in this state shall file the Alabama Form 65 on or before the due date, including extension.

Under the new law, a partnership, or other entity classified as a Subchapter K entity, is required to file a composite return and make composite payments on behalf of its nonresident owners or members if there are one or more nonresident owners or members at anytime during the taxable year.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.

By filing Form PTE-C, an Alabama Subchapter K entity/S corporation reports each nonresident owner's/shareholder's share of the Alabama Subchapter K entity/S corporation income. No further filing may then be required by an individual owner/shareholder.

The tax rate for the Alabama Business Privilege Tax is based on how much revenue your business brings to the state of Alabama. So, your rate will rise and fall depending on how much money your business earns each year. Alabama tax rates range from $0.25 to $1.75 for each $1000 of your entity's Alabama net worth.

The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form). In general, any full-year resident can choose to file Long Form 40 instead of Short Form 40A.

Also called the Registration and Annual Report for Canadian Securities Form, Form 40-F is a filing with the US Securities and Exchange Commission (SEC) used by Canadian companies that want to offer their securities to United States investors.

The Alabama Electing Pass-Through Entity Tax Act (Act 2021-1 and Act 2021-423) allows Alabama S-Corporations and Subchapter K entities (pass-through entities or PTEs) to elect to pay Alabama income tax at the entity level. Entities making this election (Electing PTEs) must submit Form PTE-E via My Alabama Taxes (MAT).

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return.