Alaska Coverage for Interns under the Affordable Care Act

Description

How to fill out Coverage For Interns Under The Affordable Care Act?

Have you been inside a position in which you need papers for sometimes organization or specific purposes nearly every time? There are plenty of legal document themes accessible on the Internet, but locating kinds you can trust isn`t effortless. US Legal Forms gives 1000s of develop themes, much like the Alaska Coverage for Interns under the Affordable Care Act, that happen to be written to satisfy state and federal needs.

When you are already informed about US Legal Forms website and also have a merchant account, basically log in. Afterward, you are able to obtain the Alaska Coverage for Interns under the Affordable Care Act web template.

Should you not come with an profile and want to start using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is to the proper city/county.

- Make use of the Review button to check the form.

- Look at the information to ensure that you have chosen the appropriate develop.

- In case the develop isn`t what you`re looking for, make use of the Look for industry to discover the develop that meets your needs and needs.

- Whenever you get the proper develop, click on Purchase now.

- Pick the rates plan you desire, fill in the necessary info to produce your account, and pay for your order using your PayPal or charge card.

- Choose a convenient data file file format and obtain your duplicate.

Find every one of the document themes you have bought in the My Forms food list. You can obtain a additional duplicate of Alaska Coverage for Interns under the Affordable Care Act whenever, if possible. Just click on the essential develop to obtain or print out the document web template.

Use US Legal Forms, probably the most substantial variety of legal varieties, to save lots of efforts and prevent errors. The services gives appropriately made legal document themes which you can use for a selection of purposes. Produce a merchant account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

If you received a paycheck during your internship or training program in the U.S. during 2021, taxes were likely withheld from your pay. It's important that you file a tax return with the Internal Revenue Service (IRS) by April 18, 2022 in order to receive any refund that you may be due.

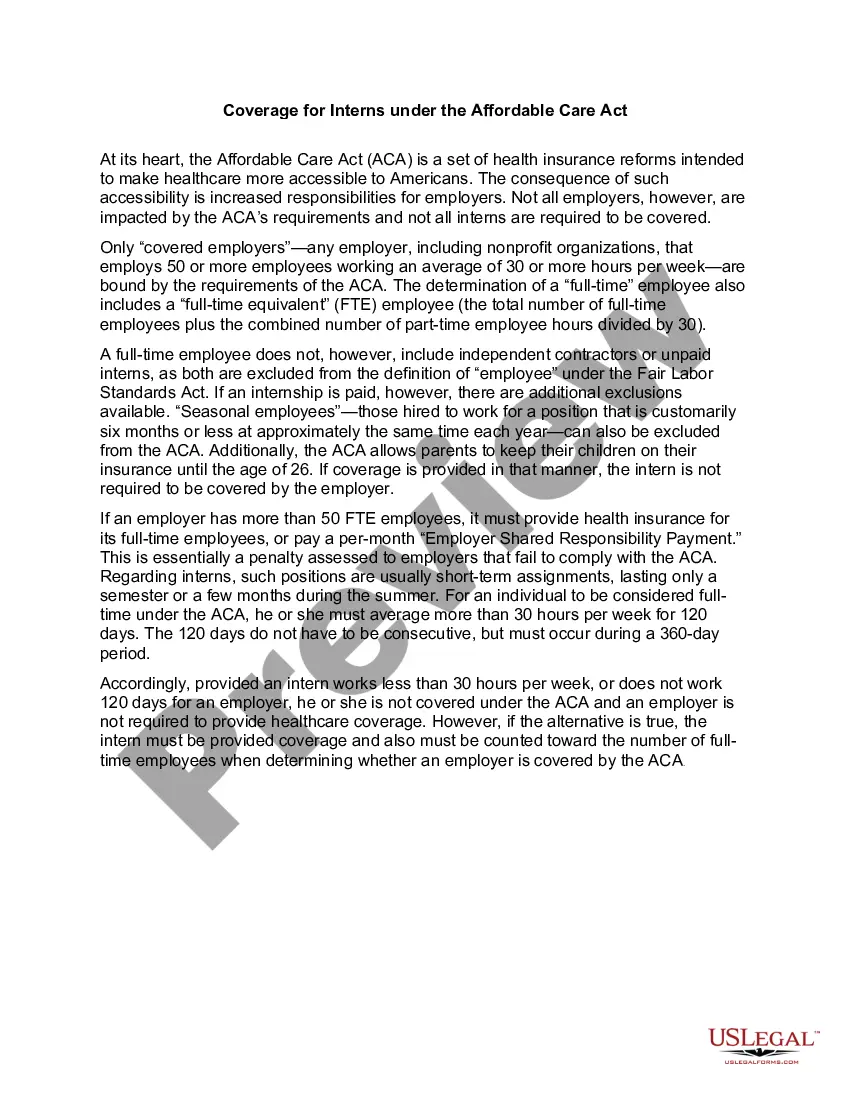

Who must comply with the ACA? The ACA applies to applicable large employers (ALEs), which are businesses that had 50 or more full-time and full-time equivalent (FTE) employees on average during the previous year.

Some employers choose to offer temps and interns only medical coverage. The ACA employer mandate does not require an offer of other health benefits (such as dental and vision coverage) to avoid potential penalties.

Any intern that meets the ACA definition of a full time employee should receive a Form 1095-C. No Form 1095-C is required if an intern terminates employment before 1) meeting the plan's waiting period (if coverage would otherwise be offered) or 2) completing the initial measurement period.

More In Forms and Instructions Form 1095-C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a full-time employee for one or more months of the calendar. ALE members must report that information for all twelve months of the calendar year for each employee.

The answer is generally yes, but different conditions must be satisfied depending on whether the intern job classification results in an indirect service requirement. An employer may exclude certain job titles from participating in its 401(k) plan.

Paid interns working more than 30 hours per week may be considered eligible employees who should receive health coverage insurance. Exceptions may include: Interns employed by a company for fewer than 120 days. Interns who have worked fewer than 30 hours a week on average for the last 12 months.

For example, if you are hired as an independent contractor, your employer may be required to fill out a 1099 form. Paid interns, on the other hand, who are not contracted to complete specific work, are often taxed like W-2 employees, which allows them to write-off any work-related expenses.