Alabama Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

How to fill out Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

Are you presently in a position that you need files for sometimes business or individual uses almost every time? There are tons of legitimate papers themes available on the Internet, but locating ones you can rely isn`t straightforward. US Legal Forms gives 1000s of develop themes, like the Alabama Sample Letter for Request of State Attorney's opinion concerning Taxes, that happen to be created to fulfill state and federal demands.

If you are presently acquainted with US Legal Forms web site and have your account, basically log in. Afterward, you can acquire the Alabama Sample Letter for Request of State Attorney's opinion concerning Taxes template.

If you do not have an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is to the right town/state.

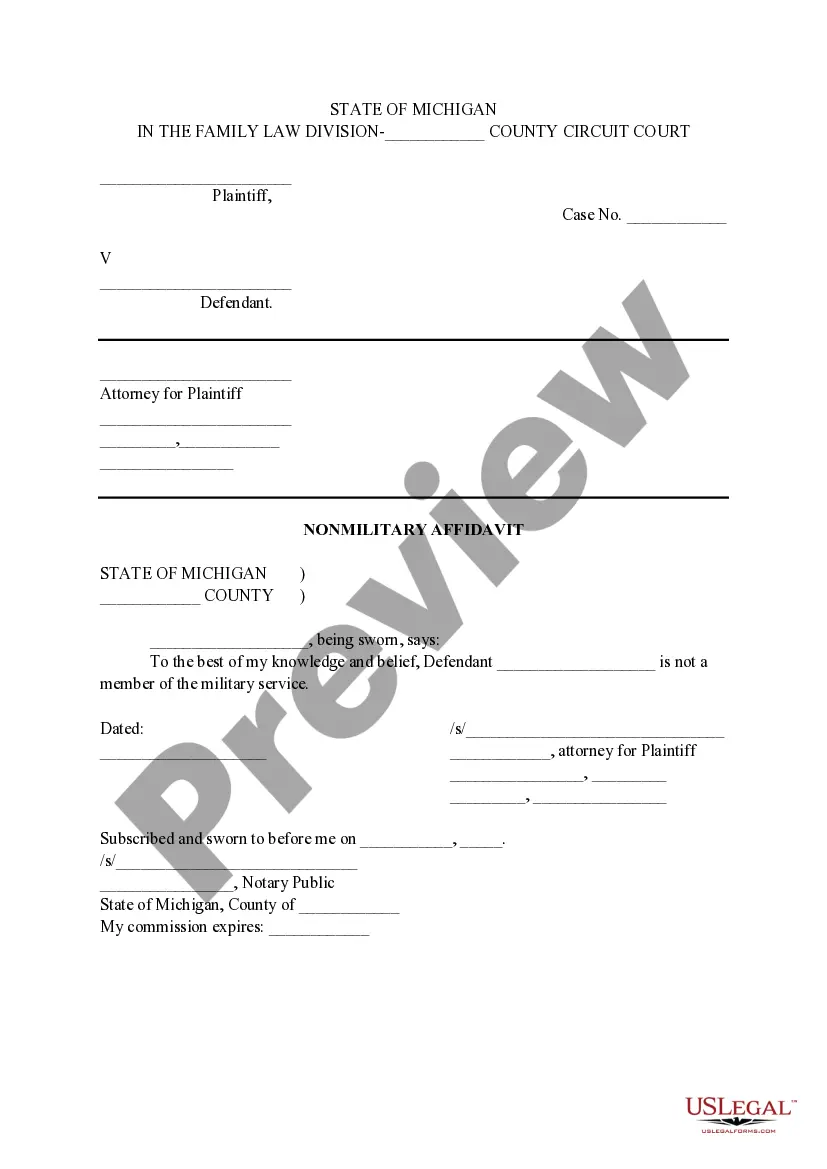

- Take advantage of the Review option to check the form.

- See the description to ensure that you have selected the right develop.

- If the develop isn`t what you are looking for, utilize the Research area to obtain the develop that fits your needs and demands.

- Whenever you get the right develop, click Acquire now.

- Choose the pricing strategy you desire, submit the necessary details to make your bank account, and purchase an order with your PayPal or credit card.

- Pick a handy paper structure and acquire your duplicate.

Discover every one of the papers themes you have bought in the My Forms menus. You may get a further duplicate of Alabama Sample Letter for Request of State Attorney's opinion concerning Taxes anytime, if needed. Just click on the needed develop to acquire or print the papers template.

Use US Legal Forms, one of the most comprehensive collection of legitimate varieties, in order to save efforts and prevent mistakes. The support gives expertly manufactured legitimate papers themes which can be used for a range of uses. Create your account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

If you are trying to locate, download, print, or fill state of Alabama tax forms, you can do so on the Alabama Department of Revenue website.

Address the letter appropriately. The salutation of the letter should be: Dear Attorney General (last name). For the Attorney General of a State address the envelop: The Honorable/(Full name)/Attorney General of (Name of State)/(Address). The salutation of the letter should read: Dear Attorney General (last name).

Like other members of a governor's cabinet, all state attorneys general are addressed in writing as 'the Honorable (Full Name)'. 80% are elected in a general election. 20% are appointed by their governor.

The proper form of addressing a person holding the office is addressed Mister or Madam Attorney General, or just as Attorney General. The plural is "Attorneys General" or "Attorneys-General".

You may submit your appeal by U.S. mail or a delivery service, i.e., FedEx or UPS. You may also file your appeal in person at the Tribunal's office at 7515 Halcyon Summit Drive, Suite 103, Montgomery, Alabama.

You are certainly within your rights to write directly to the prosecutor, but no good is likely to come of it. Either your letter will be ignored, or it will be used against you. In many cases, the prosecutor doesn't even care if you're innocent.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

For additional assistance in locating an Opinion, contact the Opinions Division at (334)-242-7403.