Alaska Operating Agreement of Minnesota Corn Processors, LLC

Description

How to fill out Operating Agreement Of Minnesota Corn Processors, LLC?

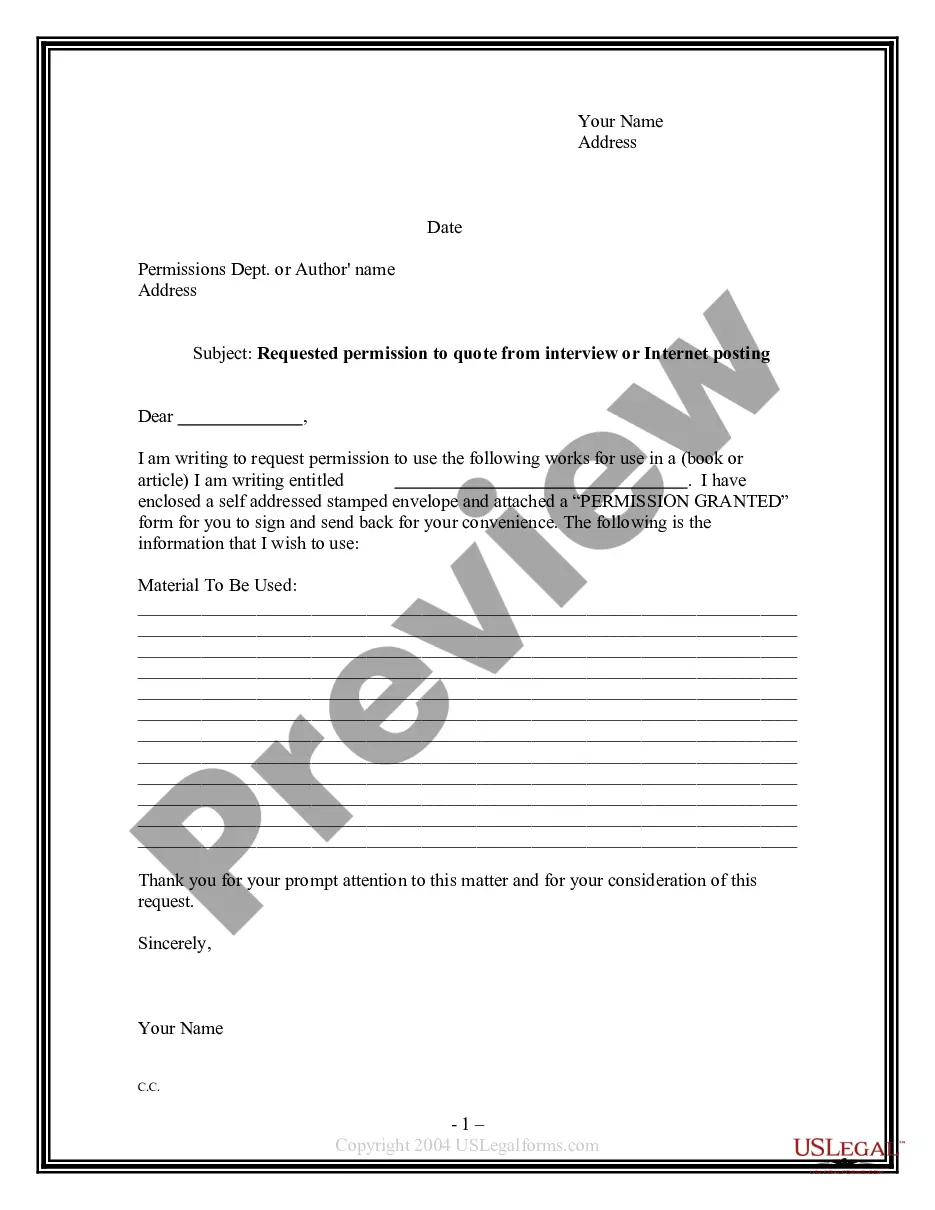

You are able to invest hrs on the web looking for the lawful file design which fits the state and federal specifications you require. US Legal Forms offers a large number of lawful types which can be evaluated by experts. It is possible to download or print the Alaska Operating Agreement of Minnesota Corn Processors, LLC from your assistance.

If you already possess a US Legal Forms accounts, you are able to log in and click the Obtain option. Following that, you are able to complete, change, print, or indicator the Alaska Operating Agreement of Minnesota Corn Processors, LLC. Each and every lawful file design you get is your own for a long time. To obtain yet another version for any acquired develop, proceed to the My Forms tab and click the related option.

If you work with the US Legal Forms site for the first time, keep to the straightforward directions below:

- Initially, make sure that you have selected the best file design for that area/metropolis of your choosing. Browse the develop information to make sure you have picked out the correct develop. If offered, take advantage of the Review option to check throughout the file design too.

- If you want to find yet another variation of your develop, take advantage of the Research area to get the design that meets your requirements and specifications.

- After you have found the design you desire, simply click Acquire now to carry on.

- Select the prices strategy you desire, type your references, and sign up for your account on US Legal Forms.

- Full the transaction. You can use your Visa or Mastercard or PayPal accounts to fund the lawful develop.

- Select the structure of your file and download it in your device.

- Make changes in your file if required. You are able to complete, change and indicator and print Alaska Operating Agreement of Minnesota Corn Processors, LLC.

Obtain and print a large number of file themes while using US Legal Forms Internet site, which offers the most important variety of lawful types. Use professional and status-particular themes to tackle your company or person needs.

Form popularity

FAQ

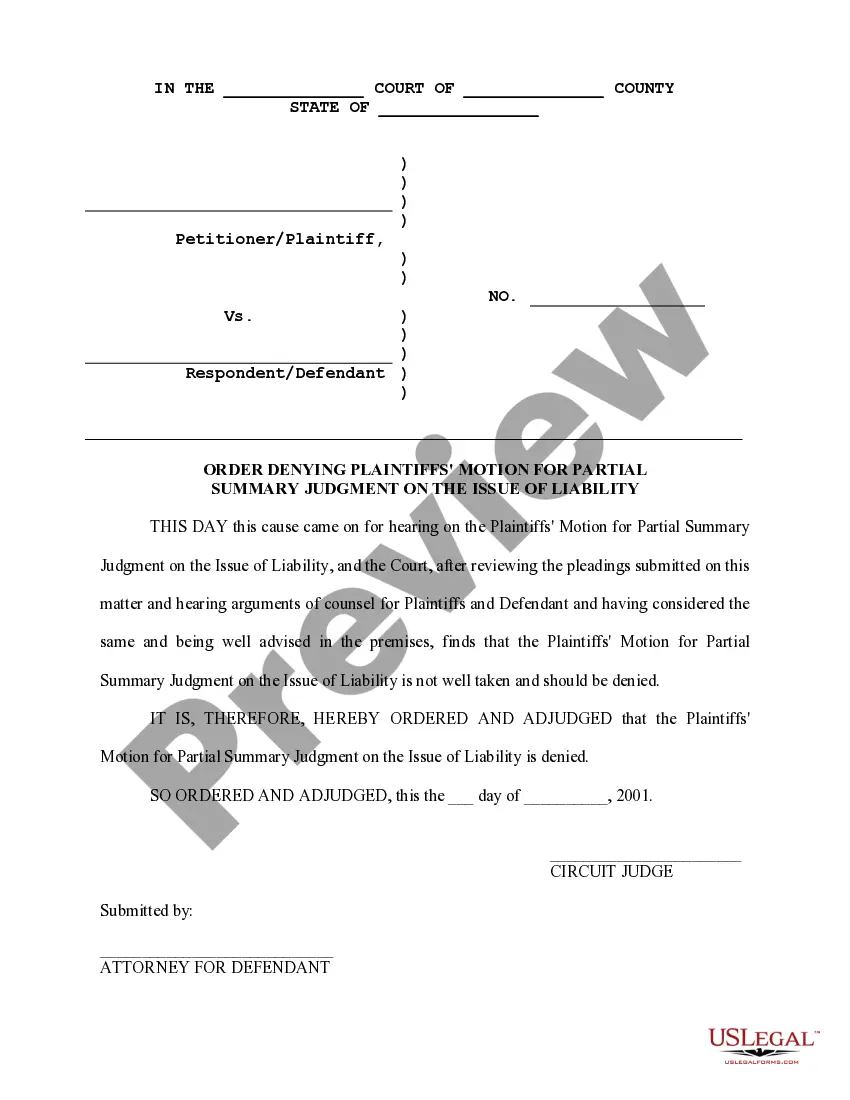

Although most states do not require the creation of an operating agreement, it is nonetheless regarded as a critical document that should be included when forming a limited liability company. Once each member (owner) signs the document, it becomes a legally binding set of regulations that must be followed.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

Yes, Delaware's LLC law requires all Delaware LLCs to have an Operating Agreement in some form. The law states that an LLC Operating Agreement can be ?written, oral, or implied? between the members. However, having a written LLC Operating Agreement is the only way to make the agreement enforceable.

For tax purposes, LLCs must apply for a federal Employer ID Number from the Internal Revenue Service (IRS), and a Minnesota Tax ID Number from the Minnesota Department of Revenue.

This flexible business entity provides an affordable and easy way for business owners to protect their assets. Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business.

There is no requirement for an LLC to have an operating agreement in the State of Alaska, however, it is highly recommended as it is the only document that states the ownership (important for multi-member companies) along with other valuable business information.