Alaska Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

US Legal Forms provides thousands of template options, including the Alaska Nonqualified Defined Benefit Deferred Compensation Agreement, designed to comply with state and federal regulations.

Choose the payment plan you prefer, fill in the required information to set up your payment, and complete your order using your PayPal or Visa or Mastercard.

Select a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Alaska Nonqualified Defined Benefit Deferred Compensation Agreement template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

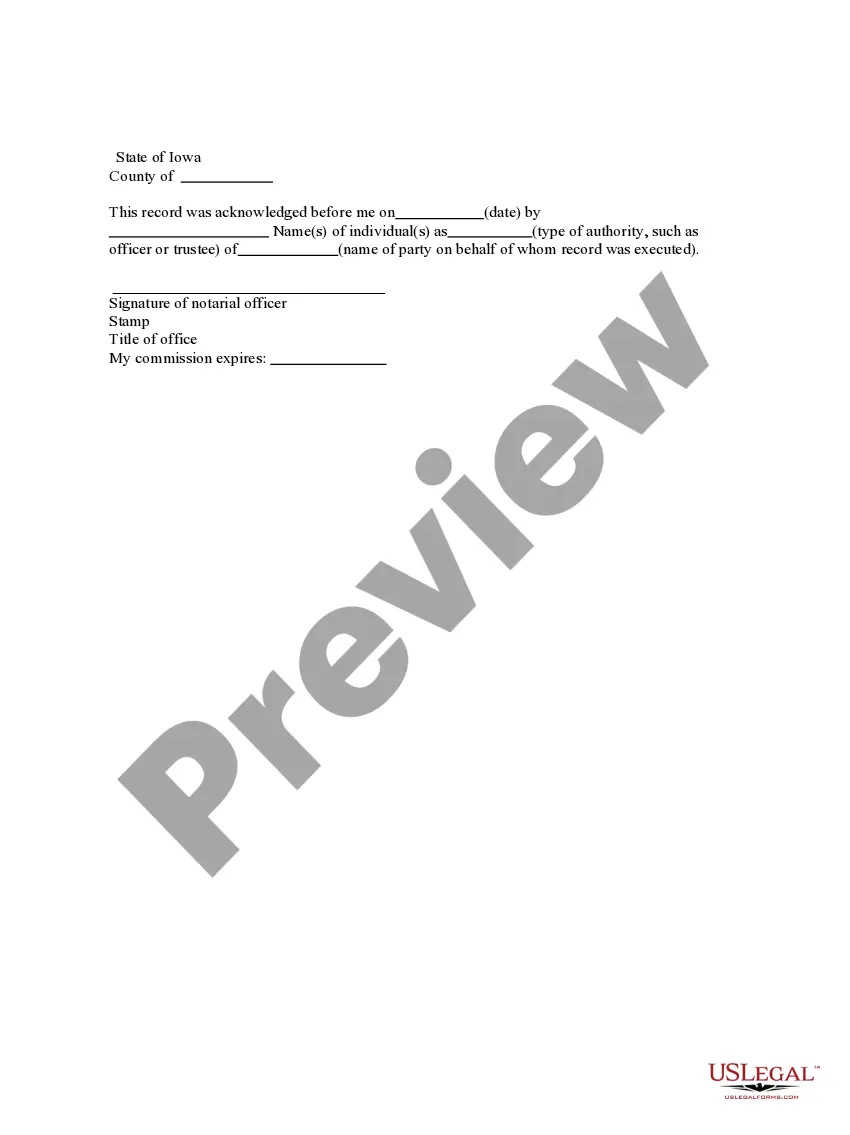

- Utilize the Preview button to review the form.

- Examine the description to confirm you have selected the correct document.

- If the form isn’t what you require, use the Search field to find the document that fits your needs and specifications.

- Once you locate the correct form, click Buy now.

Form popularity

FAQ

The Alaska Nonqualified Defined Benefit Deferred Compensation Agreement is a financial tool designed to help employees save for retirement beyond traditional limits. This plan allows qualified Alaskan workers to defer a portion of their salary, growing their savings over time. It's essential for those looking to enhance their retirement income in a structured manner. By using USLegalForms, you can easily access templates and resources to establish your own deferred compensation agreement, ensuring compliance with state regulations.

Deferred compensation can either be qualified or nonqualified, with the Alaska Nonqualified Defined Benefit Deferred Compensation Agreement being an example of a nonqualified plan. Nonqualified plans do not adhere to the strict IRS regulations that govern qualified plans, offering more flexibility to employers. However, this flexibility comes with less security for employees. Choosing between qualified and nonqualified plans depends on your financial goals and risk tolerance.

Yes, all deferred compensation must be reported to the IRS. When it comes time to receive your funds, the Alaska Nonqualified Defined Benefit Deferred Compensation Agreement requires you to report these amounts as income. This inclusion in your taxable income can impact your overall tax liability. Therefore, it is crucial to maintain accurate records for IRS reporting.

The downside of an Alaska Nonqualified Defined Benefit Deferred Compensation Agreement lies in potential tax implications and risk of losing funds. Unlike qualified plans, these agreements do not provide the same legal protections. If your employer faces financial difficulties, your deferred compensation could be at risk. Thus, understanding these risks is essential before deciding to enter into such agreements.

Setting up a nonqualified deferred compensation plan requires careful planning and legal compliance. Start by determining the plan's design and eligibility criteria, ensuring it aligns with your business goals. Utilize platforms like US Legal Forms to draft your Alaska Nonqualified Defined Benefit Deferred Compensation Agreement, making the process easier and more efficient while ensuring that all necessary legal language is included.

Yes, nonqualified deferred compensation plans can be a beneficial option for both employers and employees. They provide a way to attract top talent by offering competitive benefits that are not available through regular retirement plans. Additionally, an Alaska Nonqualified Defined Benefit Deferred Compensation Agreement can help high-income earners defer taxes and enhance their retirement savings potential.

A nonqualified deferred compensation plan is a type of agreement that allows employees to defer a portion of their income to a future date, often for tax advantages. This plan doesn't have to follow the same regulations as qualified plans, giving employers more flexibility in designing the benefits. In Alaska, a Nonqualified Defined Benefit Deferred Compensation Agreement can offer tailored benefits that help attract and retain valuable employees.

Setting up an Alaska Nonqualified Defined Benefit Deferred Compensation Agreement involves a few key steps. First, you need to define your objectives and the benefits you want to provide to employees. Next, consult with a legal or financial advisor to ensure compliance with IRS regulations. Finally, you can find a reliable platform, like US Legal Forms, to create and finalize the agreement documents for your specific needs.