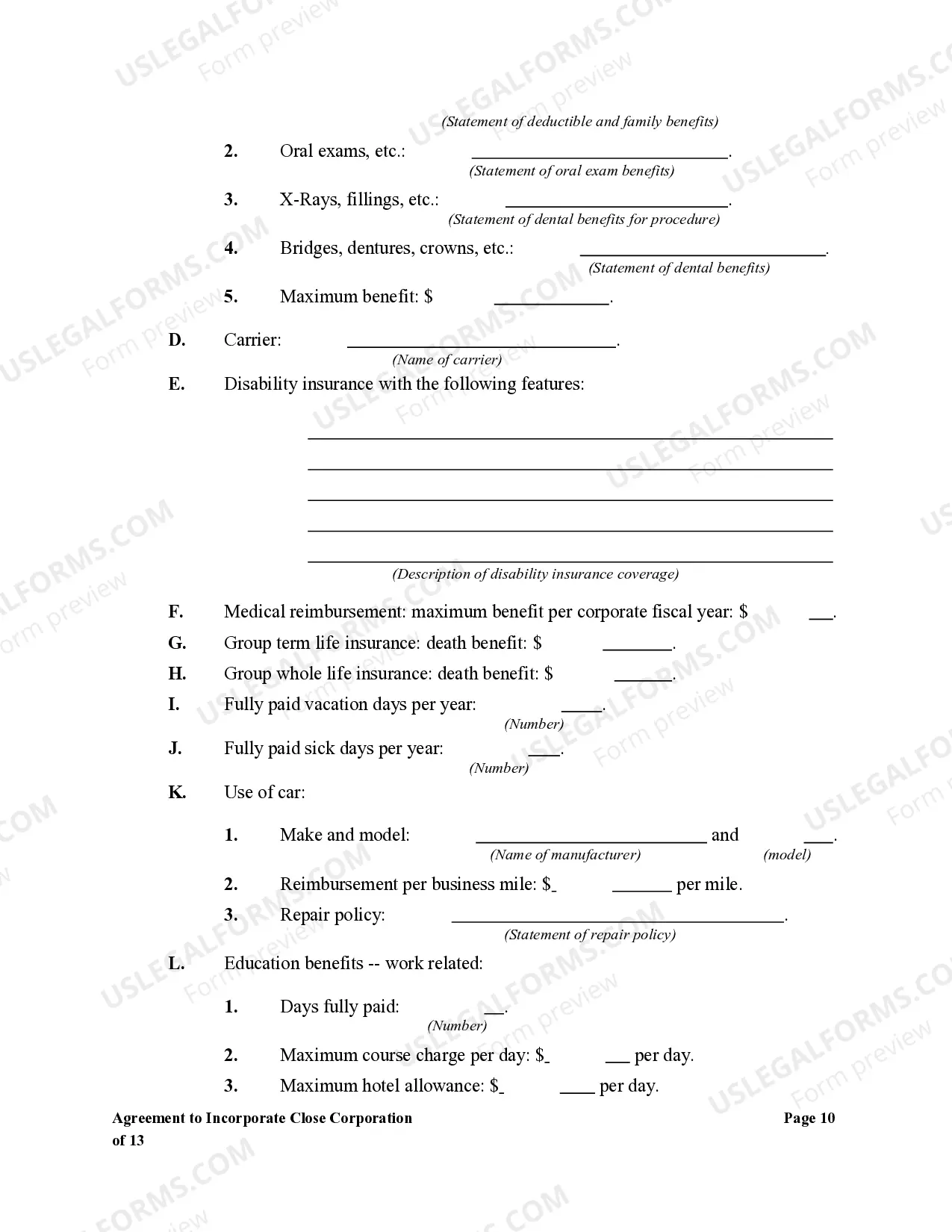

Alabama Agreement to Incorporate Close Corporation

Description

How to fill out Agreement To Incorporate Close Corporation?

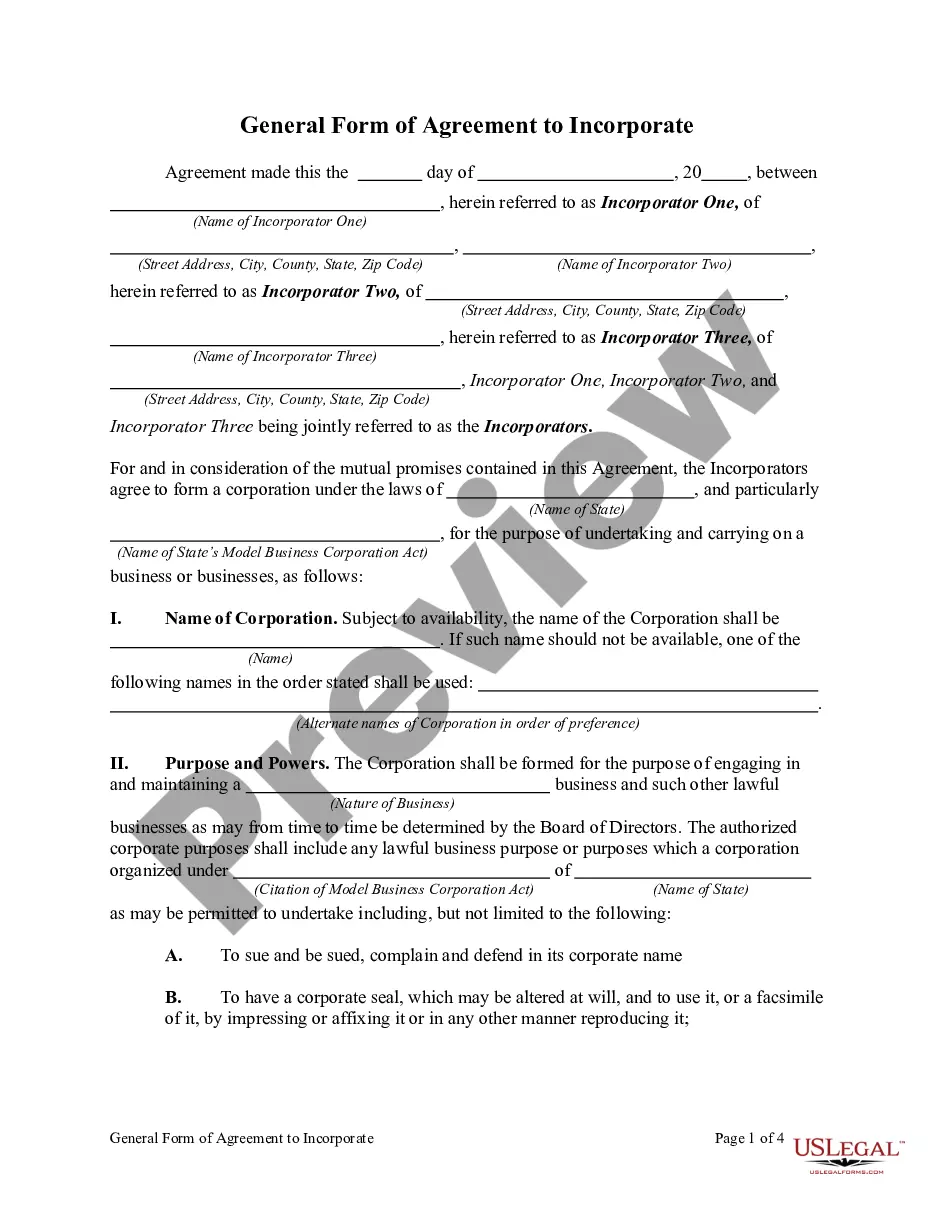

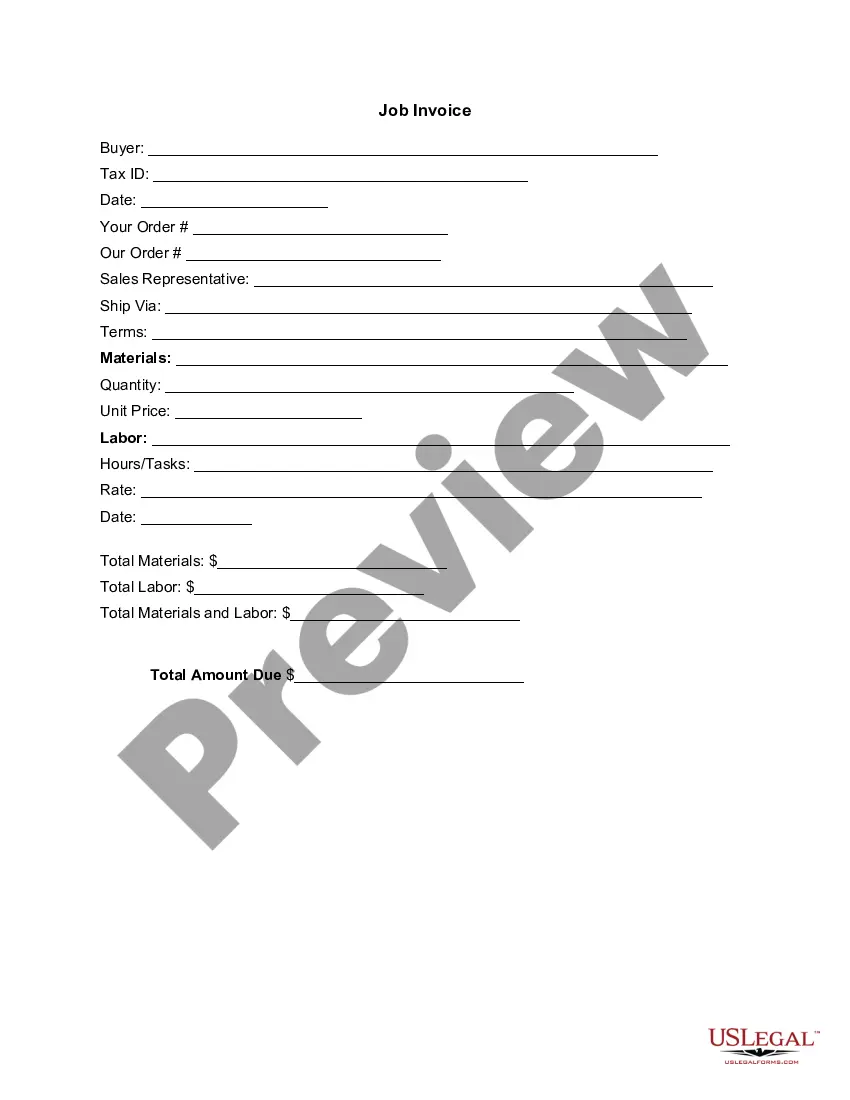

You can spend hours on the web attempting to find the legitimate record design that suits the state and federal demands you require. US Legal Forms supplies a huge number of legitimate forms that happen to be analyzed by professionals. It is simple to acquire or print the Alabama Agreement to Incorporate Close Corporation from our services.

If you already have a US Legal Forms accounts, you may log in and click the Down load button. Following that, you may total, edit, print, or indicator the Alabama Agreement to Incorporate Close Corporation. Every single legitimate record design you buy is the one you have forever. To get an additional backup for any purchased type, visit the My Forms tab and click the related button.

Should you use the US Legal Forms website the very first time, adhere to the basic guidelines listed below:

- Very first, be sure that you have chosen the proper record design to the area/town of your liking. Browse the type information to ensure you have picked out the proper type. If readily available, take advantage of the Review button to look from the record design as well.

- In order to find an additional variation of the type, take advantage of the Look for discipline to get the design that meets your needs and demands.

- Once you have discovered the design you need, click Get now to carry on.

- Find the costs plan you need, type your accreditations, and sign up for a free account on US Legal Forms.

- Total the transaction. You can utilize your credit card or PayPal accounts to pay for the legitimate type.

- Find the format of the record and acquire it to the product.

- Make modifications to the record if possible. You can total, edit and indicator and print Alabama Agreement to Incorporate Close Corporation.

Down load and print a huge number of record web templates making use of the US Legal Forms website, which offers the most important assortment of legitimate forms. Use professional and status-certain web templates to deal with your organization or specific requirements.

Form popularity

FAQ

Any corporation may be incorporated as a close corporation, except mining or oil companies, stock exchanges, banks, insurance companies, public utilities, educational institutions and corporations declared to be vested with public interest in ance with the provisions of this Code.

The easiest definition of a close corporation is one that is held by a limited number of shareholders and is not publicly traded. The company is run by the shareholders and is generally exempt from many requirements of other corporations, including having a board of directors and holding annual meetings.

A CC is similar to a private company. It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC.

A close, or "closely held," corporation is a type of venture where the shareholders, directors and officers are typically the same people, and where all parties desire to remain a small, tight-knit group. Close corporations are restricted to no more than 30 shareholders.

What Is a Corporation? A corporation is a legal entity that is separate and distinct from its owners. Under the law, corporations possess many of the same rights and responsibilities as individuals. They can enter contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes.

A Statutory Close Corporation is a corporation that has filed an election or supplement for special status in its Articles of Incorporation or through an amendment to its entity formation documents.

If your close corporation does not elect S-Corp status, then it is taxed as a C-Corporation, the regular taxation status for corporations. While a C-Corp must file its own tax return, S-Corp status allows corporations to "pass through" its income and expenses to the corporation's owners.

The tax status of a close corporation is determined by the type of corporation that is elected. The company may elect to use C corporation status or may take the IRS S corporation election. Since an S corporation limits the number of shareholders to 100, a close corporation would qualify for this designation.