Alabama Invoice Template for Farmer

Description

How to fill out Invoice Template For Farmer?

Have you ever been in a situation where you require documents for business or specific objectives almost all the time.

There are numerous legal document templates available online, but finding reliable ones isn’t straightforward.

US Legal Forms offers thousands of template options, similar to the Alabama Invoice Template for Farmers, which are designed to comply with state and federal regulations.

Once you locate the correct form, just click Buy now.

Choose the pricing plan you desire, fill in the necessary details to process your payment, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and possess your account, simply Log In.

- After that, you can download the Alabama Invoice Template for Farmers design.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/region.

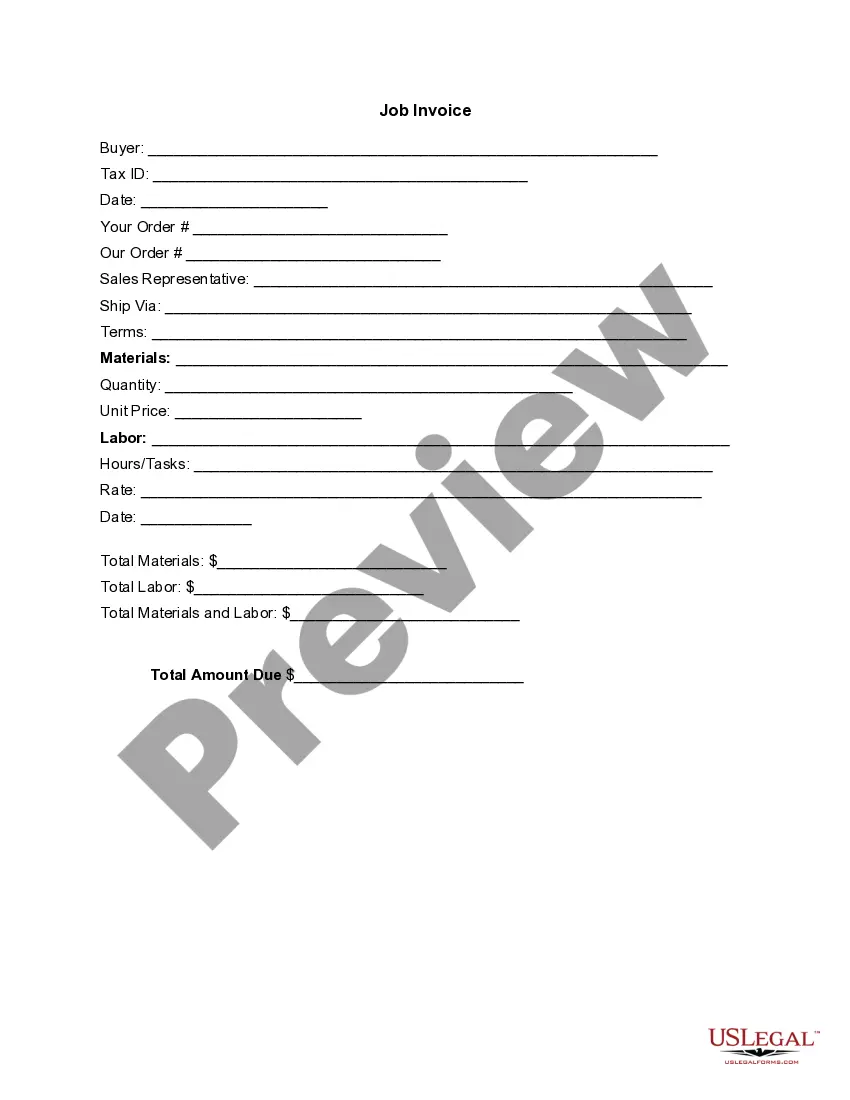

- Utilize the Preview feature to review the document.

- Check the description to make sure that you have selected the proper form.

- If the document isn’t what you’re looking for, use the Lookup section to find the form that meets your requirements.

Form popularity

FAQ

To qualify for a farm property tax exemption, demonstrate that your property is predominantly used for farming activities. You will usually need to submit documentation, such as income statements and tax forms. Leveraging an Alabama Invoice Template for Farmer can assist you in maintaining organized financial records, which are crucial for the exemption application process.

Generally, the number of acres required to be categorized as a farm for tax purposes is determined by local law and can differ widely. Many jurisdictions may allow exceptions for smaller parcels if farming income can be demonstrated. Using an Alabama Invoice Template for Farmer can support your case by consistently showing income generated from your agricultural activities, regardless of acreage.

The number of acres needed to qualify as a farm for tax purposes varies by jurisdiction. In many areas, even a small number of acres may be sufficient if the land is used primarily for farming. Using an Alabama Invoice Template for Farmer can help validate your agricultural use, even on smaller parcels of land.

To obtain a tax-exempt farm number, contact your local agricultural department or tax authority. You may need to submit application forms and supporting documents including proof of your farming activities. Keeping accurate records using an Alabama Invoice Template for Farmer can simplify this process and ensure your application aligns with the requirements.

You can classify your property as a farm if it meets specific criteria set by your local government. Typically, this includes the primary use of the land for agricultural production and the generation of income. Utilizing an Alabama Invoice Template for Farmer can aid in documenting sales and income from your farming activities, further supporting your classification process.

To become farm tax exempt in Virginia, you'll need to apply for a farm exemption with your local tax authority. Ensure that you demonstrate your property is primarily used for agricultural purposes. Financial records and an Alabama Invoice Template for Farmer can provide essential evidence of your farming operations. This will not only help in your exemption application but also streamline your farming finances.

Creating an invoice bill template involves outlining key elements such as your business name, contact information, itemized services or products, and total costs. You can also use online platforms that provide easy-to-edit templates, including Alabama Invoice Template for Farmer, which ensures your invoices are professionally formatted and ready to send.

Farmers typically use IRS Form 1040, Schedule F to report their income and expenses from farming activities. This form allows for detailing agricultural sales, costs, and deductions. Streamlining this process with an Alabama Invoice Template for Farmer will ensure you have all relevant data at your fingertips when filing.

To obtain a farm tax-exempt number in Alabama, you must complete an application through your local Department of Revenue. Be prepared to provide evidence of your farming activities and the size of your operation. An Alabama Invoice Template for Farmer can help you organize necessary documents and financial records to support your application.

For tax purposes, a farm must generate income and involve the cultivation of soil, livestock, or both. Generally, significant farming operations benefit from various tax incentives and deductions aimed at supporting agricultural businesses. An Alabama Invoice Template for Farmer can assist in maintaining accurate records to qualify for these benefits.