Alaska Personal Representative's Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alaska Personal Representative's Deed?

Utilize US Legal Forms to acquire a printable Alaska Personal Representative's Deed. Our forms, which are acceptable in court, are crafted and frequently updated by experienced lawyers.

Ours is the most extensive library of forms available online, offering budget-friendly and precise samples for consumers, legal practitioners, and small to medium-sized businesses (SMBs). The templates are organized into state-specific categories, with numerous options available for preview before download.

To retrieve samples, users are required to have a subscription and to Log In to their account. Click Download next to any form you wish and locate it in My documents.

US Legal Forms offers a vast array of legal and tax templates and packages tailored for both business and personal requirements, including the Alaska Personal Representative's Deed. Over three million users have already found success with our platform. Choose your subscription plan and access high-quality documents in just a few clicks.

- Ensure you select the correct template for the state it is needed in.

- Examine the document by reading the description and using the Preview feature.

- Click Buy Now if it is the document you desire.

- Establish your account and pay using PayPal or by credit/debit card.

- Download the template to your device and feel free to reuse it multiple times.

- Utilize the Search field if you wish to find another document template.

Form popularity

FAQ

When done properly, a deed is recorded anywhere from two weeks to three months after closing. However, there are many instances where deeds are not properly recorded. Title agents commit errors, lose deeds, and even go out of business. Even county offices sometimes fail to record deeds that were properly submitted.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

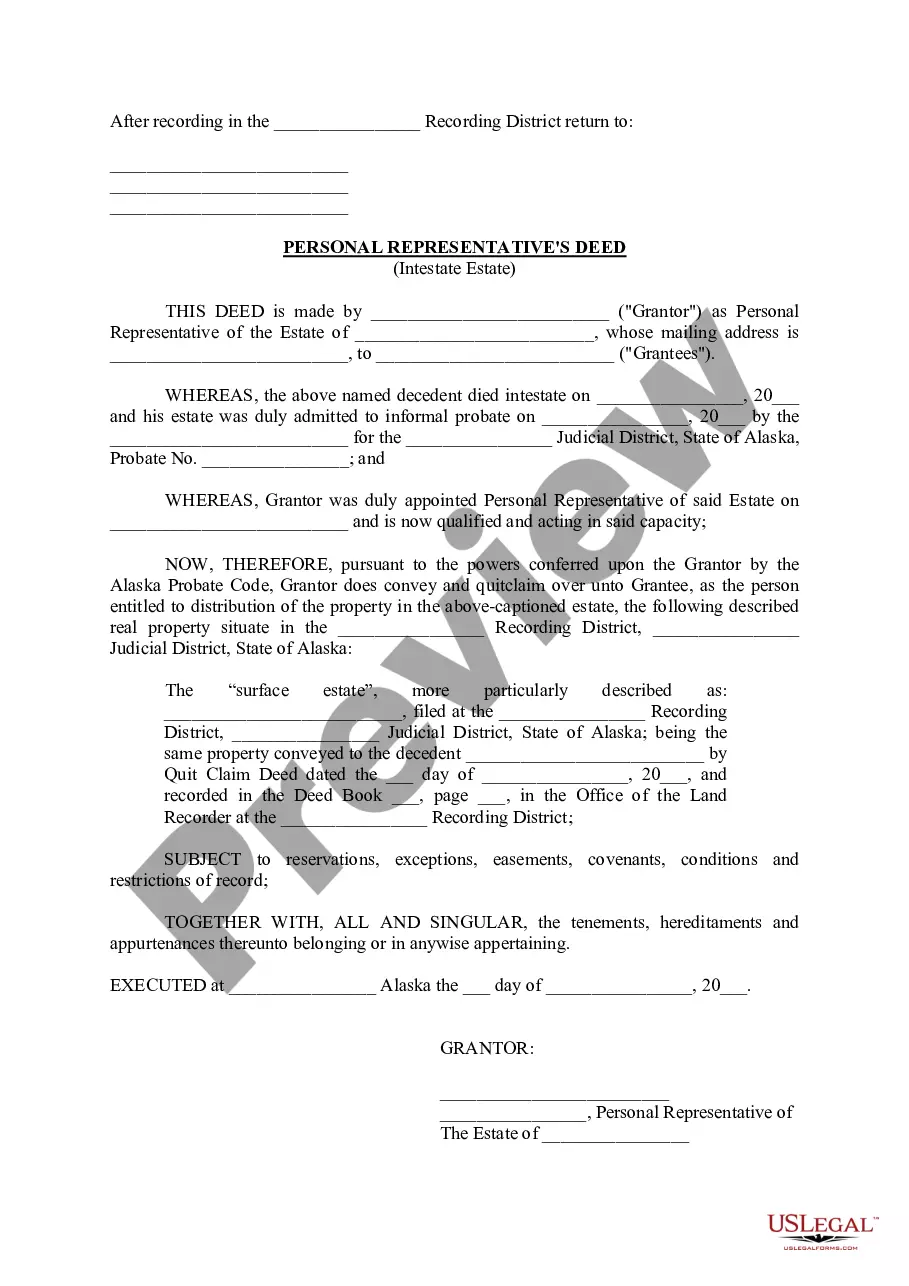

This form is a Personal Representative s Deed where the Grantor is the individual appointed as personal representative of a intestate estate and the Grantee is the surviving joint tenant entitled to the property interest of decedent in the joint tenancy property.

By both spouses as tenants by the entirety; By both spouses as Alaska Community Property with a right of survivorship; or. By a Trustee in trust; or.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Alaska quit claim deeds must be submitted to the recording district that is local to the property. They must also be accompanied by the applicable recording fee set by regulation; if the document is to be recorded for multiple purposes, it must be accompanied by the applicable fee for each of the multiple purposes.

Preparing the Deed. First, get a deed form. Recording the Deed. After the deed is signed, you need to "record" it -- that is, put a copy of the notarized deed on file in the county office that keeps local property records. Transfer Taxes. Insurance. Due-on-Sale Mortgage Clauses. California Property Taxes.

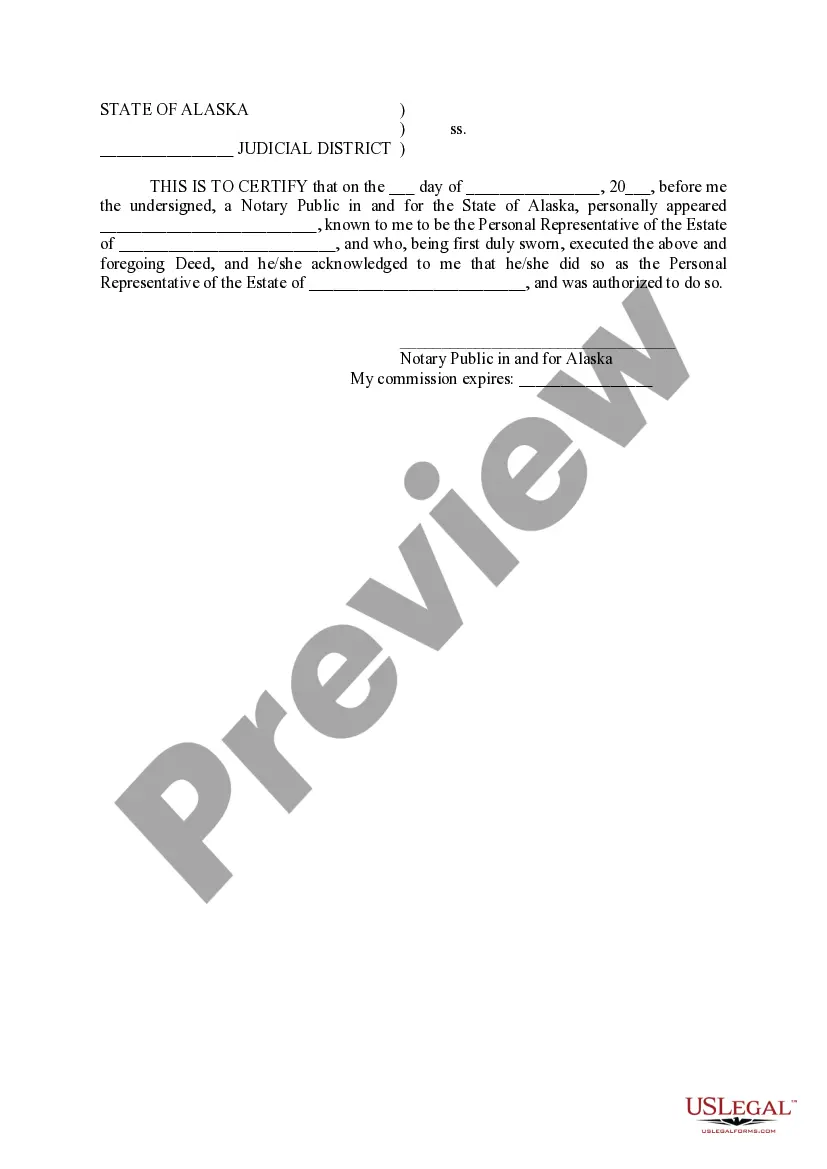

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.