Montana Stock Option Agreement between Corporation and Officer or Key Employee

Description

How to fill out Stock Option Agreement Between Corporation And Officer Or Key Employee?

It is feasible to spend time online trying to discover the legal document template that satisfies the state and federal requirements you require.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

You can download or print the Montana Stock Option Agreement between Corporation and Officer or Key Employee from this service.

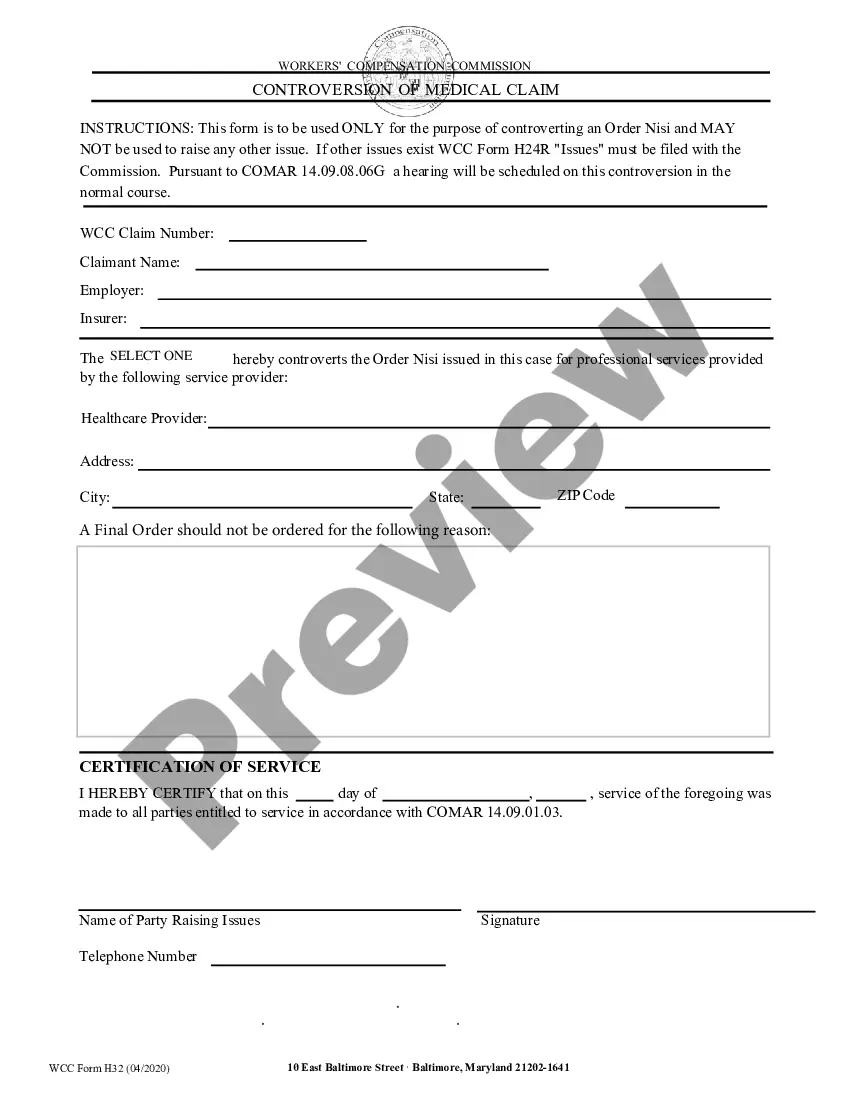

If available, utilize the Review button to browse through the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Montana Stock Option Agreement between Corporation and Officer or Key Employee.

- Each legal document template you purchase belongs to you for years.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your state/town of choice.

- Check the form details to ensure you have chosen the appropriate form.

Form popularity

FAQ

The $100,000 incentive stock option limit is the maximum fair market value of stock options that can be granted to an employee that qualifies for favorable tax treatment in a single year. If the options exceed this threshold, they may be treated as non-qualified stock options, which do not enjoy the same tax benefits. Therefore, it is crucial to carefully structure the Montana Stock Option Agreement between Corporation and Officer or Key Employee to adhere to this limit.

An operating agreement outlines the management structure and operational procedures of a limited liability company (LLC), while a shareholder agreement focuses on the rights and responsibilities of shareholders. In a Montana Stock Option Agreement between Corporation and Officer or Key Employee, both agreements play pivotal roles but serve different purposes. The operating agreement governs day-to-day operations, whereas the shareholder agreement addresses ownership stakes and decision-making processes.

Under the said Rules, ESOPs can be issued only to the employees of an unlisted private limited company.

Basically, as the company profits, employees profit as well. Thus, stock options are a way to create a loyal partnership with employees. Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Excluding directors and promoters of a company who have more than 10% equity in the company, every employee is eligible for ESOP.

Key Takeaways. Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

Share options are agreements between a company and another party entitling the latter to buy shares in the company under certain conditions. A price will be specified, as well as, in most cases, a time limit for purchasing or a specific event that will trigger the purchase.

According to the IRS, the maximum age an employer can impose to be eligible for an ESOP is 21 and employees must be eligible for the ESOP within a year of joining the company. An employer can restrict eligibility to employees with two years of service but only if the plan has immediate vesting.