Alabama Letter of Intent to Form a Limited Partnership

Description

How to fill out Letter Of Intent To Form A Limited Partnership?

Are you in the location where you need paperwork for both organizational or personal reasons almost daily.

There are numerous legal document templates accessible online, but locating reliable ones isn't easy.

US Legal Forms provides a vast array of form templates, such as the Alabama Letter of Intent to Form a Limited Partnership, designed to meet federal and state requirements.

When you find the appropriate form, click Buy now.

Select the pricing plan you want, provide the necessary details to set up your account, and pay for your order using your PayPal or credit card.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alabama Letter of Intent to Form a Limited Partnership template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct area/state.

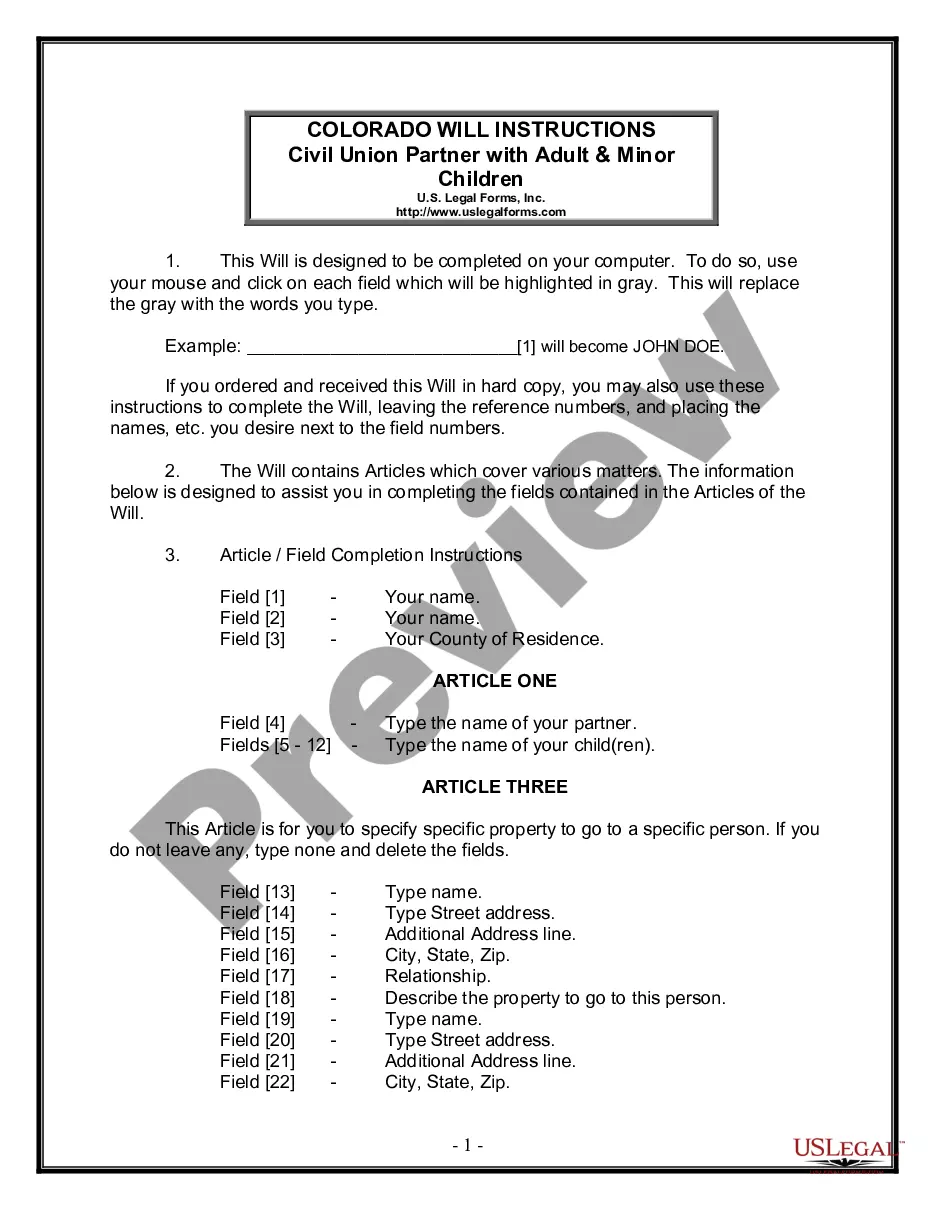

- Utilize the Preview button to review the form.

- Read the information to confirm you have selected the right template.

- If the form isn't what you're looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

How to Set up a Partnership LLCCreate an operating agreement specifying each member's role in the company.Choose a name for your partnership LLC and either register it or file a DBA form with your secretary of state.Publish a notice in local newspapers announcing your intent to form an LLC if your state requires it.More items...

How to Start a General Partnership in Alabama Confirm you should start a general partnership. Determine if you need to register your business name. Check name availability. File an Alabama Trade Name Application. Create a Partnership Agreement. Get a Federal Employer Identification Number.More items...

All owners of Alabama businesses are able to be their own registered agents. This means you can designate yourself to accept official notices and service of process for your business, and there are only a few requirements you must meet in order to be the registered agent.

Step 1: Select a business name. The business name can be any name that isn't currently being used by another business.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.Step 5: Get your day to day business affairs in order.

Register yourself on the website of Ministry of Corporate Affairs, developed for LLP services, i.e. . This website may also be accessed through the website of the ministry On the home page of the URL click Register tab on top right hand corner of the page.

An LLC can be a partnership for tax purposes, because the IRS automatically classifies both LLCs and partnerships as disregarded entities." This means that owners report their share of company profits and losses on their personal tax returns.

LLP Formation Documents RequiredAddress Proof of the Partners. Utility Bill of the proposed Registered Office of the LLP. No-Objection Certificate from the Landlord. Rental Agreement Copy between the LLP and the Landlord.

The Alabama Certificate of Existence will show that your LLC in Alabama or Alabama corporation exists and is what you'll need to provide if registering your business in a different state.

How to Start a General Partnership in Alabama Confirm you should start a general partnership. Determine if you need to register your business name. Check name availability. File an Alabama Trade Name Application. Create a Partnership Agreement. Get a Federal Employer Identification Number.More items...

Liability protectionLLPs have an advantage if some owners want more passive ownership with no management responsibility and lower liability as limited partners. All LLC owners have the same liability protection unless an owner is a manager.