Alaska Self-Employed Independent Contractor Chemist Agreement

Description

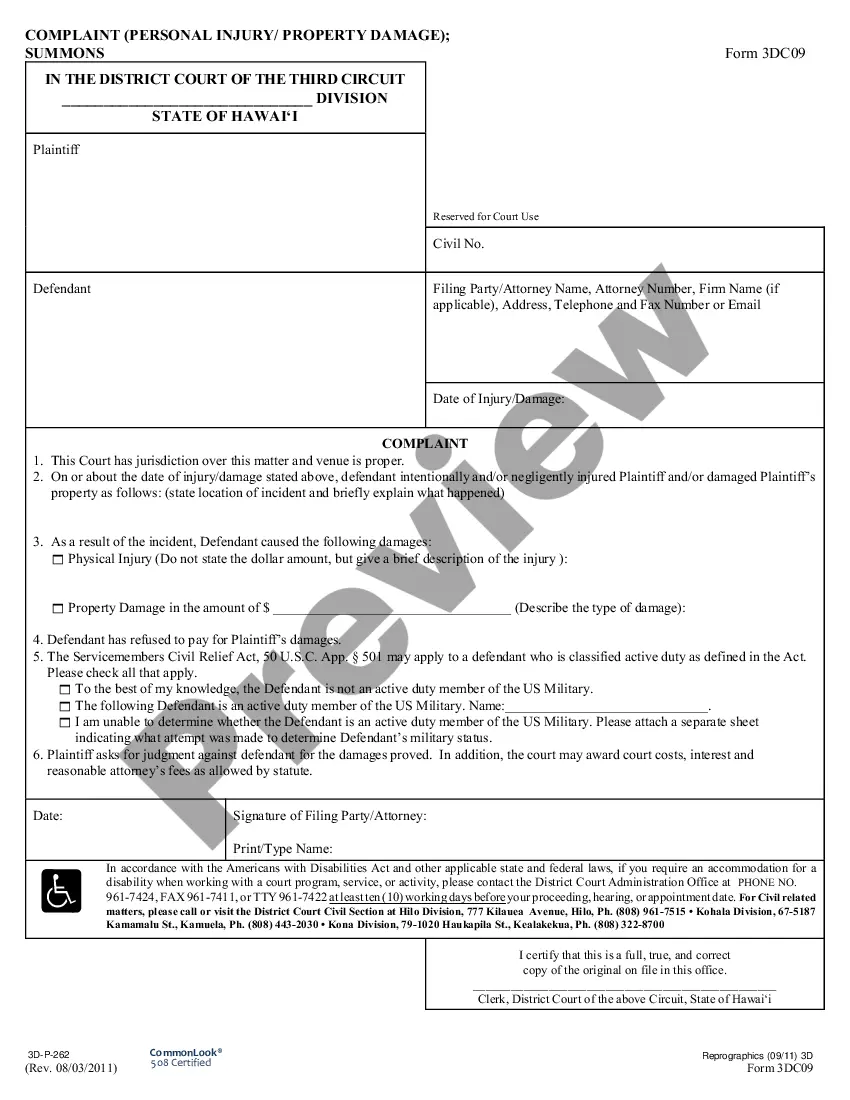

How to fill out Self-Employed Independent Contractor Chemist Agreement?

US Legal Forms - one of the largest collections of legal templates in the United States - offers an extensive array of legal document designs that you can download or print. By utilizing the site, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest templates like the Alaska Self-Employed Independent Contractor Chemist Agreement in moments.

If you already have a subscription, Log In to download the Alaska Self-Employed Independent Contractor Chemist Agreement from the US Legal Forms database. The Download option will be available on every form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/county. Click the Preview option to examine the form’s content. Review the form description to confirm that you have chosen the appropriate form. If the form does not meet your needs, use the Search box at the top of the page to find one that does. Once you are satisfied with the form, confirm your selection by clicking the Buy Now button. Then, select the payment plan you want and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Alaska Self-Employed Independent Contractor Chemist Agreement. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Alaska Self-Employed Independent Contractor Chemist Agreement using US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal requirements and needs.

Form popularity

FAQ

To classify yourself as an independent contractor, you need to meet specific criteria defined by the IRS. Typically, you must have control over how you perform your work, and you should not be under the direction of an employer. When working under an Alaska Self-Employed Independent Contractor Chemist Agreement, ensure you outline your services, payment terms, and responsibilities clearly. This agreement not only clarifies your status but also provides protection and outlines expectations for both you and your clients.

Alaska's contract law is guided by principles that govern agreements between parties, including those involved in an Alaska Self-Employed Independent Contractor Chemist Agreement. Contracts in Alaska require an offer, acceptance, and consideration to be enforceable. It's essential to create clear terms to avoid misunderstandings and disputes. Utilizing tools from uslegalforms can help ensure that your agreements are compliant with Alaska's contract laws.

An independent contractor typically needs to complete an agreement outlining the terms of their work, a W-9 form for tax purposes, and any specific state-required documents. It’s essential to ensure all information is accurate and comprehensive. By adhering to these requirements, you can create a solid foundation for your business relationship. Tools like uslegalforms can assist you in assembling the necessary paperwork, including the Alaska Self-Employed Independent Contractor Chemist Agreement.

Writing an independent contractor agreement involves clearly defining the relationship between you, the contractor, and your client. Start with identifying all parties involved, then outline the work scope, payment details, and obligations. Include necessary legal provisions to protect your interests and ensure compliance with the Alaska Self-Employed Independent Contractor Chemist Agreement guidelines. Using uslegalforms can help you create a well-structured agreement that meets your needs.

To fill out an independent contractor agreement effectively, start by entering your personal information, including your name and address. Next, detail the services you will provide and specify the payment terms. Make sure to include timelines, confidentiality clauses, and any other relevant terms for the Alaska Self-Employed Independent Contractor Chemist Agreement. Consider using a reliable platform like uslegalforms to ensure your agreement is comprehensive and legally sound.

Yes, having a contract as an independent contractor is essential for protecting your rights and clarifying expectations. A written agreement, such as the Alaska Self-Employed Independent Contractor Chemist Agreement, can help prevent disputes by outlining the terms of your work arrangement. It serves as a reference point for both parties, ensuring a smoother working relationship.

The primary difference between an independent contractor and an employee in Alaska lies in the level of control and independence. Independent contractors operate their own business, set their schedules, and manage their tools and methods. In contrast, employees work under the employer's direction and usually receive benefits. Understanding this distinction is crucial when utilizing the Alaska Self-Employed Independent Contractor Chemist Agreement.

To create an independent contractor agreement, start by outlining the scope of work, payment structure, and expectations. You can use templates available on platforms like US Legal Forms to ensure you include all necessary clauses. A comprehensive Alaska Self-Employed Independent Contractor Chemist Agreement can guide you through the process, ensuring all details are covered.

The basic independent contractor agreement includes essential elements such as the description of services, payment terms, and timelines. It helps define the relationship between the contractor and the client, reducing misunderstandings. Utilizing the Alaska Self-Employed Independent Contractor Chemist Agreement can provide a solid framework for these essential components.

In Alaska, independent contractors must meet specific legal requirements to operate effectively. These requirements include obtaining necessary permits, paying taxes, and adhering to any local regulations. Understanding the Alaska Self-Employed Independent Contractor Chemist Agreement can help ensure compliance with these obligations, protecting your business and your clients.