Alaska Insurance Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Insurance Agent Agreement - Self-Employed Independent Contractor?

Are you presently in a situation where you require documents for occasional business or personal reasons almost all the time.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a wide array of form templates, such as the Alaska Insurance Agent Agreement - Self-Employed Independent Contractor, which can be tailored to meet state and federal requirements.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download another copy of the Alaska Insurance Agent Agreement - Self-Employed Independent Contractor at any time if needed. Simply click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. This service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Alaska Insurance Agent Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

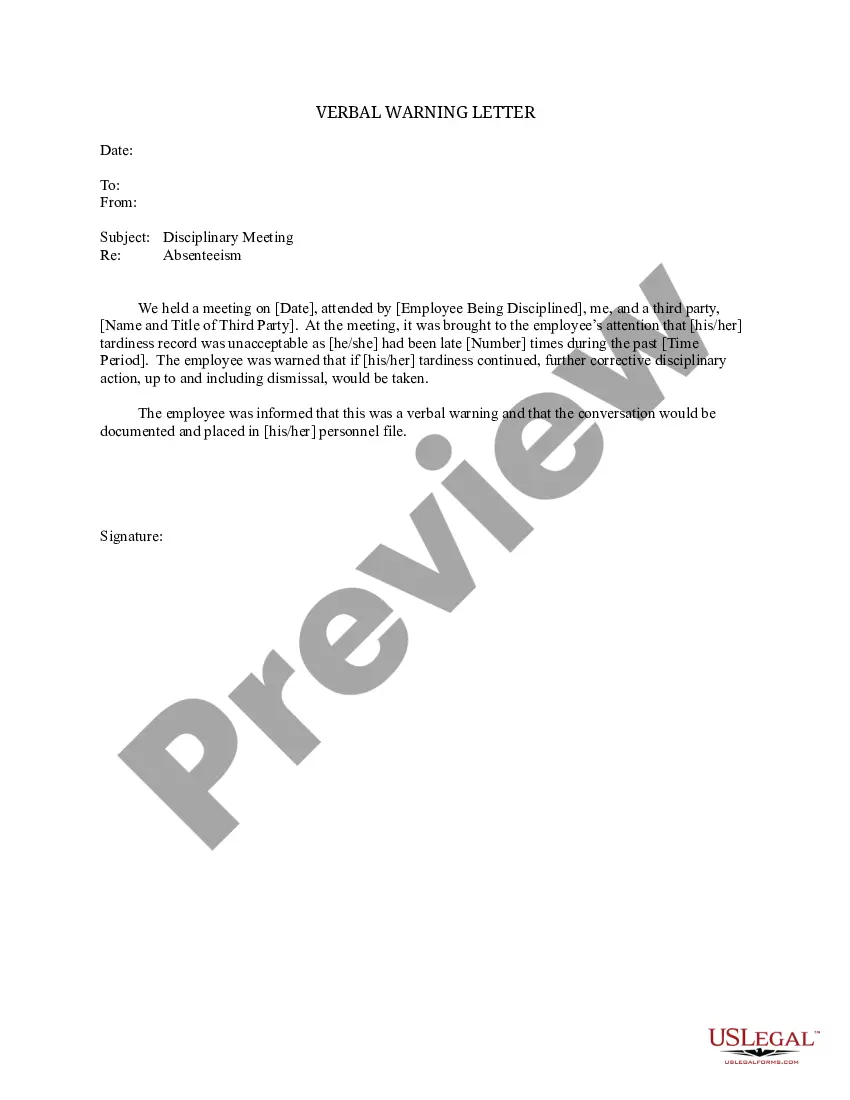

- Utilize the Review button to examine the form.

- Review the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

- If you find the appropriate form, click Buy now.

Form popularity

FAQ

The basic independent contractor agreement is a straightforward document that defines the relationship between a contractor and a client. It typically includes key details such as the nature of services, compensation, project timelines, and confidentiality clauses. Utilizing an Alaska Insurance Agent Agreement - Self-Employed Independent Contractor ensures that both parties are aligned, promoting a smooth working relationship.

Yes, an insurance agent can be considered self-employed if they operate independently and control their business operations. Self-employed insurance agents typically enter into an Alaska Insurance Agent Agreement - Self-Employed Independent Contractor, outlining their business relationship with insurance companies or clients. This status allows agents more flexibility and control over their professional activities.

Filling out an independent contractor agreement requires careful attention to detail, as it lays the foundation for your working relationship. Start by clearly identifying the parties involved, the type of work to be performed, payment structure, and deadlines. Many professionals find using templates, such as those available on the Uslegalforms platform, helpful in creating an effective Alaska Insurance Agent Agreement - Self-Employed Independent Contractor.

Independent contractors in Alaska must comply with specific legal requirements, including proper licensing, tax obligations, and liability insurance. Additionally, they should maintain accurate records of business transactions and expenses. By understanding these requirements and implementing an Alaska Insurance Agent Agreement - Self-Employed Independent Contractor, individuals can better position themselves for success in their business ventures.

An independent contractor agreement in Alaska is a legal document that outlines the terms and conditions between a contractor and a hiring entity. This agreement specifies the scope of work, payment terms, and responsibilities of both parties. It is essential for professionals, including those in the insurance industry, to have a clear Alaska Insurance Agent Agreement - Self-Employed Independent Contractor to avoid misunderstandings.

In Alaska, an independent contractor operates as a self-employed individual, managing their own business operations and determining their work schedule. An employee, on the other hand, works under the control and direction of an employer, who sets the hours and pays wages. Understanding this distinction is crucial, especially when drafting an Alaska Insurance Agent Agreement - Self-Employed Independent Contractor. This ensures that both parties clarify their rights and obligations.

To create an independent contractor agreement, start by outlining the key elements relevant to the arrangement. Include the services to be provided, payment terms, and the duration of the contract. Ensure that you address any legal requirements specific to the Alaska Insurance Agent Agreement - Self-Employed Independent Contractor. Using a reliable platform like USLegalForms can simplify this process, providing templates that help you cover all necessary components efficiently.

Filling out an independent contractor form involves providing essential information such as the contractor's name, address, and tax identification number. Make sure to outline the services offered, as they relate to the Alaska Insurance Agent Agreement - Self-Employed Independent Contractor, to create clarity. Review each section carefully to ensure accuracy, and include all required signatures at the end. Utilizing tools from USLegalForms can help you finish this task accurately and efficiently.

To write an independent contractor agreement, you should begin by clearly defining the scope of work, terms of payment, and deadlines. It's also important to specify the relationship between the parties, ensuring it aligns with the Alaska Insurance Agent Agreement - Self-Employed Independent Contractor framework. Additionally, include clauses for confidentiality, termination, and liability. Using a template from a reliable source, like USLegalForms, can streamline this process and ensure you cover all necessary elements.

While not legally required, it is highly advisable for 1099 employees to have general liability insurance. This type of coverage protects against potential claims of property damage or bodily injury related to your work. In the context of an Alaska Insurance Agent Agreement - Self-Employed Independent Contractor, this insurance can enhance your credibility and help you maintain a professional standard.