Alaska Lab Worker Employment Contract - Self-Employed

Description

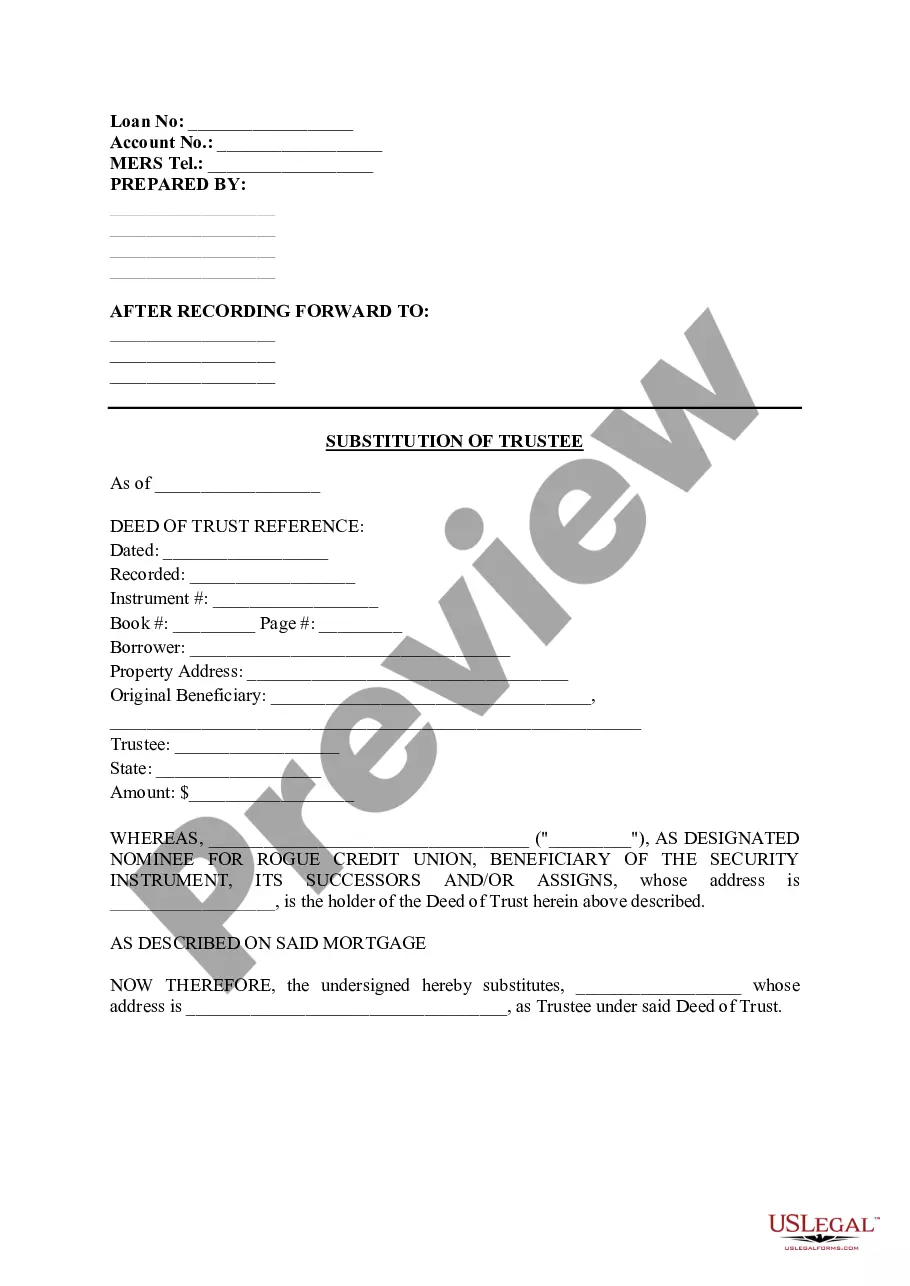

How to fill out Lab Worker Employment Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal templates in the USA - provides an assortment of legal document formats you can acquire or print. By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can locate the latest versions of forms like the Alaska Lab Worker Employment Contract - Self-Employed in just a few minutes.

If you already have a subscription, Log In and obtain the Alaska Lab Worker Employment Contract - Self-Employed from the US Legal Forms repository. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content. Read the form description to confirm that you have selected the right form. If the form doesn’t meet your requirements, utilize the Search field at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Download now button. Then, choose the payment plan you prefer and provide your details to create an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Alaska Lab Worker Employment Contract - Self-Employed. Every document you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

- Access the Alaska Lab Worker Employment Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

Yes, self-employed individuals can and should have contracts in place. These contracts not only define your work scope and payment but also establish important terms to avoid misunderstandings. Using the Alaska Lab Worker Employment Contract - Self-Employed allows you to formalize your agreements and secure your freelance relationships.

New regulations for self-employed individuals typically revolve around taxation, benefits, and business reporting duties. It's essential to stay informed about these changes to ensure compliance and maximize your financial benefits. Utilizing resources, like the Alaska Lab Worker Employment Contract - Self-Employed, can help navigate these new rules effectively.

Absolutely, being self-employed often involves entering into contracts. Contracts serve as formal agreements outlining the relationship between you and your clients, ensuring clarity on deliverables and payment. A well-crafted Alaska Lab Worker Employment Contract - Self-Employed solidifies this relationship and protects both parties involved.

Both terms can describe your work status accurately, but 'independent contractor' often reflects a deeper commitment to specific projects. However, 'self-employed' encompasses a broader range of entrepreneurial activities. When discussing your status, sticking with the term 'Alaska Lab Worker Employment Contract - Self-Employed' may resonate more clearly with potential clients.

Yes, you can create a contract with yourself, often referred to as a self-directed agreement. This practice is common among self-employed individuals, especially when outlining terms for services you will provide under your company name. Utilizing a well-structured Alaska Lab Worker Employment Contract - Self-Employed can help clarify these terms.

Proving your status as an independent contractor typically involves demonstrating that you control the means and methods of your work. This could include contracts, invoices, and a consistent client list that reflects your engagements. When using an Alaska Lab Worker Employment Contract - Self-Employed, documenting these elements can help establish your independent status.

The primary difference lies in the level of control and relationship. Independent contractors maintain more control over their work, while employees follow the directives of an employer. In Alaska, understanding these distinctions is crucial, especially when drafting an Alaska Lab Worker Employment Contract - Self-Employed, to ensure compliance with state regulations.

Yes, contract workers are typically considered self-employed. They operate under their own guidance, providing services on a contractual basis, rather than being listed as employees within a company. This arrangement offers flexibility but also requires them to manage their own taxes and benefits, making it essential to understand the details of the Alaska Lab Worker Employment Contract - Self-Employed.

Yes, a 1099 employee is generally considered self-employed. They receive a 1099 form to report their earnings, which often relates to contracts like the Alaska Lab Worker Employment Contract - Self-Employed. This classification underscores the importance of understanding your financial and legal responsibilities as you navigate contract work.

While related, 'contract' and 'self-employed' are not entirely synonymous. A contract, such as the Alaska Lab Worker Employment Contract - Self-Employed, outlines specific terms for a job or project, while being self-employed describes your overall work status. Understanding this distinction is crucial when navigating your professional landscape, as both terms have unique implications for your rights and responsibilities.