Alaska Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - one of several most significant libraries of lawful varieties in the States - delivers a wide array of lawful file themes you are able to obtain or print. Using the web site, you will get a huge number of varieties for organization and specific functions, sorted by classes, says, or keywords and phrases.You will find the latest versions of varieties like the Alaska Term Sheet - Convertible Debt Financing within minutes.

If you already possess a monthly subscription, log in and obtain Alaska Term Sheet - Convertible Debt Financing through the US Legal Forms library. The Download switch can look on each type you view. You gain access to all earlier saved varieties within the My Forms tab of your own profile.

In order to use US Legal Forms the first time, listed below are basic guidelines to help you get started off:

- Be sure you have picked out the best type for your personal metropolis/state. Click on the Review switch to review the form`s information. Look at the type description to ensure that you have chosen the appropriate type.

- When the type doesn`t satisfy your demands, utilize the Lookup field near the top of the display to obtain the one which does.

- If you are content with the form, verify your option by clicking on the Get now switch. Then, opt for the prices plan you prefer and give your credentials to register on an profile.

- Method the financial transaction. Make use of your bank card or PayPal profile to finish the financial transaction.

- Pick the file format and obtain the form in your device.

- Make adjustments. Load, modify and print and indication the saved Alaska Term Sheet - Convertible Debt Financing.

Every single template you put into your bank account lacks an expiry particular date and is your own permanently. So, if you want to obtain or print another copy, just check out the My Forms section and click in the type you will need.

Get access to the Alaska Term Sheet - Convertible Debt Financing with US Legal Forms, one of the most extensive library of lawful file themes. Use a huge number of professional and express-particular themes that satisfy your organization or specific requires and demands.

Form popularity

FAQ

Convertible bonds are basically debt instruments but they also contain an option to convert into equity shares and this means that a convertible bond contains both debt and equity elements. The option to convert into equity is strictly a derivative that is embedded into the host contract. What is a financial instrument? ? part 2 - ACCA Global accaglobal.com ? student ? technical-articles accaglobal.com ? student ? technical-articles

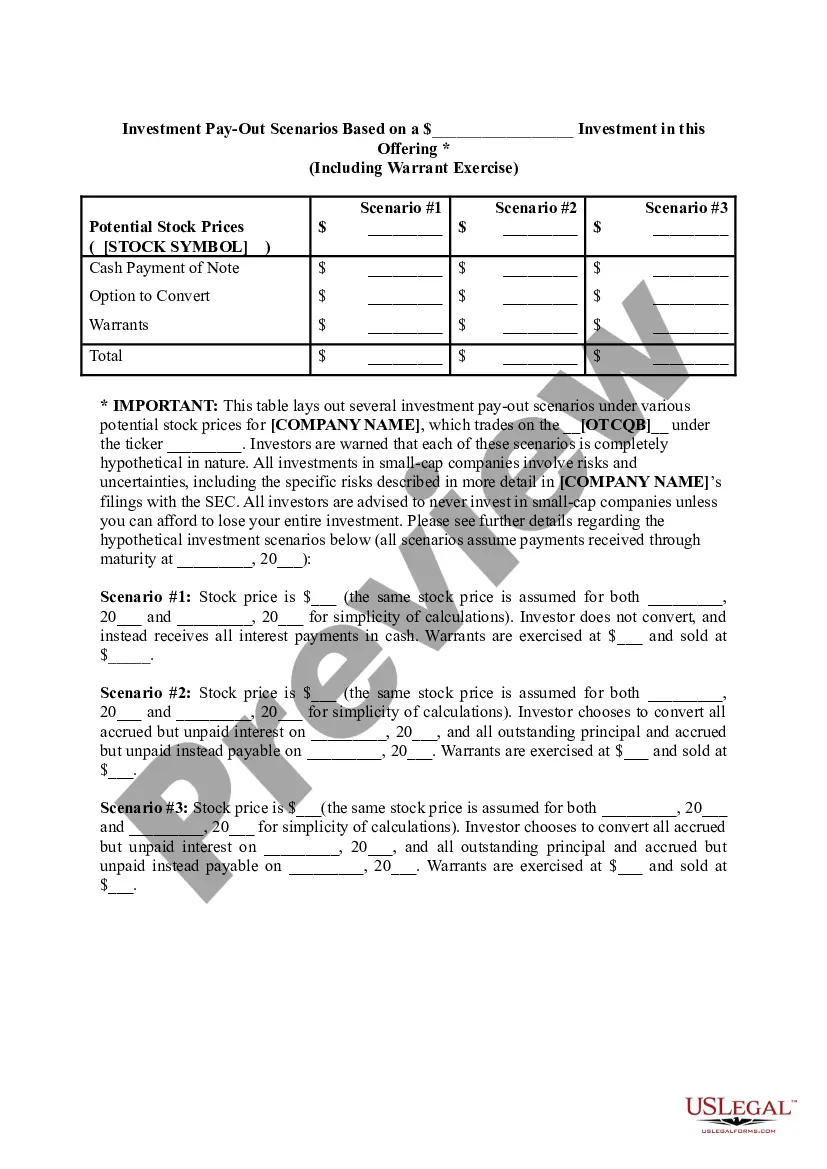

Here's an example: You sell $1m in convertible notes to an investor with a valuation cap of $10m, and a 30% discount rate. After 18 months, your startup gets a pre-money valuation of $20m, at $20 per share, during a Series A funding.

Repayment Method With most convertible debt, you will repay the investment by converting the entire value to stock. Some investors, though, may also include language that obligates you to pay back a certain percentage of the original investment as cash and the remainder as stock.

A company lists its long-term debt on its balance sheet under liabilities, usually under a subheading for long-term liabilities. On Which Financial Statements Do Companies Report Long-Term Debt? investopedia.com ? ask ? answers ? which-fi... investopedia.com ? ask ? answers ? which-fi...

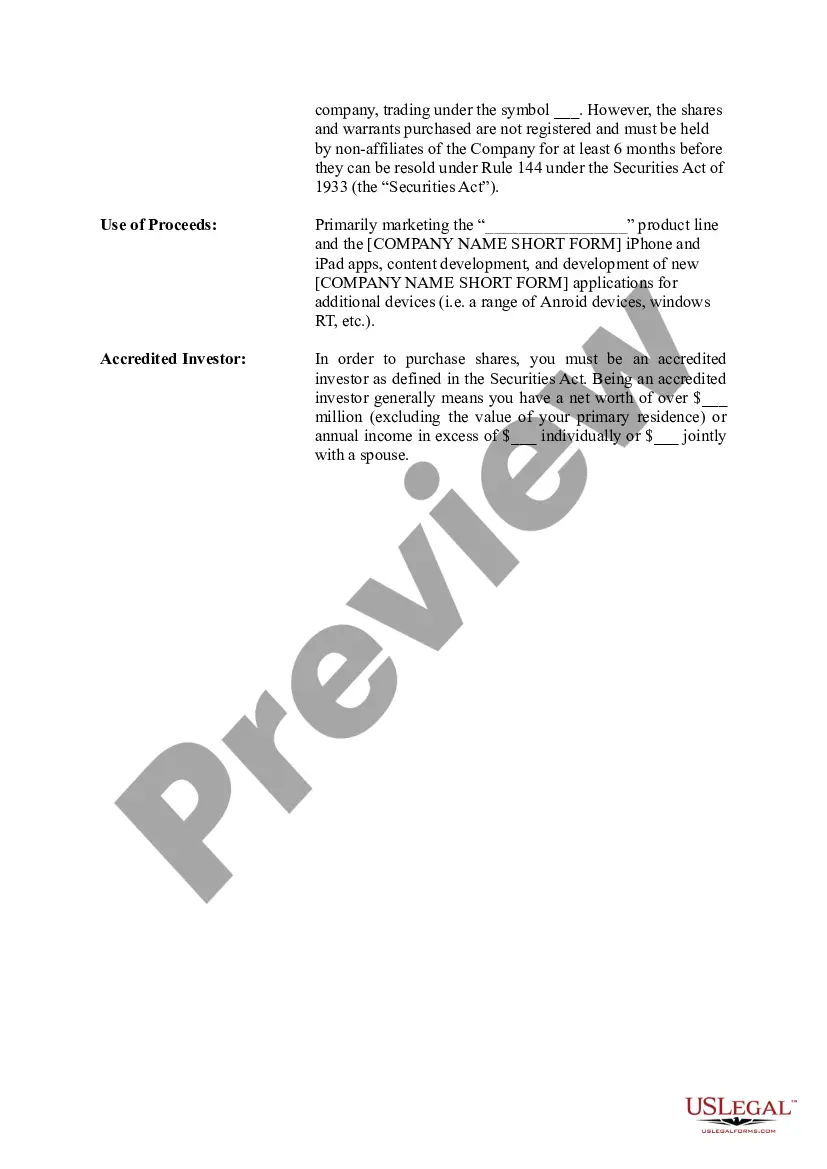

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible debt may become current Generally, if a liability has any conversion options that involve a transfer of the company's own equity instruments, these would affect its classification as current or non-current. Classifying liabilities as current or non-current kpmg.com ? dam ? kpmg ? pdf ? 2020/07 kpmg.com ? dam ? kpmg ? pdf ? 2020/07