Alabama Proof of Residency for Mortgage

Description

How to fill out Proof Of Residency For Mortgage?

Are you currently in the situation in which you require paperwork for both organization or specific uses nearly every day? There are a lot of lawful file templates available on the net, but discovering kinds you can trust is not simple. US Legal Forms gives 1000s of type templates, like the Alabama Proof of Residency for Mortgage, that are published in order to meet state and federal requirements.

In case you are presently informed about US Legal Forms site and possess a merchant account, basically log in. Afterward, you can down load the Alabama Proof of Residency for Mortgage design.

Should you not come with an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Get the type you want and make sure it is for the correct area/region.

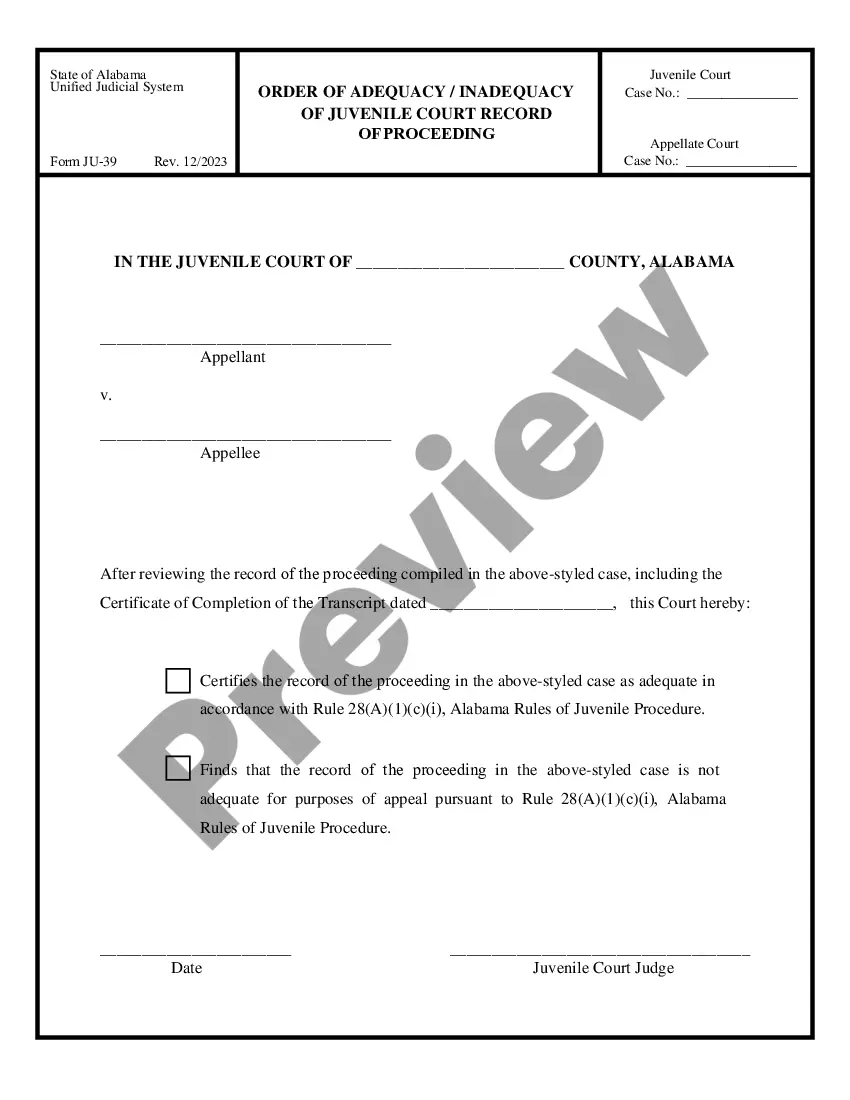

- Utilize the Review switch to check the shape.

- Browse the information to actually have selected the appropriate type.

- If the type is not what you`re trying to find, take advantage of the Lookup discipline to obtain the type that suits you and requirements.

- If you discover the correct type, simply click Get now.

- Pick the rates prepare you want, complete the required info to make your bank account, and pay for the order using your PayPal or credit card.

- Choose a practical paper format and down load your version.

Get all the file templates you have purchased in the My Forms food list. You can obtain a more version of Alabama Proof of Residency for Mortgage whenever, if possible. Just click the essential type to down load or print out the file design.

Use US Legal Forms, probably the most comprehensive assortment of lawful varieties, to save lots of some time and stay away from blunders. The support gives professionally made lawful file templates which can be used for a range of uses. Make a merchant account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

A proof of residence is a document confirming where you live, and must have both your full name and your address printed on it.

What is accepted as proof of address? Water, electricity, gas, telephone, or Internet bill. Credit card bill or statement. Bank statement. Bank reference letter. Mortgage statement or contract. Letter issued by a public authority (e.g. a courthouse) Company payslip. Car or home insurance policy.

Effective , every air traveler will need a REAL ID compliant license/ID (STAR ID) or another form of identification for domestic air travel. (See TSA's website for a full list of acceptable identification for domestic air travel.)

This information can come from a number of documents, but is necessary to proving where you live. A utility bill, credit card statement, lease agreement or mortgage statement will all work to prove residency. If you've gone paperless, print a billing statement from your online account.

Home property tax. Health insurance forms with address. The last three months of a utility bill with address. Certificate of employment, if containing proof of permanent residency.

This information can come from a number of documents, but is necessary to proving where you live. A utility bill, credit card statement, lease agreement or mortgage statement will all work to prove residency.

Proof of IL Residency Illinois driver's license. Tax Return Transcript with Illinois address. Illinois voter's registration card. State of Illinois identification card issued by the Secretary of State. Utility or rent bills in the parent's name. Residential lease in the parent's name. Property tax bill.

An Alabama Resident is someone who is domiciled in Alabama. Your domicile is where you live permanently. A person can only have one domicile. Individuals not domiciled in Alabama that maintain a permanent home in Alabama, or spend more than seven months of the taxable year in Alabama are considered to be residents.