Alaska Deferred Compensation Investment Account Plan

Description

How to fill out Deferred Compensation Investment Account Plan?

Choosing the best legal papers template can be a battle. Of course, there are a lot of themes accessible on the Internet, but how will you get the legal kind you need? Take advantage of the US Legal Forms website. The assistance offers a large number of themes, like the Alaska Deferred Compensation Investment Account Plan, which you can use for enterprise and personal requirements. Each of the varieties are examined by experts and meet state and federal demands.

In case you are currently authorized, log in for your accounts and click the Obtain key to find the Alaska Deferred Compensation Investment Account Plan. Use your accounts to appear from the legal varieties you might have purchased formerly. Go to the My Forms tab of your accounts and acquire an additional version of your papers you need.

In case you are a brand new consumer of US Legal Forms, allow me to share easy recommendations that you can adhere to:

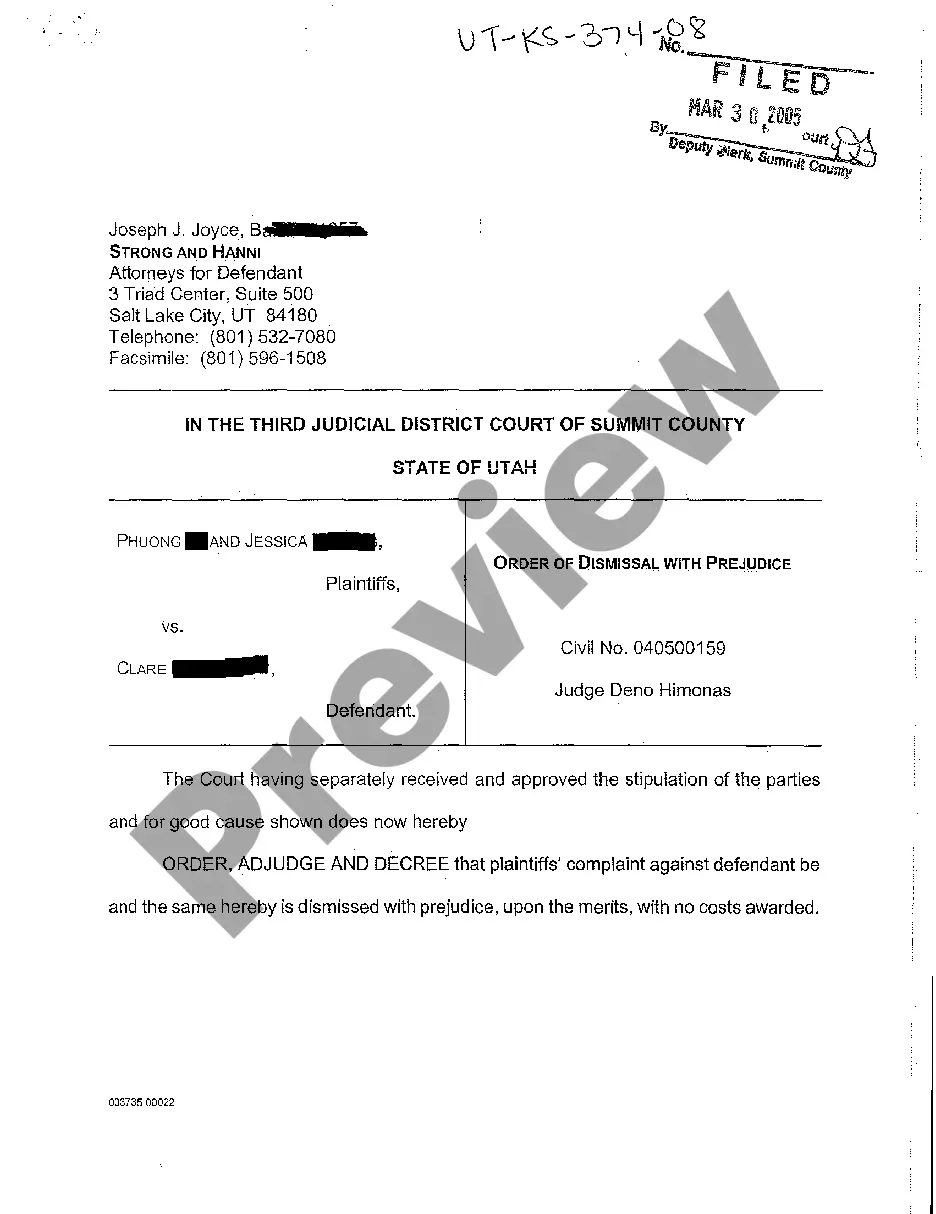

- Very first, make sure you have selected the proper kind for your town/area. You may check out the shape using the Review key and look at the shape description to guarantee this is basically the best for you.

- If the kind fails to meet your needs, make use of the Seach industry to obtain the proper kind.

- When you are sure that the shape would work, click on the Buy now key to find the kind.

- Choose the pricing plan you would like and enter in the necessary details. Make your accounts and pay for your order with your PayPal accounts or bank card.

- Choose the file formatting and acquire the legal papers template for your device.

- Full, revise and produce and signal the attained Alaska Deferred Compensation Investment Account Plan.

US Legal Forms will be the greatest local library of legal varieties in which you can find different papers themes. Take advantage of the company to acquire expertly-made files that adhere to state demands.

Form popularity

FAQ

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

The plans carry some inherent risk for the employees in that the deferred payments are unsecured and not guaranteed. So if the organization faces bankruptcy and creditor claims, the employees may not receive their promised funds. (In contrast, qualified plans such as 401(k)s are protected from bankruptcy creditors).

Deferred compensation has the potential to increase capital gains over time when offered as an investment account or a stock option. Rather than simply receiving the amount that was initially deferred, a 401(k) and other deferred compensation plans can increase in value before retirement.

Why Is Deferred Compensation Better Than a 401(k)? Deferred compensation is often considered better than a 401(k) for high-paid executives looking to reduce their tax burden. As well, contribution limits on deferred compensation plans can be much higher than 401(k) limits.

Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state. The biggest risk of deferred compensation plans is they're not guaranteed; if your company goes bankrupt, you might receive none of the income you deferred.

Remember, when received, deferred compensation is taxable as income. If you're still employed, it's added to your income, which could increase your tax rate. I advise using a deferred comp plan on a limited basis, if at all, for shorter-term goals.

The State of Alaska 457 Deferred Compensation Plan (DCP) allows you to set aside and invest a portion of your income for your retirement on a voluntary basis. It is designed to complement the Alaska SBS Supplemental Annuity Plan and the Alaska PERS/TRS Defined Contribution Retirement Plan.