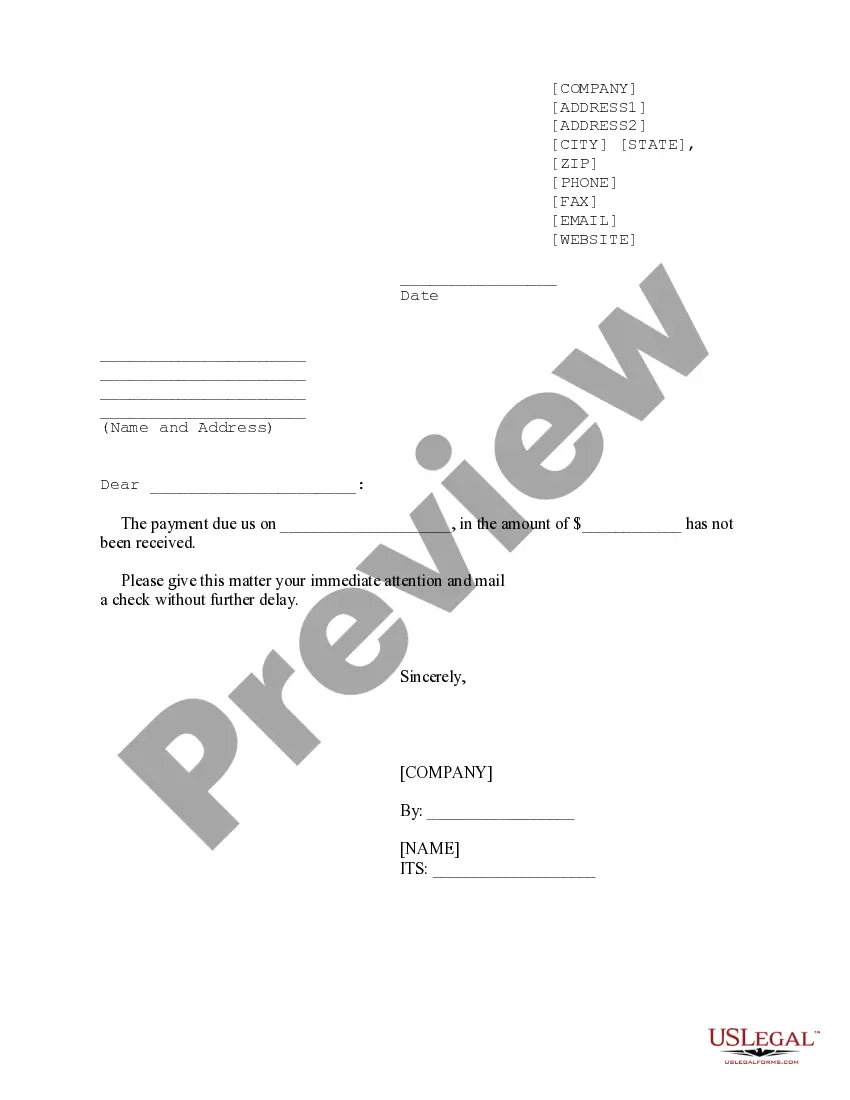

South Carolina Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

Are you currently in a situation where you frequently need to have documents for either organizational or personal purposes.

There are numerous authentic form templates accessible online, but finding reliable ones is challenging.

US Legal Forms offers a vast array of form templates, such as the South Carolina Final Notice of Past Due Account, which are designed to meet federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the South Carolina Final Notice of Past Due Account at any time, if necessary. Just click the respective form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Final Notice of Past Due Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Find the form you need and ensure it is for the correct city/county.

- 2. Use the Review option to look over the form.

- 3. Read the description to ensure you have selected the correct form.

- 4. If the form isn’t what you are looking for, use the Lookup field to find a form that fits your needs.

- 5. Once you locate the proper form, click Get now.

- 6. Choose the pricing plan you want, provide the required information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

The state of South Carolina is one of four states that does not permit wage garnishment. However, state law does permit creditors to pursue garnishment against your bank account, effectively freezing your assets.

In South Carolina, creditors and debt collectors can only come after you for medical and credit card debt for three years. They can pursue you for mortgage debt for twenty years and state tax debt for ten years.

Your wages CANNOT be garnished for collection of a debt or a judgment incurred here in South Carolina. Wage garnishment is prohibited in South Carolina EXCEPT in 3 cases: 1) If money is owed to the government (i.e., unpaid taxes, defaulted federal student loans)

Under South Carolina law (S.C. Code § 15-3-530), the statute of limitations for most types of consumer and business debt is three (3) years. As an article from the U.S. Federal Trade Commission (FTC) explains, the statute of limitations typically begins ticking once a debtor fails to make payments on the debt.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

In South Carolina, creditors and debt collectors can only come after you for medical and credit card debt for three years. They can pursue you for mortgage debt for twenty years and state tax debt for ten years.

If the creditor gets a judgment, that does not mean it has to be paid to them immediately. You can pay it voluntarily or make a payment arrangement.

The statute of limitations for all types of debt is three years in South Carolina. This includes written contracts such as bank loans and medical bills, promissory notes such as mortgages and open-ended accounts such as credit cards.