Alaska Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

You can spend time online attempting to locate the legal document template that meets the federal and state criteria you require. US Legal Forms offers numerous legal forms that can be reviewed by experts.

You can indeed obtain or create the Alaska Temporary Worker Agreement - Self-Employed Independent Contractor from my service.

If you possess a US Legal Forms account, you can Log In and select the Download option. Subsequently, you can complete, modify, print, or sign the Alaska Temporary Worker Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours indefinitely. To obtain another copy of any purchased form, navigate to the My documents section and select the corresponding option.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the formatting of your document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the Alaska Temporary Worker Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms site, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the area/region of your choice.

- Review the form summary to confirm you have chosen the correct form.

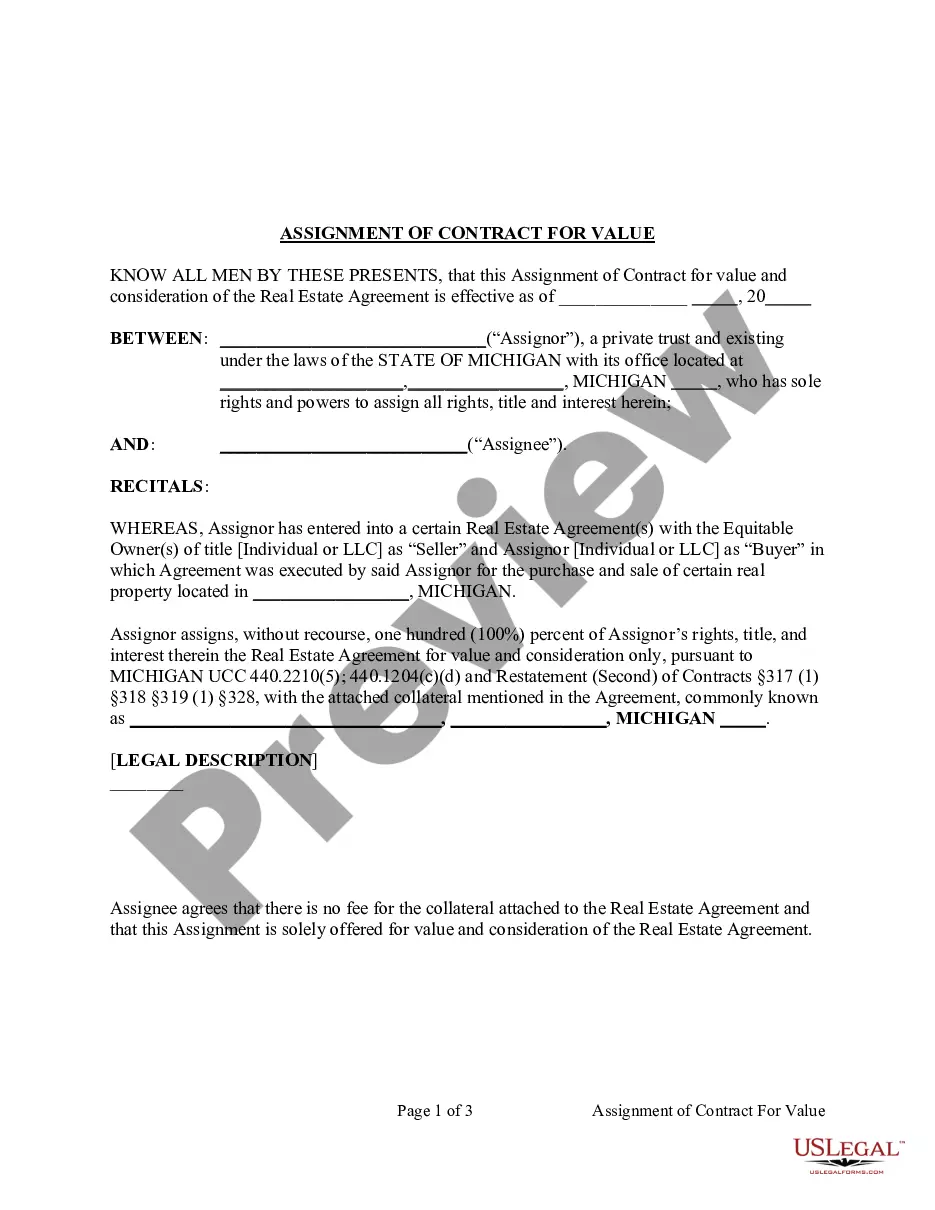

- If available, utilize the Preview option to inspect the document template as well.

- To find another version of your form, use the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click on Get now to proceed.

- Select the pricing plan you wish, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

In Alaska, independent contractors may need a business license depending on their specific work activities. This requirement helps ensure that you operate legally and comply with state regulations. The Alaska Temporary Worker Agreement - Self-Employed Independent Contractor can provide you with guidelines on how to proceed with licensing. It's wise to check local regulations to determine what is necessary for your business.

Yes, you can have a contract if you're self-employed. In fact, having a written agreement is highly recommended when entering any work arrangement. The Alaska Temporary Worker Agreement - Self-Employed Independent Contractor sets clear terms that protect both you and your client. A solid contract ensures everyone understands their responsibilities and expectations.

To provide proof of employment as an independent contractor, you can present various documents, such as invoices, contracts, and payment records. The Alaska Temporary Worker Agreement - Self-Employed Independent Contractor is a helpful tool to outline your work arrangement. Additionally, you may collect references from clients to further support your employment status. Gather all documentation to create a clear picture of your independent work.

A temporary employee and an independent contractor are not the same, even though they may both work on a short-term basis. Temporary employees typically have an employer-employee relationship, which includes following specific work hours and policies. In contrast, independent contractors, governed by an Alaska Temporary Worker Agreement - Self-Employed Independent Contractor, have greater autonomy over their work. Understanding these differences helps businesses effectively structure their workforce.

Legal requirements for independent contractors in Alaska include obtaining proper business licenses and ensuring compliance with tax obligations. It is also crucial to have a written agreement, such as the Alaska Temporary Worker Agreement - Self-Employed Independent Contractor, to outline responsibilities, payment details, and project specifications. By following these requirements, you can protect your rights and cultivate a professional working environment.

In Alaska, the primary difference between an independent contractor and an employee lies in the level of control and independence in work. An independent contractor operates their own business and dictates how and when they complete tasks, whereas an employee works under the employer’s direction. With an Alaska Temporary Worker Agreement - Self-Employed Independent Contractor, contractors enjoy these freedoms while ensuring compliance with state requirements. It is essential to understand this distinction to align your business practices correctly.

1099 employees, often referred to as independent contractors, are not classified as temporary employees by default. Instead, they work on a contractual basis, which can vary in duration. When utilizing an Alaska Temporary Worker Agreement - Self-Employed Independent Contractor, you can define the terms of your work, including the project length and payment structure. This flexibility allows you to adapt your workforce to meet specific business needs.

Filling out an independent contractor agreement requires careful consideration of various elements. Start by clearly identifying the parties involved, then outline the work scope, deadlines, and payment structures. When drafting your Alaska Temporary Worker Agreement - Self-Employed Independent Contractor, ensure that all sections are completed accurately. For additional guidance, US Legal Forms provides user-friendly resources to assist you in completing the agreement correctly.

The independent contractor agreement in Alaska specifically addresses the legal and practical aspects of contracting work within the state. It outlines rights and obligations for both the client and the contractor, including payment procedures and work requirements. To ensure clarity and compliance, it is essential to draft an Alaska Temporary Worker Agreement - Self-Employed Independent Contractor that reflects Alaska's regulations. US Legal Forms offers templates to help you create a compliant agreement easily.

A basic independent contractor agreement is a legal document that outlines the relationship between a client and a self-employed independent contractor. This agreement details the scope of work, payment terms, and project timelines. When establishing an Alaska Temporary Worker Agreement - Self-Employed Independent Contractor, it is crucial to include specific expectations to protect both parties involved. Utilizing a platform like US Legal Forms can simplify the creation of this agreement.