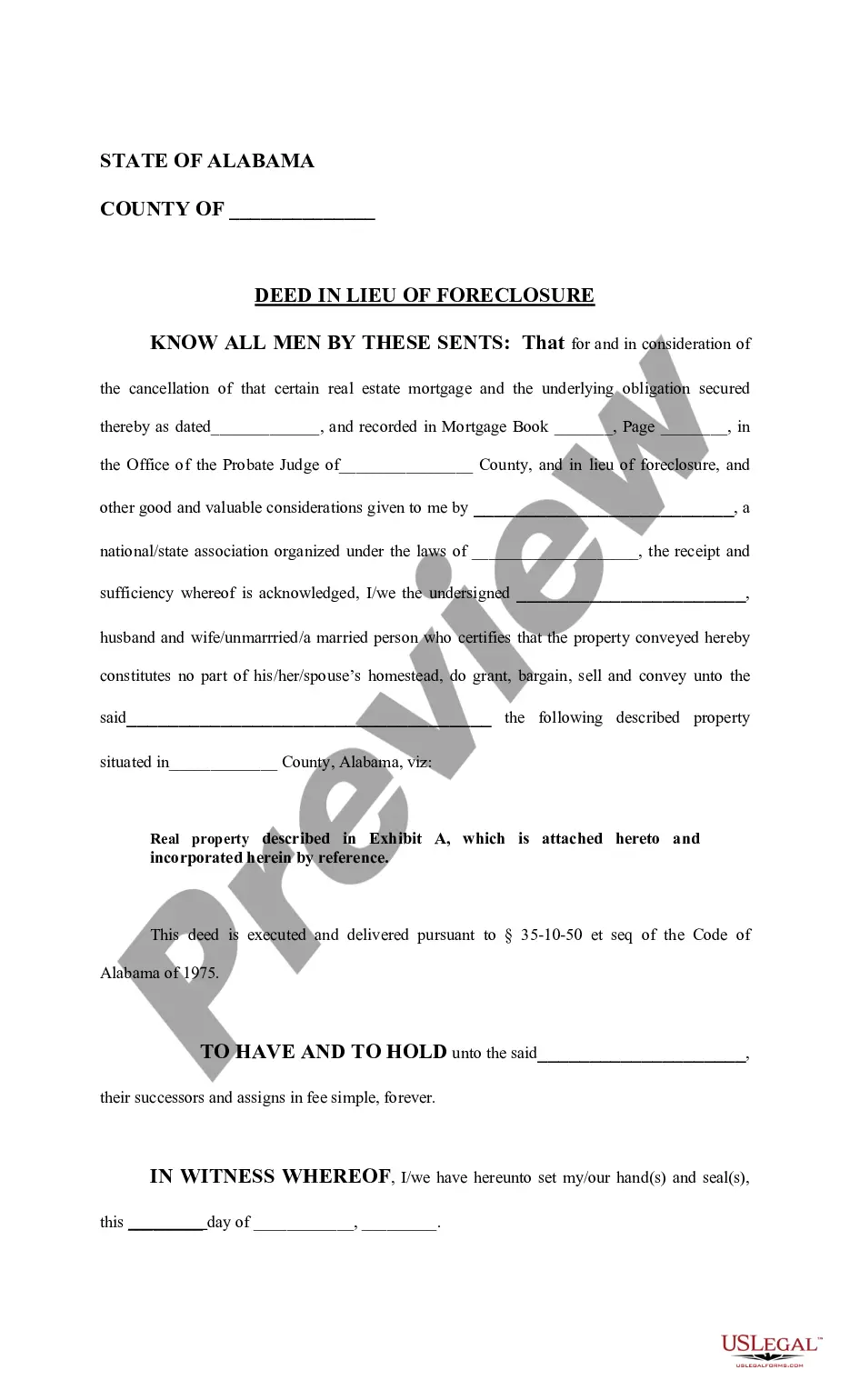

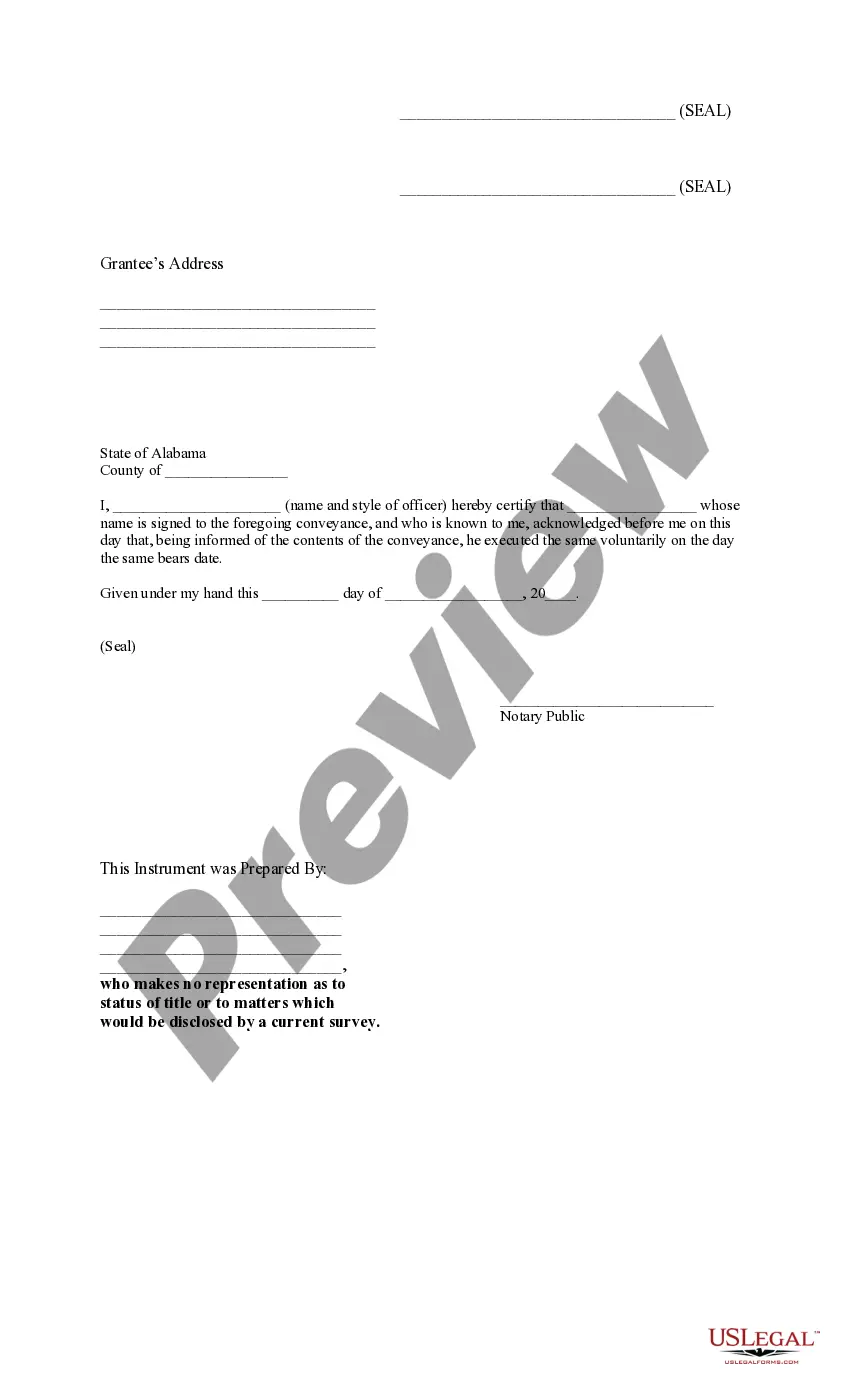

This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

Alabama Deed In Lieu of Foreclosure

Description

How to fill out Alabama Deed In Lieu Of Foreclosure?

Utilizing Alabama Deed In Lieu of Foreclosure templates created by knowledgeable attorneys helps you evade stress when completing paperwork.

Simply download the template from our site, fill it in, and seek legal advice to verify it.

This can save you significantly more time and effort than having a lawyer draft a document from scratch to meet your requirements.

Utilize the Preview feature and read the provided description (if available) to determine if you need this specific template and if so, just click Buy Now. Search for another template using the Search field if required. Choose a subscription that fits your needs. Begin using your credit card or PayPal. Choose a file format and download your document. Once you have completed all the prior steps, you will be able to fill out, print, and sign the Alabama Deed In Lieu of Foreclosure template. Ensure to verify all entered information for accuracy before submitting it or mailing it out. Minimize the time spent on completing documents with US Legal Forms!

- If you've already purchased a US Legal Forms subscription, just Log In to your profile and revisit the sample page.

- Locate the Download button adjacent to the templates you're examining.

- After downloading a document, your saved samples can be found in the My documents tab.

- If you lack a subscription, it's not a significant issue.

- Simply adhere to the steps below to register for your account online, obtain, and fill out your Alabama Deed In Lieu of Foreclosure template.

- Verify and confirm that you are downloading the correct form specific to your state.

Form popularity

FAQ

A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

Both short sales and deeds in lieu can help homeowners avoid foreclosure.One benefit to these options is that that you won't have a foreclosure on your credit history. But your credit score will still take a major hit. A short sale or deed in lieu is almost as bad as a foreclosure when it comes to credit scores.

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you were to go through a foreclosure.

The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? a. The lender takes the real estate subject to all junior liens.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Most lenders find this option less appealing than a short sale because they will need to handle the logistics of the sale instead of the homeowner.