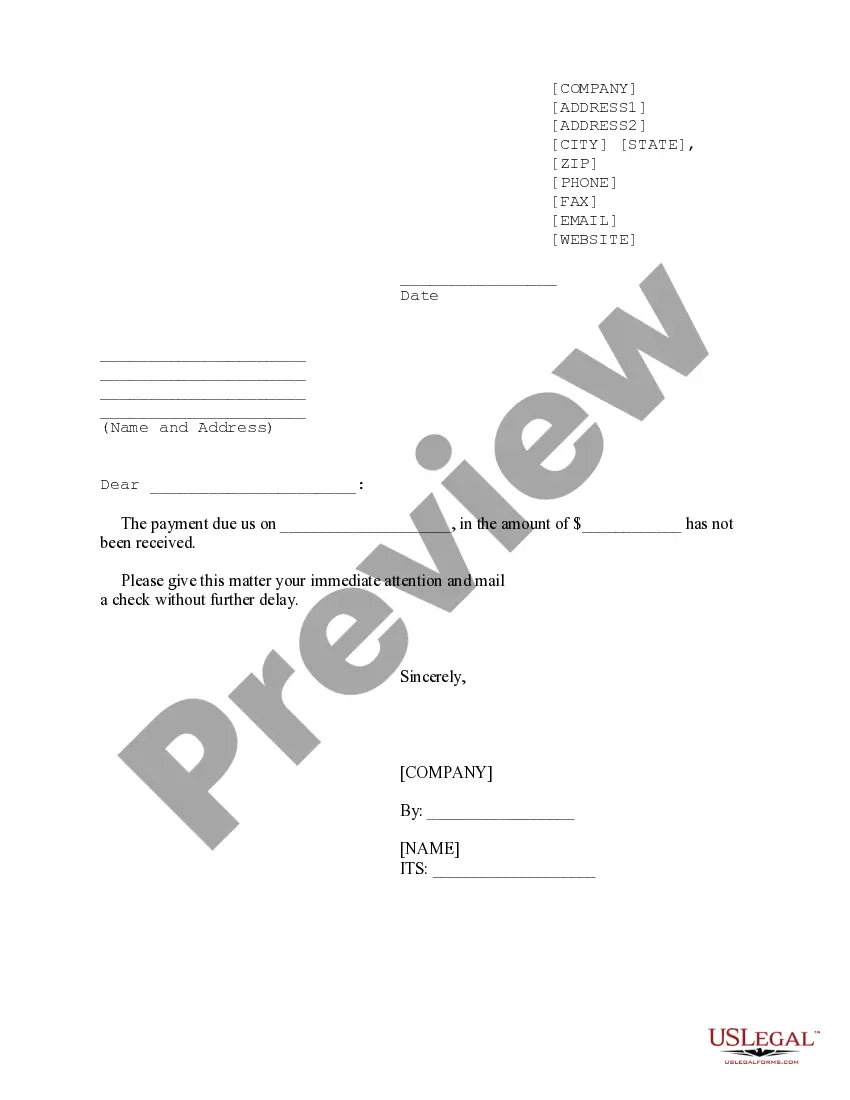

Virginia Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

If you need to thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal templates, which are available online.

Employ the site's simple and convenient search to locate the documents you need.

An assortment of templates for business and personal uses are categorized by types and categories, or keywords. Use US Legal Forms to find the Virginia Final Notice of Past Due Account within a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and obtain, and print the Virginia Final Notice of Past Due Account with US Legal Forms. There are millions of professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Virginia Final Notice of Past Due Account.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Review option to examine the form’s content. Don't forget to read the description.

- Step 3. If you aren't satisfied with the form, use the Search field at the top of the screen to find alternatives of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Virginia Final Notice of Past Due Account.

Form popularity

FAQ

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

There are no tax lien sales in Virginia, however, you may purchase real estate at a public auction.

Liens give the IRS a legal claim to a taxpayer's property as security or payment for a tax debt. A tax lien arises after the IRS assesses the liability, sends Notice and Demand for Payment, and the taxpayer neglects or refuses to fully pay the debt within 10 days after notification.

Under the new Virginia law that became effective January 1, 2022, judgments entered in a Virginia circuit court after July 1, 2021, have a 10-year limitations period and may only be extended up to two additional 10-year periods, for a maximum limitations period of 30 years.

This finite period of time is known as the statute of limitations. In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

Copies or Search for UCC/Tax Lien Filings To ascertain the number of pages in a document and determine the proper amount of payment for your request, contact the Clerk's Office at (804) 371-9733 or toll-free in Virginia at 1-866-722-2551.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

No execution shall be issued and no action brought on a judgment, including a judgment in favor of the Commonwealth and a judgment rendered in another state or country, after 20 years from the date of such judgment or domestication of such judgment, unless the period is extended as provided in this section.

Collection out of estate in hands of or debts due by third party.