Alaska Agreement for Purchase of Business Assets from a Corporation

Description

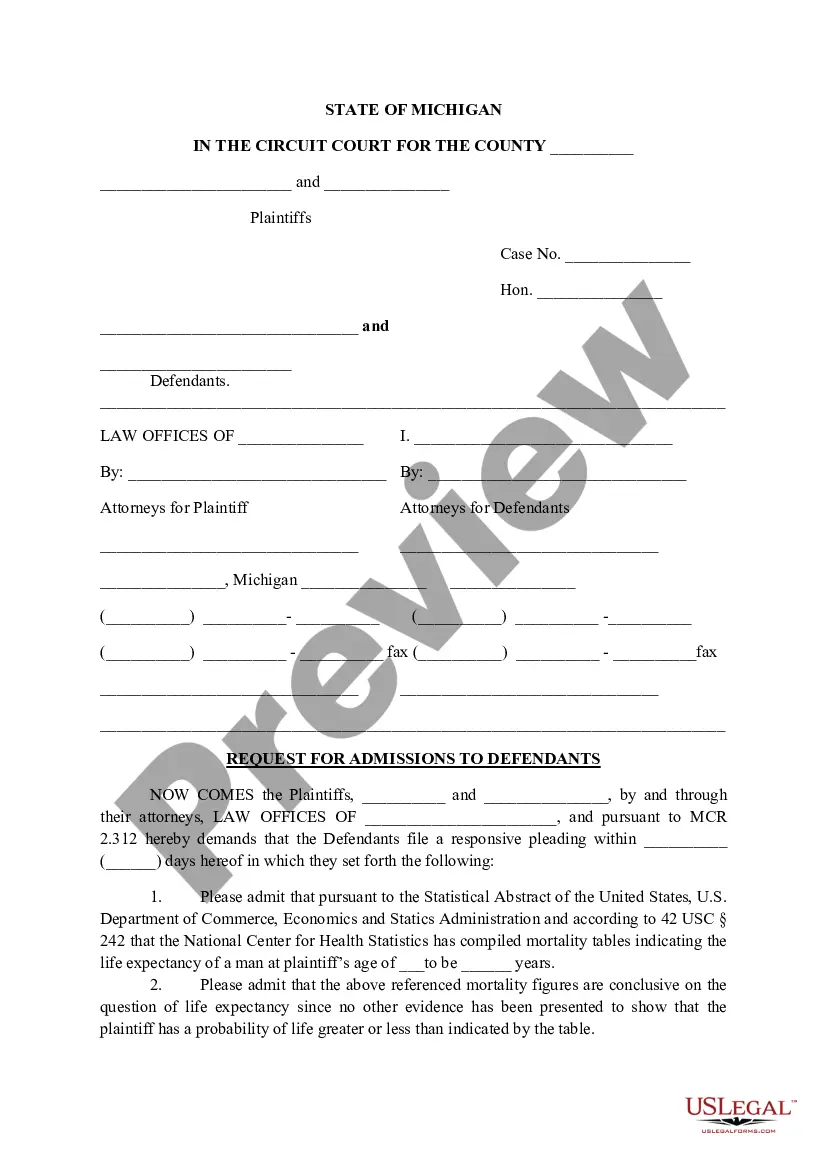

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Finding the appropriate legal document template can be challenging.

Clearly, there are numerous formats available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Alaska Agreement for Purchase of Business Assets from a Corporation, which can be used for both business and personal purposes.

First, ensure you have chosen the correct form for your area/state. You can preview the document using the Preview button and review the document details to confirm it is the right one for you.

- All the documents are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Alaska Agreement for Purchase of Business Assets from a Corporation.

- Use your account to access the legal forms you may have acquired in the past.

- Go to the My documents section of your account to retrieve another copy of the form you need.

- For new users of US Legal Forms, here are straightforward steps to follow.

Form popularity

FAQ

To cancel your business license in Alaska, you will need to submit a cancellation request to the relevant state department. This process often requires you to complete specific forms outlining your intention to close your business. Most importantly, ensure you have fulfilled any pending tax obligations and complied with regulations before initiating the cancellation. Utilizing resources from the USLegalForms platform can simplify this process, offering guidance tailored to Alaska's requirements.

A foreign qualified corporation is a business entity that is incorporated in one state but operates in another. For example, if a corporation is formed in California and conducts business in Alaska, it must register as a foreign corporation in Alaska. This registration allows the foreign corporation to operate legally while adhering to local laws and regulations.

Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership. The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

The list of types of business contracts is as follows: General business contracts (partnership agreement, indemnity agreement, non-disclosure agreement, property and equipment lease) Bill of Sale.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

A Purchase of Business Agreement is a document used to transact the sale of a business between two parties (a buyer and a seller).

Relevant legal documents include:confidentiality agreements;heads of agreements;sale of business agreements; and.non-compete agreements.

To dissolve your corporation in Alaska, you must file a Certificate of Election to Dissolve, before or at the same time as, the Articles of Dissolution form. File in duplicate with the Alaska Division of Corporations, Business, and Professional Licensing by mail, fax or in person.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.