Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

Locating the appropriate legal document template may be a challenge.

It goes without saying, there are numerous templates accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward instructions you can follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm this is the appropriate one for you. If the form does not meet your needs, use the Search area to find the right form. When you are sure that the form is fitting, click the Purchase now button to acquire the form. Select the payment plan you want and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, revise, and print out and sign the received Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. US Legal Forms is the largest repository of legal documents where you will find a variety of document templates. Take advantage of the service to download professionally created documents that adhere to state standards.

- The service offers thousands of templates, such as the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, that you can utilize for business and personal purposes.

- All documents are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Acquire button to obtain the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Use your account to search through the legal forms you have previously bought.

- Go to the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

HAMP modification refers to the specific changes made to a mortgage under the Home Affordable Modification Program. Lenders adjust loan terms based on a borrower's need for better payment solutions. For residents in Alaska, exploring the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is an excellent way to seek these modifications.

A mortgage loan modification can be a smart move, especially if you're facing financial challenges. It often results in lower monthly payments and can help prevent foreclosure. In Alaska, submitting an Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is a proactive step toward financial stability.

Requesting a loan modification means asking your lender to change the terms of your mortgage, typically to lower your monthly payments. This process can involve adjusting interest rates, extending the loan term, or other alterations. If you're in Alaska, you can inquire about the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP to understand what's possible.

A HAMP loan modification refers to the changes made to a borrower's mortgage terms under the Home Affordable Modification Program. Specifically, it aims to reduce monthly payments and provide relief to struggling homeowners. For Alaskans, utilizing the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can help facilitate this process.

HAMP stands for the Home Affordable Modification Program, a federal initiative aimed at helping homeowners avoid foreclosure. This program allows qualified borrowers to modify their mortgage terms, making payments more affordable. Understanding HAMP is crucial for residents in Alaska looking to navigate their loan options efficiently.

As of 2025, the Home Affordable Modification Program (HAMP) is no longer active. However, borrowers in Alaska can explore alternatives for loan modifications through local programs and lenders. It is advisable to stay informed about available options, including the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, to find your best path forward.

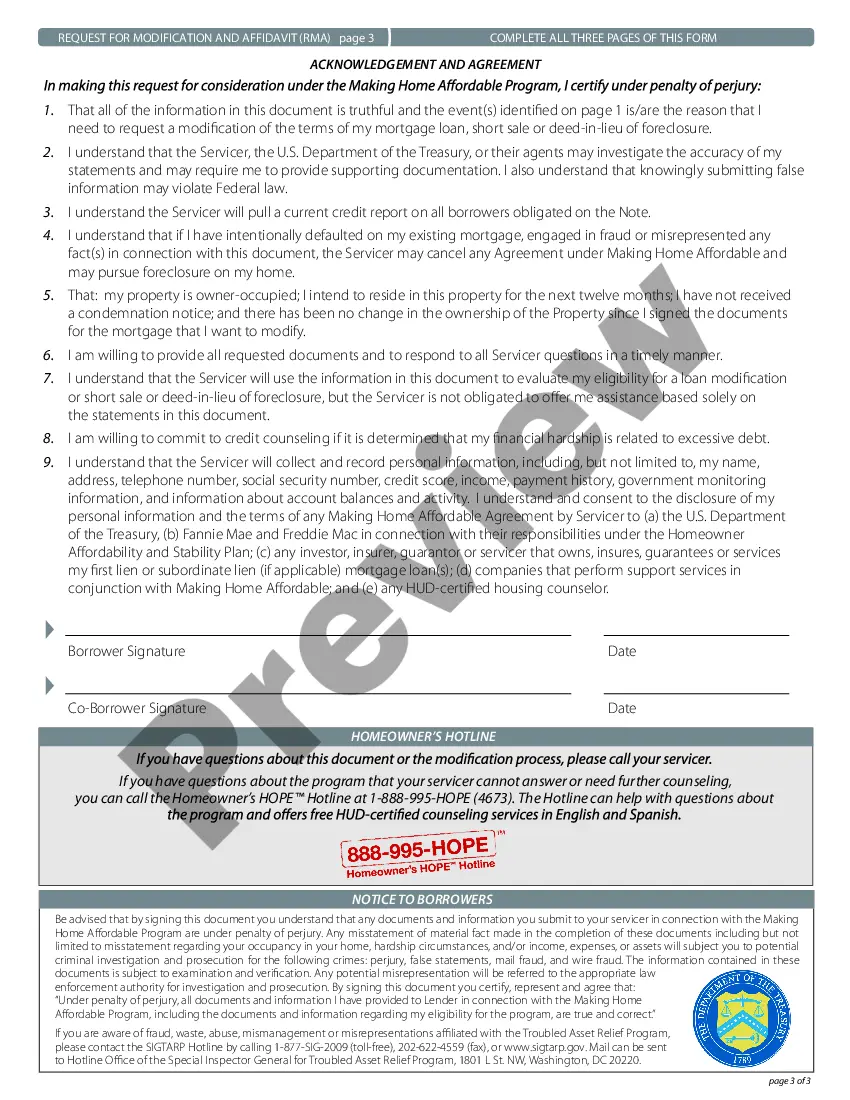

Getting approved for a loan modification can be challenging but is certainly manageable with the right approach. Factors such as your financial situation and timely submission of documentation influence the outcome. By submitting a strong Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP and working closely with your lender, you can significantly improve your chances of approval. Remember, persistence and clarity in communication are crucial during this process.

Requesting a mature modification on your loan typically involves reaching out to your lender and discussing your options. You should provide details about your current financial situation and any relevant documentation needed for the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Utilize platforms like US Legal Forms for guidance on the process. Clear communication with your lender is key to ensuring a successful modification request.

The Home Affordable Modification Program (HAMP) is a federal initiative designed to assist homeowners facing financial difficulties. HAMP enables borrowers to modify their mortgage terms, making monthly payments more manageable. If you are located in Alaska and need help, the Alaska Request for Loan Modification RMA under HAMP could be a valuable option for you. This program aims to prevent foreclosure and foster sustainable homeownership.

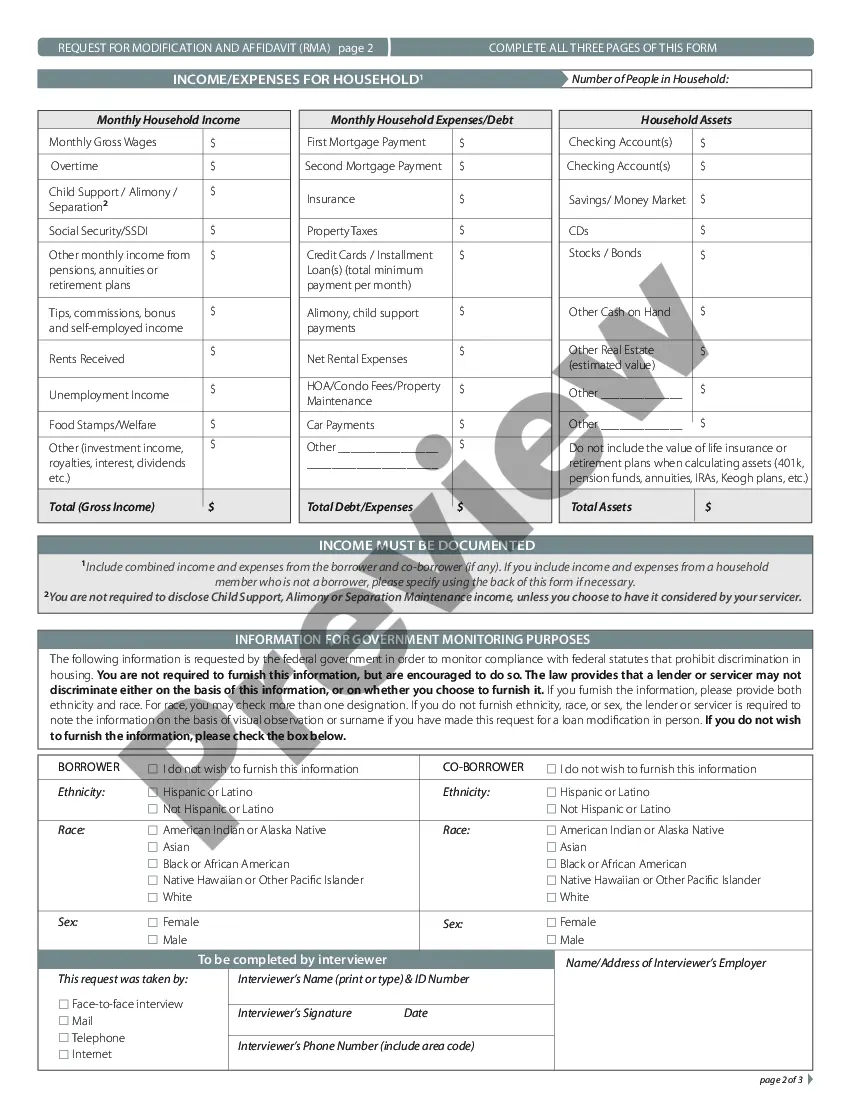

To qualify for a loan modification, you must demonstrate financial hardship, such as a loss of income or increased expenses. Typically, lenders assess your current income, monthly expenses, and payment history to evaluate your eligibility for the Alaska Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Working with a knowledgeable advisor can help you present a strong case to your lender. This increases the likelihood of receiving the modification you need.