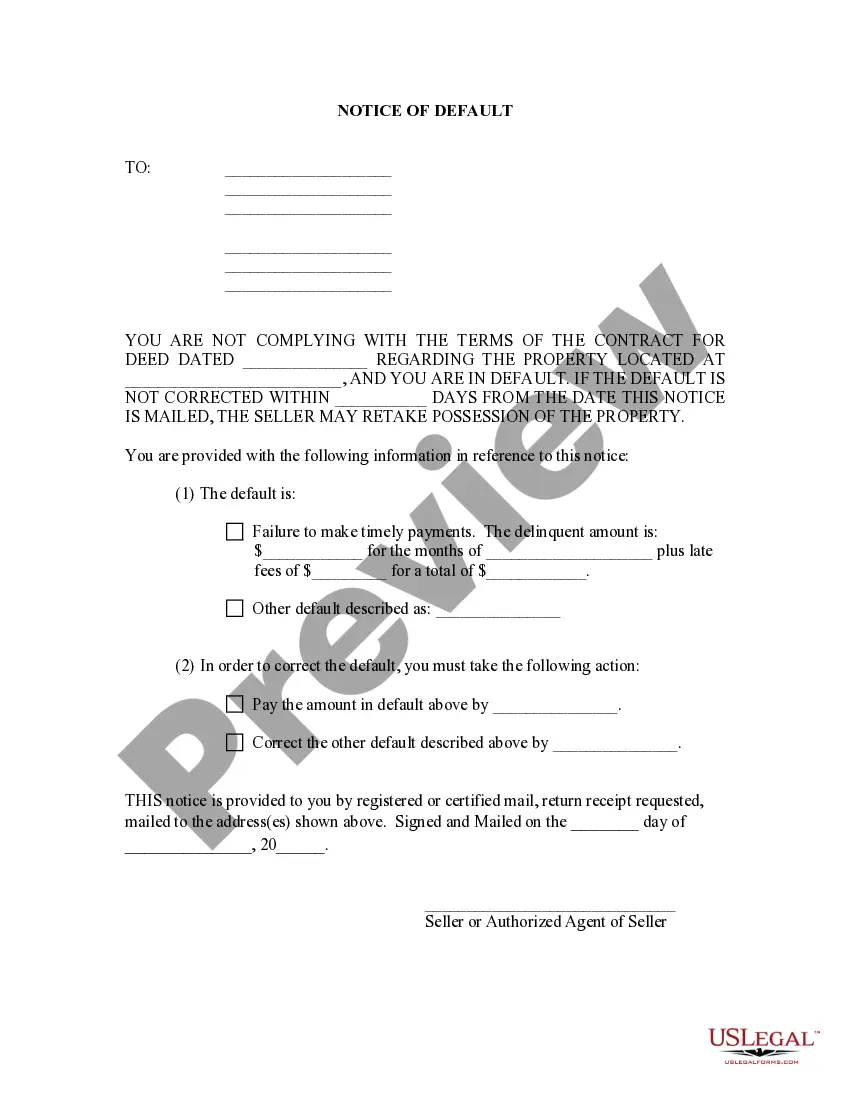

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Alaska Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

Selecting the appropriate authorized documents template can be quite a challenge. Naturally, there are numerous designs available online, but how do you find the authorized form you require? Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Alaska Notice of Harassment and Validation of Debt, that can be utilized for business and personal purposes. All of the forms are reviewed by experts and conform to federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Alaska Notice of Harassment and Validation of Debt. Use your account to browse through the authorized forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your city/county. You can review the form using the Review button and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are certain that the form is suitable, select the Get now button to obtain the form. Choose the pricing plan you wish and enter the required details. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the authorized documents template to your device. Complete, edit, print, and sign the acquired Alaska Notice of Harassment and Validation of Debt.

Use US Legal Forms for a seamless experience in obtaining legal documents that adhere to standards.

- US Legal Forms is the largest repository of authorized forms.

- You can find numerous document templates.

- Utilize the service to obtain professionally crafted paperwork.

- All templates comply with state regulations.

- Ensure you have the right form for your requirements.

- Easily navigate through your purchased forms.

Form popularity

FAQ

Filing a debt validation letter involves formally requesting proof of the debt from the collector. You should send a written request to the debt collector, clearly stating your rights under the Alaska Notice of Harassment and Validation of Debt. By using a platform like US Legal Forms, you can easily access templates that simplify the process of creating and sending a debt validation letter, ensuring you take the right steps to protect yourself.

To file harassment against a debt collector, start by documenting all instances of harassment, including dates, times, and details of the interactions. You can then submit a complaint to the CFPB or your state attorney general, citing the Alaska Notice of Harassment and Validation of Debt as your reference. If necessary, seek assistance from a legal expert who can guide you through the process and help you protect your rights.

If you experience harassment from debt collectors, you should report it to the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general. These organizations can provide guidance on your rights under the Alaska Notice of Harassment and Validation of Debt. Additionally, consider documenting the harassment and reaching out to legal professionals who can help you navigate your options.

In Alaska, the statute of limitations for collecting a debt is typically three years. This means that after three years from the date of the last payment or acknowledgment of the debt, creditors can no longer take legal action to collect. However, it's essential to document any communication regarding the Alaska Notice of Harassment and Validation of Debt. To navigate these complexities, consider using US Legal Forms for reliable resources and guidance.

To obtain a debt validation letter, start by requesting it from your creditor or debt collector. You are entitled to this letter under the Fair Debt Collection Practices Act. Clearly state your request in writing, mentioning the Alaska Notice of Harassment and Validation of Debt. This letter will help you verify the legitimacy of the debt and understand your rights.

Generally, you cannot go to jail simply for being in debt, regardless of the amount. Debt-related issues, such as non-payment, do not usually result in criminal charges under the Alaska Notice of Harassment and Validation of Debt. However, failing to comply with court orders related to debt could lead to legal consequences. It is essential to stay informed and seek assistance if you face legal challenges regarding your debts.

To respond to a debt validation letter, first review the information provided. If you believe the debt is valid, acknowledge it and discuss payment options with the creditor. If you dispute the debt, you should send a written response referencing the Alaska Notice of Harassment and Validation of Debt, requesting further verification. Using a platform like uslegalforms can simplify this process by providing templates and guidance.

Yes, debt validation letters can be effective in resolving disputes about debts. They provide you with a formal way to challenge a debt you believe is inaccurate or invalid. By utilizing the provisions of the Alaska Notice of Harassment and Validation of Debt, you can request the necessary documentation from your creditor. This process ultimately protects your rights and helps clarify your financial situation.

A debt validation letter is sent to inform you about the details of a debt you may owe. This letter serves to comply with the Alaska Notice of Harassment and Validation of Debt regulations, ensuring that you receive essential information about the original creditor and the amount owed. It is crucial to take this letter seriously, as it provides you with the opportunity to verify the debt and safeguard your rights.

You received a debt validation notice because a creditor is required to provide proof of the debt you owe. This notice helps you understand your rights under the Alaska Notice of Harassment and Validation of Debt. It ensures that you are informed about the debt's legitimacy and gives you a chance to dispute it if you believe it is incorrect. Always review this notice carefully and consider your next steps.