Alaska Employment Compensation Package

Description

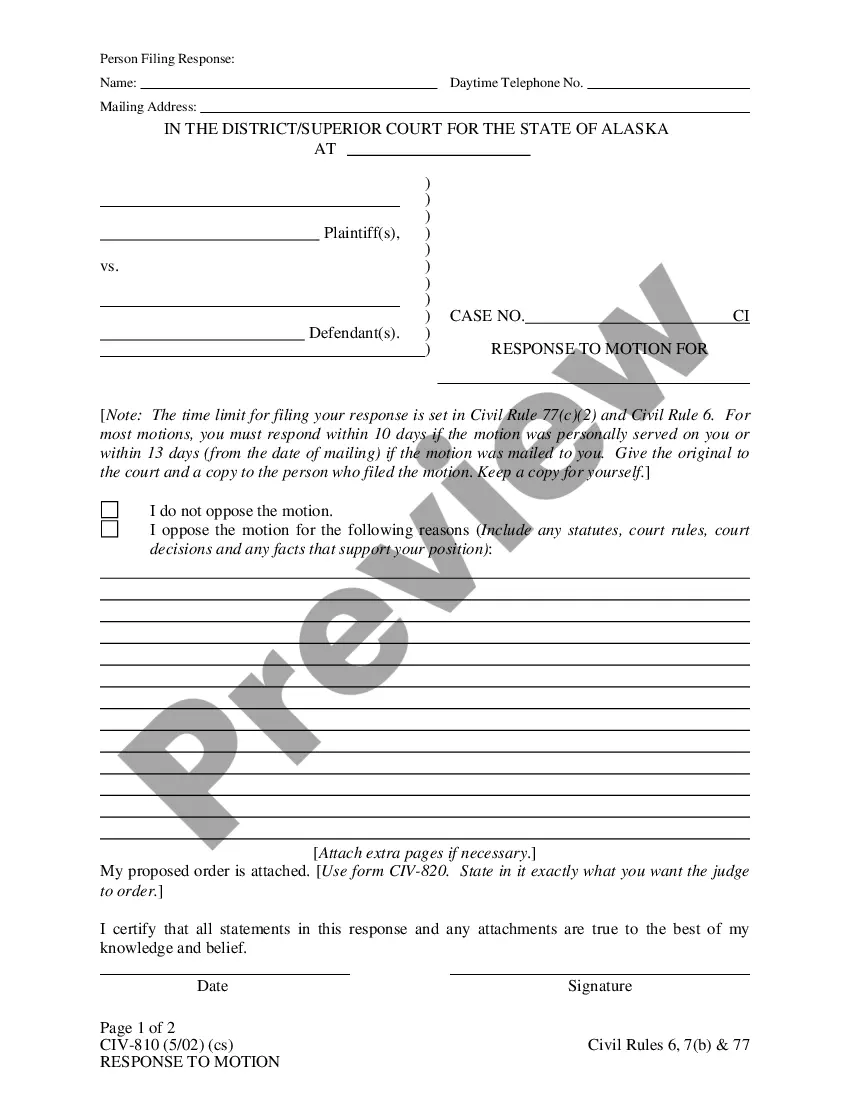

How to fill out Employment Compensation Package?

Finding the right legitimate document format can be a battle. Naturally, there are plenty of templates available on the Internet, but how would you obtain the legitimate kind you require? Utilize the US Legal Forms internet site. The assistance delivers a huge number of templates, such as the Alaska Employment Compensation Package, which you can use for business and private needs. Each of the kinds are checked out by pros and meet federal and state needs.

Should you be presently signed up, log in for your profile and click the Download switch to obtain the Alaska Employment Compensation Package. Make use of profile to look through the legitimate kinds you possess acquired earlier. Check out the My Forms tab of your own profile and obtain an additional backup from the document you require.

Should you be a brand new consumer of US Legal Forms, allow me to share straightforward instructions for you to adhere to:

- Initial, be sure you have selected the proper kind to your town/county. It is possible to look over the shape using the Preview switch and study the shape description to make certain it will be the best for you.

- If the kind fails to meet your preferences, make use of the Seach field to obtain the correct kind.

- When you are certain that the shape is suitable, go through the Acquire now switch to obtain the kind.

- Select the costs prepare you would like and enter the necessary information. Make your profile and pay money for your order utilizing your PayPal profile or bank card.

- Opt for the data file format and acquire the legitimate document format for your device.

- Total, modify and produce and indicator the obtained Alaska Employment Compensation Package.

US Legal Forms is definitely the largest collection of legitimate kinds where you can discover different document templates. Utilize the service to acquire appropriately-made files that adhere to express needs.

Form popularity

FAQ

Key Differences Deferred compensation plans tend to offer better investment options than most 401(k) plans, but are at a disadvantage regarding liquidity. Typically, deferred compensation funds cannot be accessed, for any reason, before the specified distribution date.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

The State of Alaska 457 Deferred Compensation Plan (DCP) allows you to set aside and invest a portion of your income for your retirement on a voluntary basis. It is designed to complement the Alaska SBS Supplemental Annuity Plan and the Alaska PERS/TRS Defined Contribution Retirement Plan.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

A TDA is also known as a 403(b) account. This account offers employees the opportunity to make additional tax-deferred contributions outside their required contributions to their respective retirement plans (either PERS, TRS, or ORP). All University of Alaska employees are eligible to participate in the TDA.

Staffing problems at the payroll division are causing many of Alaska's 14,000 state employees to be paid late or for the wrong amounts and have caused the state to temporarily stop using one of its main tools for hiring and retaining workers.

Dwight Stallman received $415,500 in gross pay during fiscal year 2022, which ran from July 1, 2021 through June 30, 2022. That was the highest figure among 15,484 employees listed. An executive for the Alaska Gasline Development Corp. likely was paid more, but his compensation will not be disclosed until early 2023.