Alaska Underwriter Agreement - Self-Employed Independent Contractor

Description

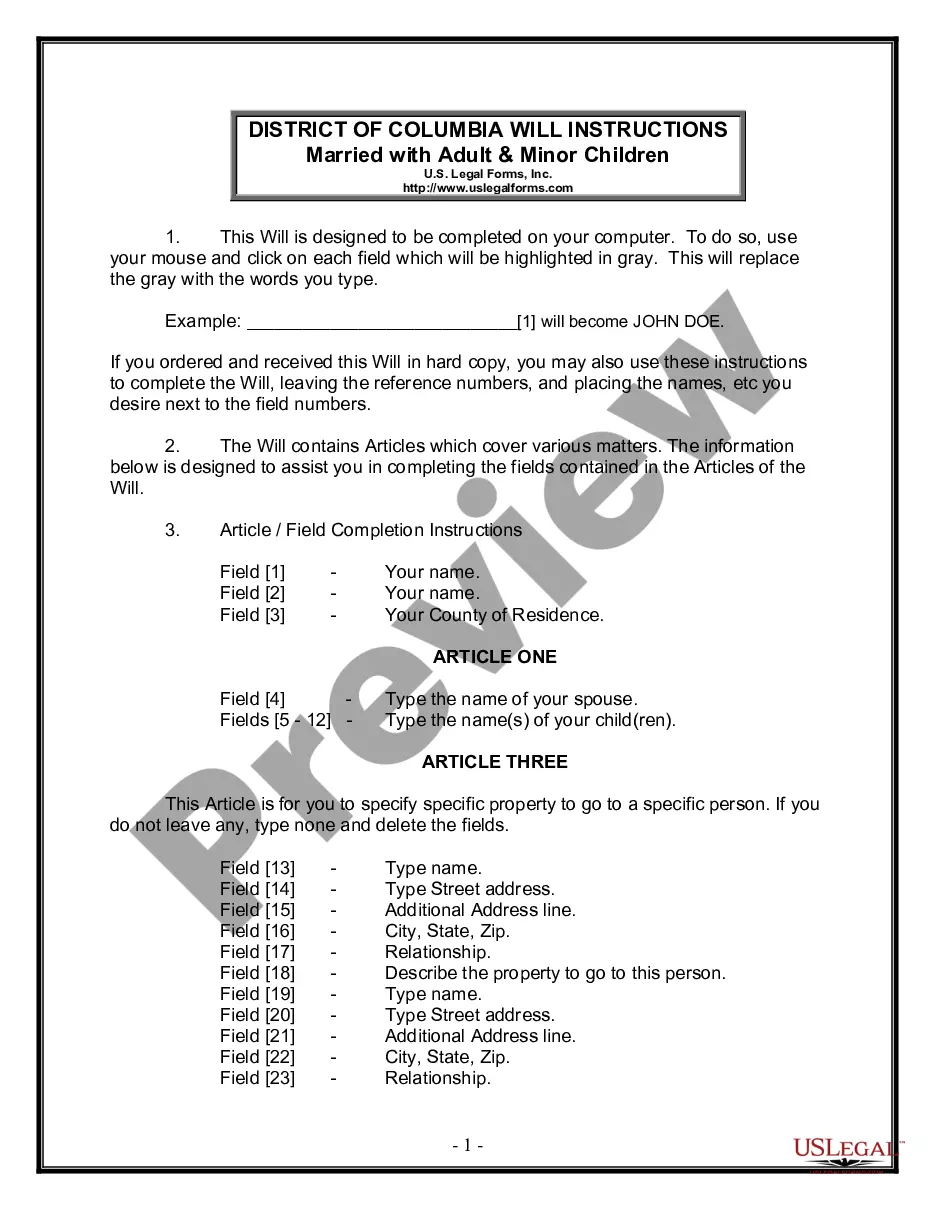

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most recent versions of forms like the Alaska Underwriter Agreement - Self-Employed Independent Contractor within minutes.

If you have an account, Log In and download the Alaska Underwriter Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

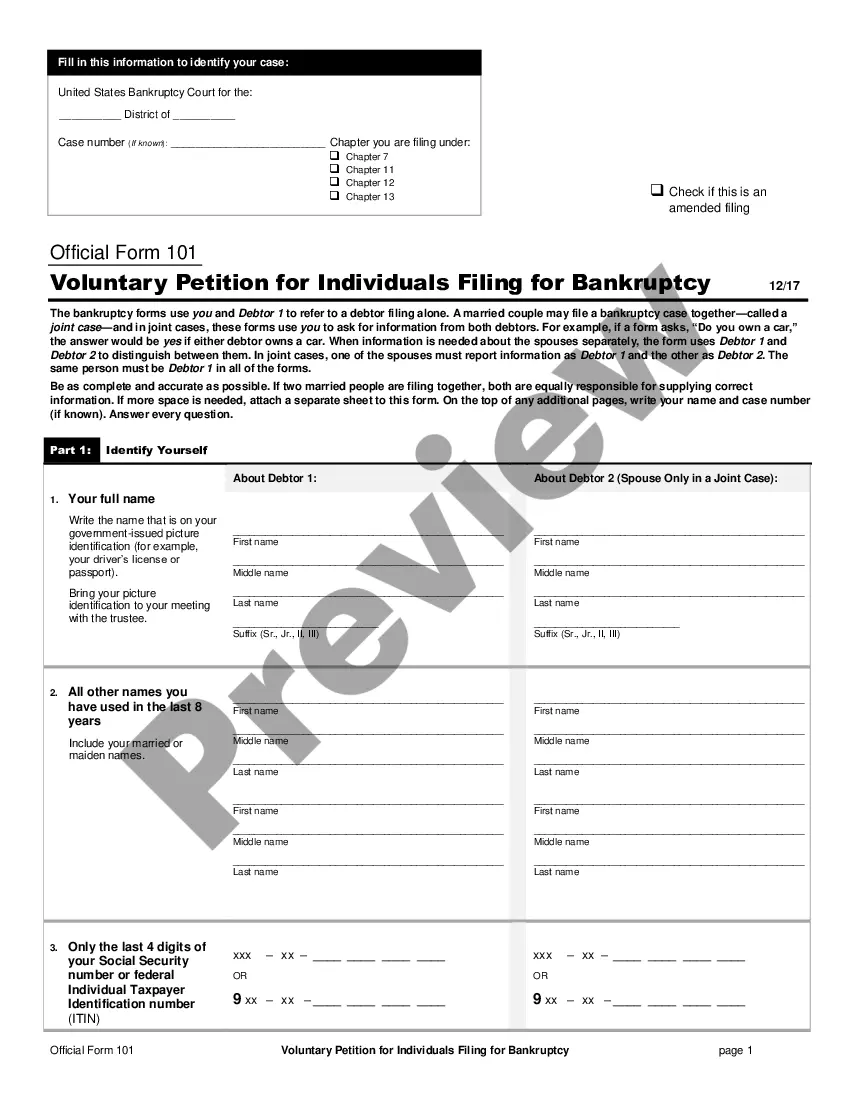

To use US Legal Forms for the first time, here are some simple steps to get you started: Ensure you have selected the correct form for your area/county. Click the Preview button to review the content of the form. Check the form details to confirm that you have chosen the right form. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your details to register for the account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Alaska Underwriter Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Alaska Underwriter Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates.

- Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements and preferences.

Form popularity

FAQ

Filling out an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, payment terms, and duration of the contract. Ensure that you include details about both parties and any specific project requirements. Utilizing platforms like uslegalforms can simplify this process, especially for creating an Alaska Underwriter Agreement - Self-Employed Independent Contractor that meets all legal standards.

Yes, independent contractors in Alaska typically need a business license to operate legally. The requirements may vary based on the nature of your work and local regulations. It's essential to check with the Alaska Department of Commerce for specific guidelines. By obtaining the necessary licenses, you ensure compliance while entering into an Alaska Underwriter Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement involves several key steps to ensure clarity and compliance. Start by outlining the scope of work, payment terms, and deadlines. The Alaska Underwriter Agreement - Self-Employed Independent Contractor offers a solid framework that you can adapt to suit your needs. Using a platform like uslegalforms can simplify this process, allowing you to customize your agreement and ensure all necessary terms are included for legal protection.

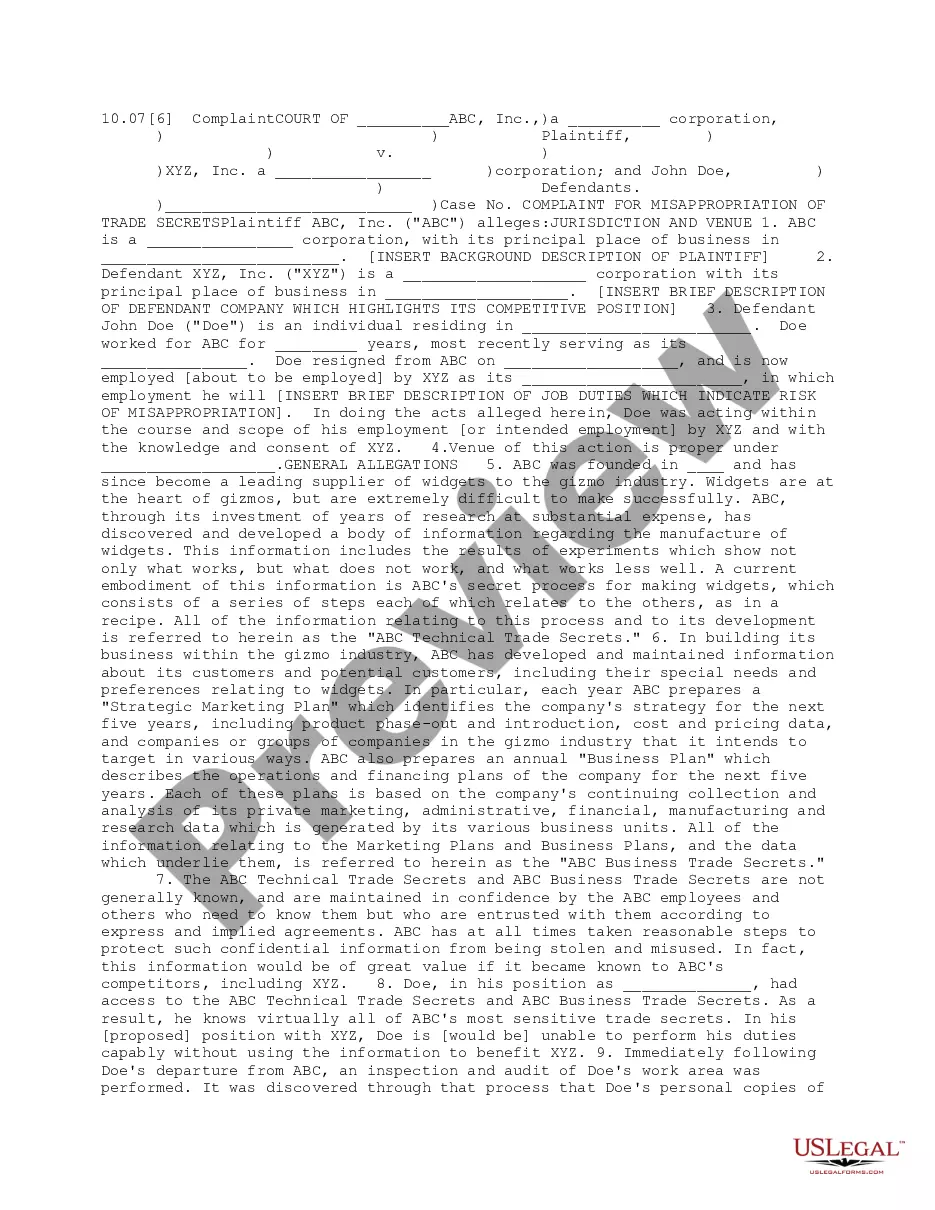

To prove your independent contractor status, you should gather documentation that showcases the nature of your work. This can include contracts, invoices, and a record of your business activities. For those using the Alaska Underwriter Agreement - Self-Employed Independent Contractor, having clear agreements that define your role can serve as powerful evidence of your status. By compiling these documents, you strengthen your position and clarify your relationship with clients.

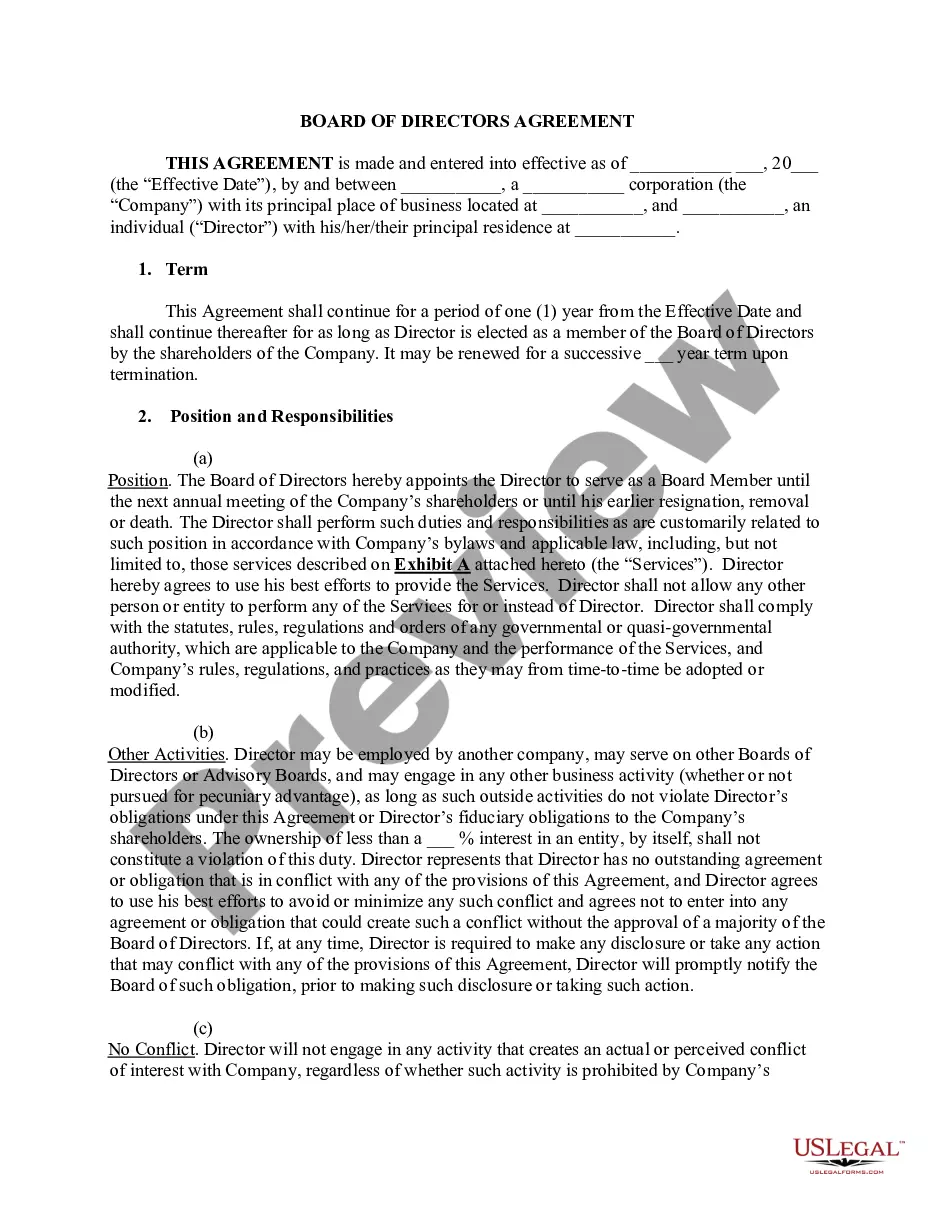

Yes, having a contract as an independent contractor is essential. A contract clarifies expectations and protects both parties' rights, reducing the risk of misunderstandings. Utilizing an Alaska Underwriter Agreement - Self-Employed Independent Contractor ensures that you and your client are aligned on key aspects of the working relationship, which can help maintain professionalism and accountability.

Yes, an independent contractor is generally considered self-employed. This classification enables contractors to operate their businesses independently, without the direct oversight of an employer. The Alaska Underwriter Agreement - Self-Employed Independent Contractor helps formally establish this status, defining the working relationship and providing clarity for legal and tax purposes.

A real estate salesperson working as an independent contractor typically receives compensation through commissions based on the sales they facilitate. This arrangement allows for flexibility in earnings, with commissions often outlined in the Alaska Underwriter Agreement - Self-Employed Independent Contractor. Understanding the payment structure within your agreement is crucial for both income planning and tax considerations.

The primary difference between an independent contractor and an employee in Alaska lies in the level of control and independence. Independent contractors have more autonomy over their work, including how they complete tasks and manage their schedules. This autonomy is clearly delineated in agreements like the Alaska Underwriter Agreement - Self-Employed Independent Contractor, which stipulates that contractors are not entitled to employee benefits.

The independent contractor agreement in Alaska specifically addresses the nuances of working as a contractor within the state. It highlights the rights and obligations of self-employed individuals while ensuring compliance with state regulations. By utilizing an Alaska Underwriter Agreement - Self-Employed Independent Contractor, you can create a tailored contract that addresses the unique aspects of working in Alaska.

A basic independent contractor agreement outlines the relationship between the contractor and the client, detailing the scope of work, payment terms, and the duration of the contract. This agreement helps define the responsibilities and expectations for both parties. Using a well-structured Alaska Underwriter Agreement - Self-Employed Independent Contractor can protect the interests of both the contractor and the client.