Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

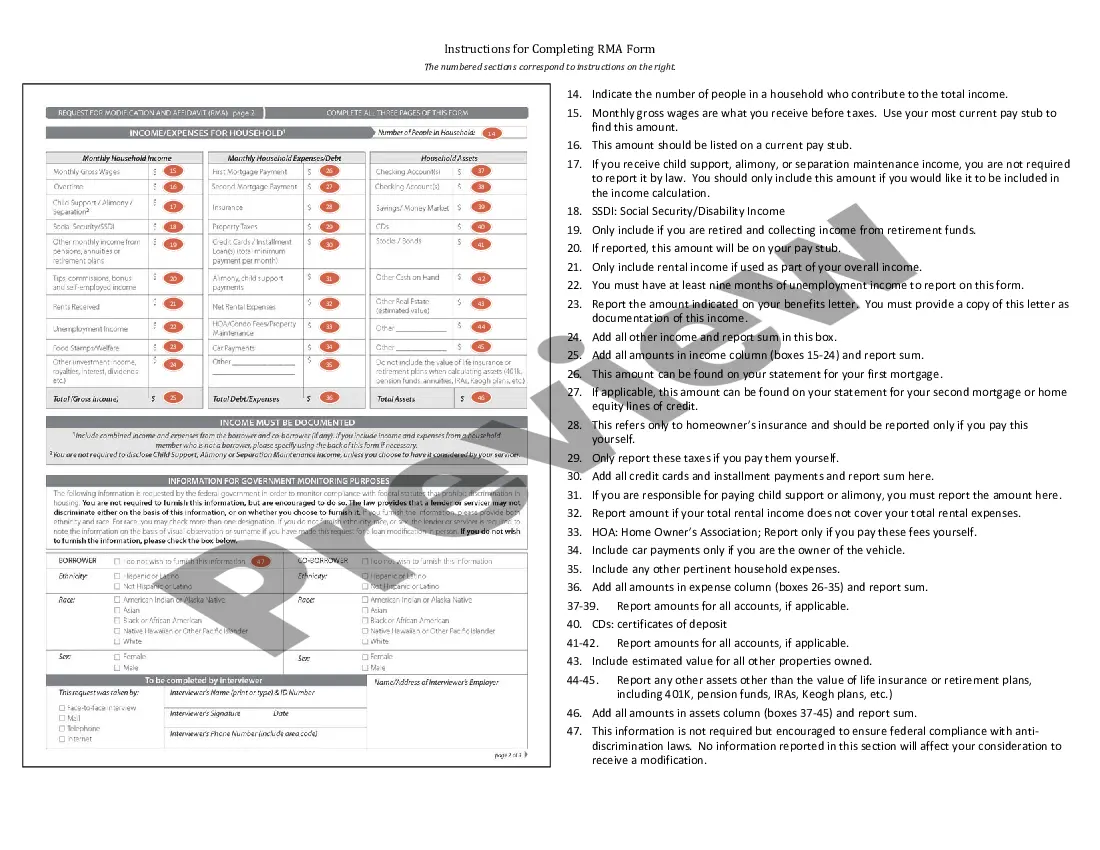

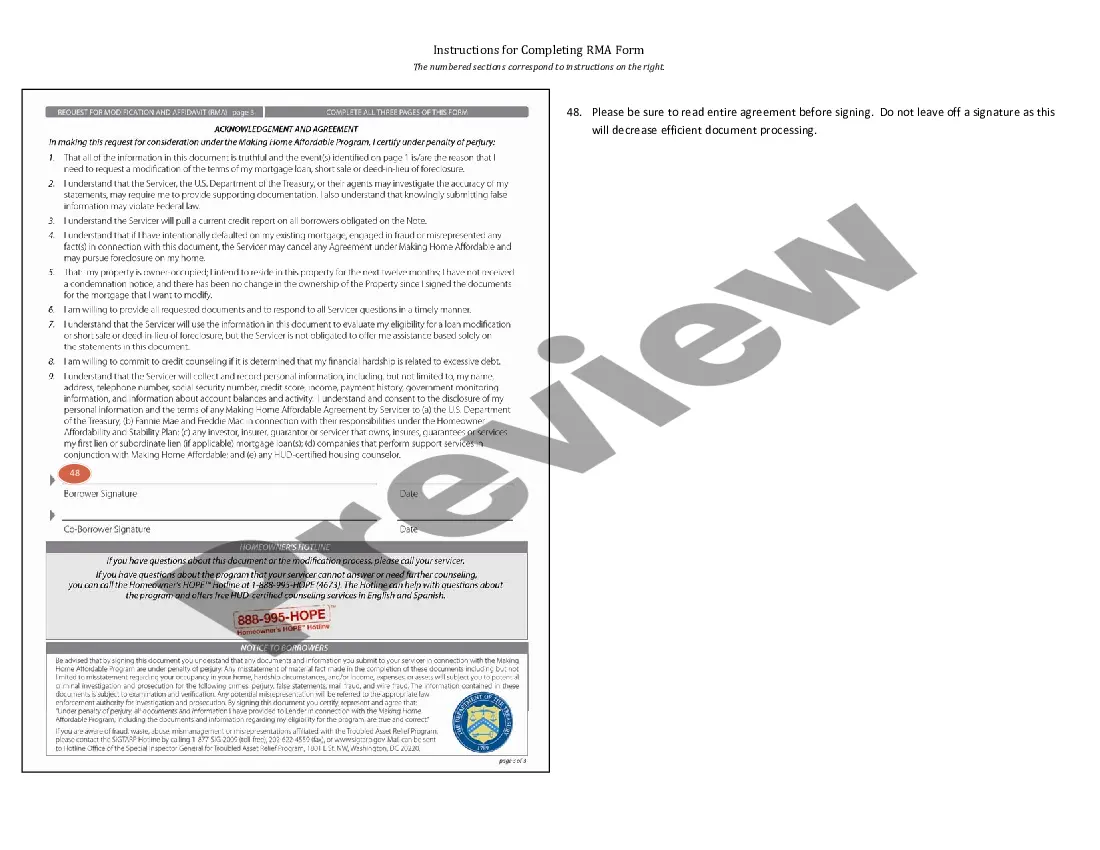

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a diverse selection of legal document templates available for download or printing.

While navigating the website, you can access a vast number of documents for commercial and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of documents such as the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form in just moments.

If you are already a monthly subscriber, Log In and download the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form from the US Legal Forms library. The Download button will appear on every document you browse.

If the document does not meet your needs, utilize the Search box at the top of the page to find the appropriate one.

Once you are satisfied with the document, confirm your choice by clicking on the Get now button. Then, select your preferred pricing plan and provide your details to register for an account.

- You can view all previously downloaded documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct document for your city/state.

- Click the Preview button to review the content of the document.

- Check the description of the document to confirm that it is the correct one.

Form popularity

FAQ

Requirements for a loan modification typically involve proving financial hardship and documenting your income. Lenders often request specific forms, including the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form, to assess your eligibility. You may need to submit proof of income, expenses, and details about your current mortgage situation. Ensure that you meet these requirements to increase your chances of obtaining a favorable modification.

The process of a loan modification usually includes assessing your financial status, completing application forms, and submitting your request to the lender. Through the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can simplify this process by ensuring that you gather the necessary information to support your application. After submission, your lender will evaluate your situation and may offer more favorable terms for your mortgage. Regular contact with your lender can keep your application moving smoothly.

The timeline for loan modification approval can vary significantly. Generally, it can take anywhere from a few weeks to several months, depending on the lender’s process and the completeness of your submission. When you follow the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you help ensure that your documents are in order, potentially speeding up the review process. Be prepared to communicate with your lender during this time for any updates.

The process for a loan modification involves several important steps. First, you need to gather your financial documents and complete the necessary forms, including the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Next, submit your application to your lender, who will review your request and determine if you qualify for a modification. Once approved, your lender will offer new loan terms that better fit your financial situation.

In real estate, RMA refers to Request for Mortgage Assistance, a document used by homeowners seeking financial assistance from their lenders. This form is essential for individuals looking to modify their mortgage terms to avoid foreclosure. Understanding this concept is crucial for homeowners in distress. For clarity and detailed assistance, refer to the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

To apply for a loan modification, you typically need several key documents. These include proof of income, bank statements, and a completed RMA form. Additionally, you may be required to provide a hardship letter that explains your situation. For a comprehensive checklist, consult the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

The full form of RMA in mortgage is Request for Mortgage Assistance. This form plays a vital role in the loan modification process. By submitting the RMA, you indicate to your lender that you are seeking assistance due to financial difficulty. Make sure to follow the guidelines outlined in the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form to avoid any errors.

The RMA mortgage form is the Request for Mortgage Assistance document required by lenders when you seek help with your mortgage payments. This form gathers your financial information and details about your hardship. Completing the RMA form accurately is crucial to ensure your application for a loan modification is processed smoothly. Refer to the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form for complete guidance.

A good hardship letter should clearly state your financial difficulties and demonstrate your willingness to cooperate with your lender. Include specific details about your current situation, such as loss of income or increases in expenses. Use the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form to format your letter appropriately. This ensures you include all necessary information that can aid in your loan modification request.

RMA in mortgage stands for Request for Mortgage Assistance. This form helps homeowners seeking modifications due to financial hardship. By filling out the RMA, you can initiate a process that allows you to potentially lower your monthly payments or receive other relief. Ensure you follow the Alaska Instructions for Completing Request for Loan Modification and Affidavit RMA Form for accurate submission.