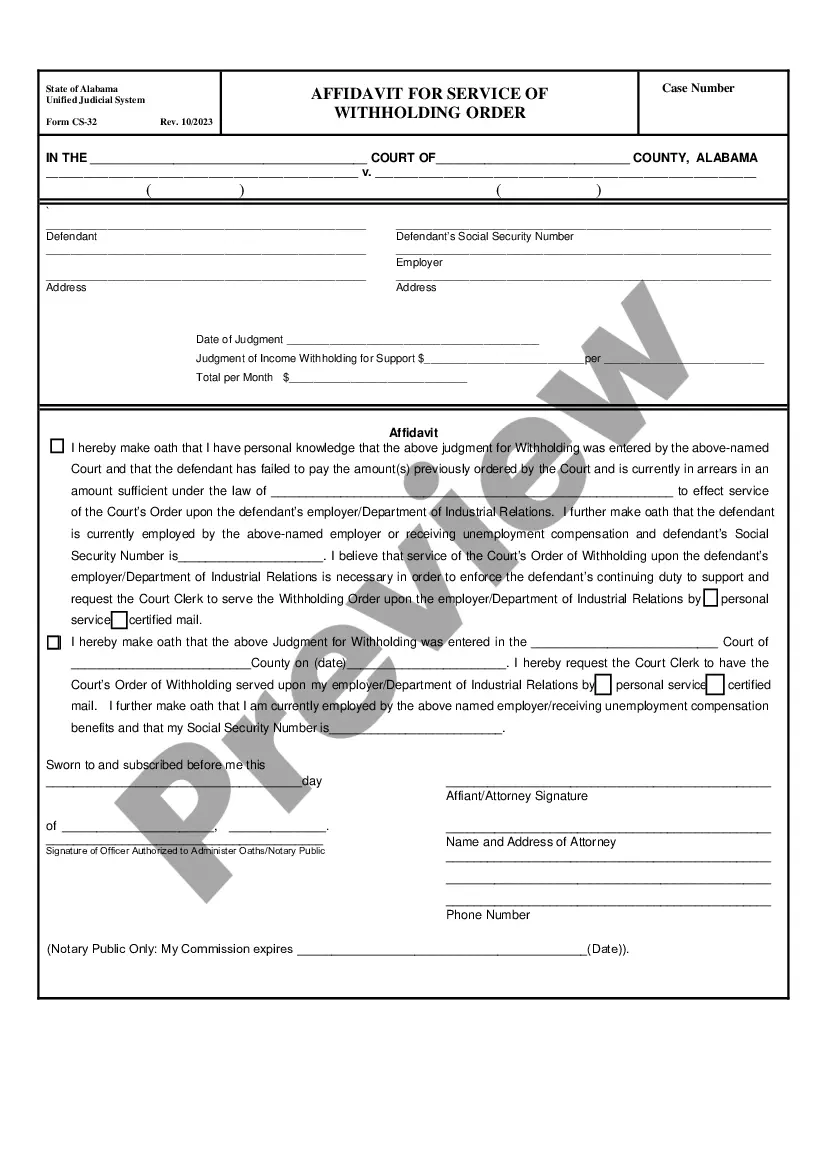

Transmitting of Withholding Order, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Transmittal of Withholding Order

Description

How to fill out Alabama Transmittal Of Withholding Order?

Utilizing Alabama Transmittal of Withholding Order templates crafted by experienced attorneys allows you to circumvent difficulties when preparing documents.

Simply download the template from our site, populate it, and have a lawyer validate it.

Doing so will conserve you considerably more time and energy than seeking a legal expert to create a document from scratch tailored to your requirements would.

Remember to verify all entered details for accuracy prior to submitting or dispatching it. Reduce the time invested in completing documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just sign in to your account and go back to the template page.

- Locate the Download button adjacent to the templates you’re reviewing.

- Upon downloading a document, your saved forms can be found in the My documents section.

- When you lack a subscription, it’s not a significant issue.

- Simply adhere to the step-by-step instructions below to register for an account online, obtain, and finalize your Alabama Transmittal of Withholding Order template.

- Double-check and ensure you’re downloading the correct state-specific form.

Form popularity

FAQ

Yes, parents in Alabama can agree to forego child support, but this agreement must be approved by the court. The court will assess whether this arrangement serves the best interests of the child before granting approval. It is essential to document this agreement properly, often through the Alabama Transmittal of Withholding Order. US Legal Forms offers resources to help navigate this legal terrain.

A father can seek to terminate child support by filing a request with the court, typically showing a significant change in circumstances. This may involve custody changes or a decrease in income. Filing an Alabama Transmittal of Withholding Order along with the request can formalize the procedure. Using templates from US Legal Forms can provide the necessary documents and guidance.

In Alabama, a mother cannot unilaterally cancel child support; this requires a court's approval. If circumstances warrant, such as changes in custody or income, she can petition the court for a review. Submitting an Alabama Transmittal of Withholding Order along with her request facilitates proper communication. Using services like US Legal Forms may simplify this process.

To remove someone from child support in Alabama, you must obtain a court order. You’ll need to show justification for terminating the support obligation, such as changes in custody or financial circumstances. Submitting an Alabama Transmittal of Withholding Order helps to communicate these changes and fulfill legal requirements. Consider using US Legal Forms for necessary documentation.

Filing for a child support modification in Alabama requires completing a request form. You will need to submit the form along with the Alabama Transmittal of Withholding Order to the relevant court. Make sure to include supporting documents that show why the modification is necessary. US Legal Forms provides templates and guidance that can streamline your filing process.

To modify child support in Alabama, you must demonstrate a substantial change in circumstances. This can include changes in income, employment status, or the needs of the child. Filing the Alabama Transmittal of Withholding Order ensures that all parties are informed of the changes. Using legal resources, like US Legal Forms, can make this process more efficient.

ACH Debit: You may pay by ACH Debit by going to My Alabama Taxes. Pay Online: Alabama Interactive. Credit Card Payments: You may be able to use your credit card to pay your tax liability with Official Payments Corporation, or Value Payment Systems.

The Alabama Form A-4, Employee's Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.If for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions.

The withholding statement is a document that shows how income payable to an account is broken down between the beneficiaries of the account.In most circumstances, we will only request a withholding statement where you provide us with a U.S. tax form W-8IMY.

You received this letter because we determined that you're not entitled to claim exempt status or more than a specified number of withholding allowances. Generally, your employer bases the amount of withholding for federal income tax on your Form W-4, Employee's Withholding Certificate PDF.